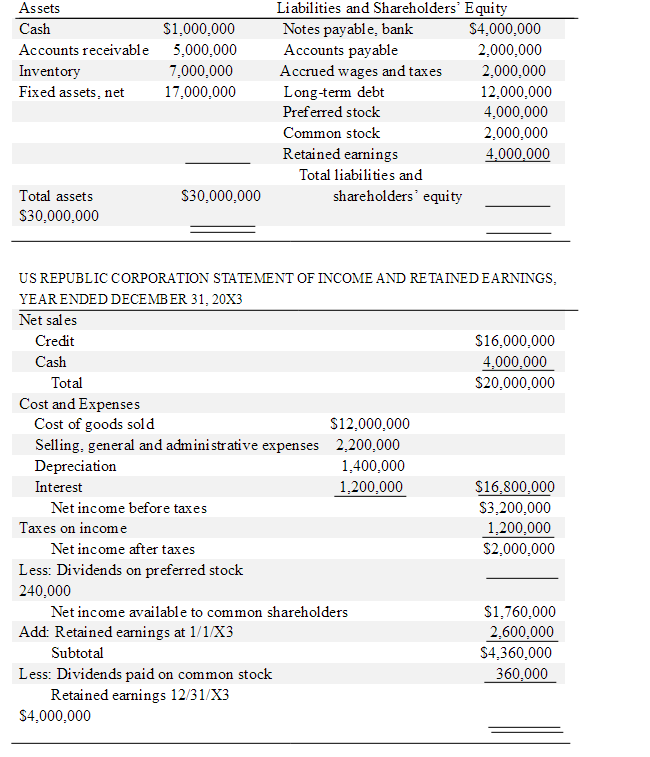

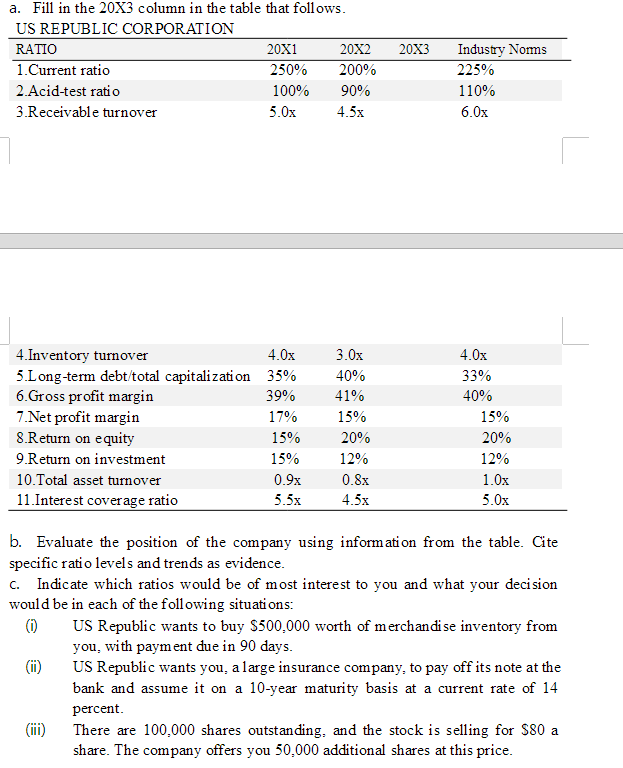

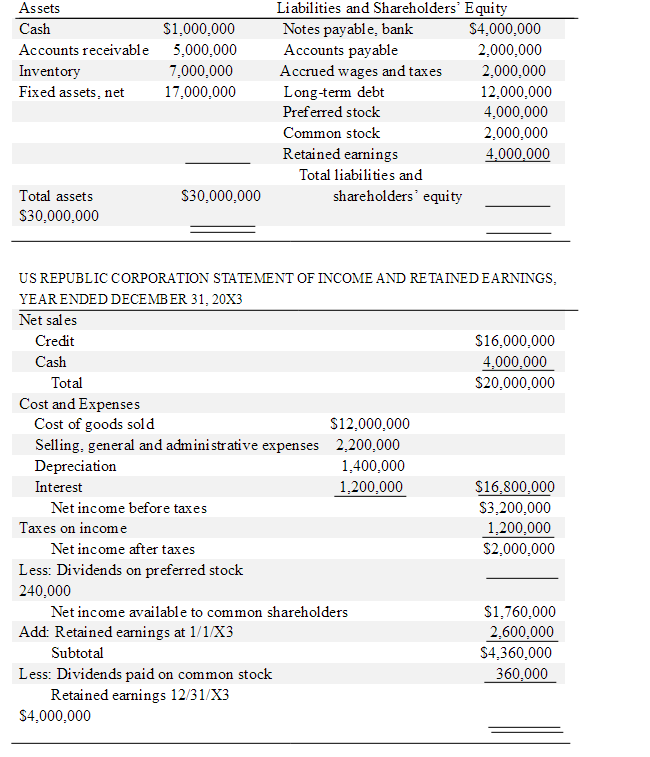

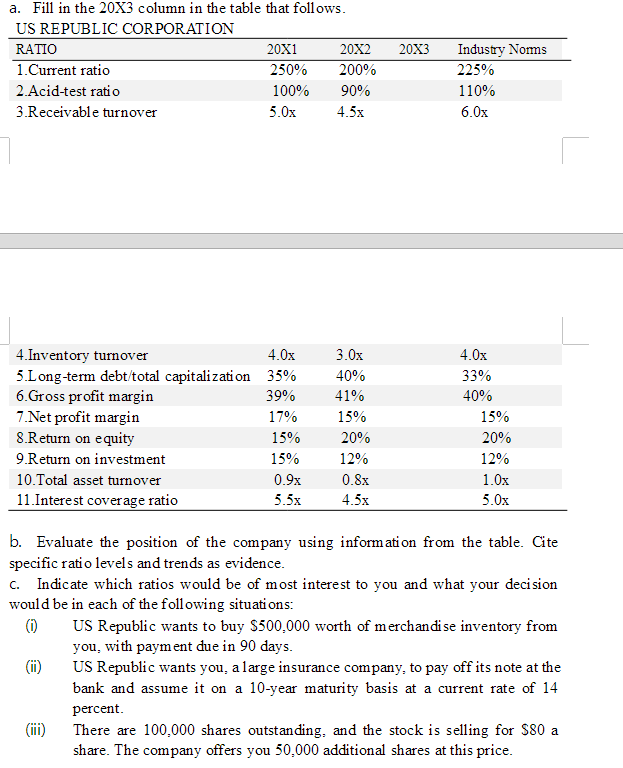

Assets Cash Accounts receivable Inventory Fixed assets, net $1,000,000 5.000.000 7.000.000 17.000.000 Liabilities and Shareholders' Equity Notes payable, bank $4,000,000 Accounts payable 2,000,000 Accrued wages and taxes 2.000.000 Long-term debt 12,000,000 Preferred stock 4,000,000 Common stock 2.000.000 Retained earnings 4.000.000 Total liabilities and shareholders' equity $30.000.000 Total assets $30.000.000 US REPUBLIC CORPORATION STATEMENT OF INCOME AND RETAINED EARNINGS, YEAR ENDED DECEMBER 31, 20X3 Net sales Credit $16.000.000 Cash 4,000,000 Total $20.000.000 Cost and Expenses Cost of goods sold $12,000,000 Selling, general and administrative expenses 2,200,000 Depreciation 1,400,000 Interest 1,200,000 $16,800,000 Net income before taxes $3,200,000 Taxes on income 1.200.000 Net income after taxes $2,000,000 Less: Dividends on preferred stock 240,000 Net income available to common shareholders $1,760,000 Add: Retained earnings at 1/1/X3 2.600.000 Subtotal $4.360.000 Less: Dividends paid on common stock 360,000 Retained earnings 12/31/X3 $4,000,000 20X3 a. Fill in the 20X3 column in the table that follows. US REPUBLIC CORPORATION RATIO 20x1 20x2 1. Current ratio 250% 200% 2. Acid-test ratio 100% 90% 3.Receivable turnover 5.0x 4.5x Industry Noms 225% 110% 6.0x 4.Inventory turnover 4.0x 5.Long-term debt/total capitalization 35% 6. Gross profit margin 39% 7. Net profit margin 17% 8. Return on equity 15% 9. Return on investment 15% 10. Total asset turnover 0.9x 11.Interest coverage ratio 5.5x 3.0x 40% 41% 15% 20% 12% 0.8x 4.5x 4.0x 33% 40% 15% 20% 12% 1.0x 5.Ox b. Evaluate the position of the company using information from the table. Cite specific ratio levels and trends as evidence. C. Indicate which ratios would be of most interest to you and what your decision would be in each of the following situations: 0 US Republic wants to buy $500.000 worth of merchandise inventory from you, with payment due in 90 days. ii) US Republic wants you, a large insurance company, to pay off its note at the bank and assume it on a 10-year maturity basis at a current rate of 14 percent (iii) There are 100.000 shares outstanding, and the stock is selling for $80 a share. The company offers you 50.000 additional shares at this price. Assets Cash Accounts receivable Inventory Fixed assets, net $1,000,000 5.000.000 7.000.000 17.000.000 Liabilities and Shareholders' Equity Notes payable, bank $4,000,000 Accounts payable 2,000,000 Accrued wages and taxes 2.000.000 Long-term debt 12,000,000 Preferred stock 4,000,000 Common stock 2.000.000 Retained earnings 4.000.000 Total liabilities and shareholders' equity $30.000.000 Total assets $30.000.000 US REPUBLIC CORPORATION STATEMENT OF INCOME AND RETAINED EARNINGS, YEAR ENDED DECEMBER 31, 20X3 Net sales Credit $16.000.000 Cash 4,000,000 Total $20.000.000 Cost and Expenses Cost of goods sold $12,000,000 Selling, general and administrative expenses 2,200,000 Depreciation 1,400,000 Interest 1,200,000 $16,800,000 Net income before taxes $3,200,000 Taxes on income 1.200.000 Net income after taxes $2,000,000 Less: Dividends on preferred stock 240,000 Net income available to common shareholders $1,760,000 Add: Retained earnings at 1/1/X3 2.600.000 Subtotal $4.360.000 Less: Dividends paid on common stock 360,000 Retained earnings 12/31/X3 $4,000,000 20X3 a. Fill in the 20X3 column in the table that follows. US REPUBLIC CORPORATION RATIO 20x1 20x2 1. Current ratio 250% 200% 2. Acid-test ratio 100% 90% 3.Receivable turnover 5.0x 4.5x Industry Noms 225% 110% 6.0x 4.Inventory turnover 4.0x 5.Long-term debt/total capitalization 35% 6. Gross profit margin 39% 7. Net profit margin 17% 8. Return on equity 15% 9. Return on investment 15% 10. Total asset turnover 0.9x 11.Interest coverage ratio 5.5x 3.0x 40% 41% 15% 20% 12% 0.8x 4.5x 4.0x 33% 40% 15% 20% 12% 1.0x 5.Ox b. Evaluate the position of the company using information from the table. Cite specific ratio levels and trends as evidence. C. Indicate which ratios would be of most interest to you and what your decision would be in each of the following situations: 0 US Republic wants to buy $500.000 worth of merchandise inventory from you, with payment due in 90 days. ii) US Republic wants you, a large insurance company, to pay off its note at the bank and assume it on a 10-year maturity basis at a current rate of 14 percent (iii) There are 100.000 shares outstanding, and the stock is selling for $80 a share. The company offers you 50.000 additional shares at this price