Answered step by step

Verified Expert Solution

Question

1 Approved Answer

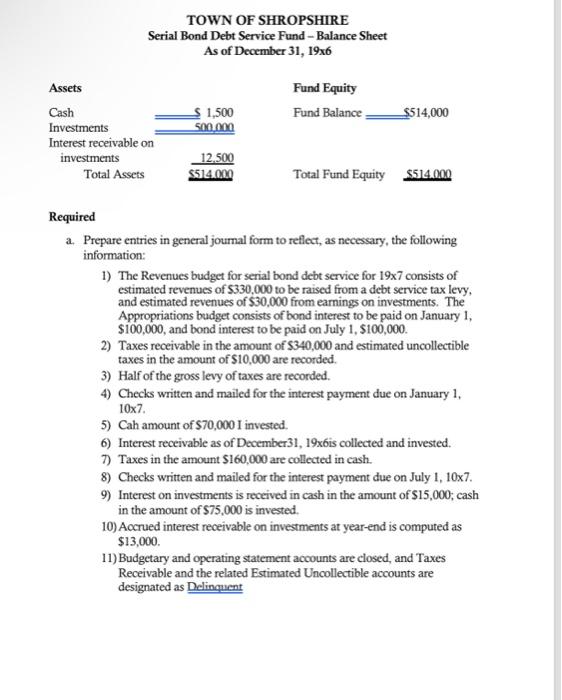

Assets Cash Investments Interest receivable on investments TOWN OF SHROPSHIRE Serial Bond Debt Service Fund - Balance Sheet As of December 31, 19x6 Total Assets

Assets Cash Investments Interest receivable on investments TOWN OF SHROPSHIRE Serial Bond Debt Service Fund - Balance Sheet As of December 31, 19x6 Total Assets $1,500 500.000 12,500 $514.000 Fund Equity Fund Balance Total Fund Equity __$514,000 $514.000 Required a. Prepare entries in general journal form to reflect, as necessary, the following information: 1) The Revenues budget for serial bond debt service for 19x7 consists of estimated revenues of $330,000 to be raised from a debt service tax levy, and estimated revenues of $30,000 from earnings on investments. The Appropriations budget consists of bond interest to be paid on January 1, $100,000, and bond interest to be paid on July 1, $100,000. 2) Taxes receivable in the amount of $340,000 and estimated uncollectible taxes in the amount of $10,000 are recorded. 3) Half of the gross levy of taxes are recorded. 4) Checks written and mailed for the interest payment due on January 1, 10x7. 5) Cah amount of $70,000 I invested. 6) Interest receivable as of December31, 19x6is collected and invested. 7) Taxes in the amount $160,000 are collected in cash. 8) Checks written and mailed for the interest payment due on July 1, 10x7. 9) Interest on investments is received in cash in the amount of $15,000; cash in the amount of $75,000 is invested. 10) Accrued interest receivable on investments at year-end is computed as $13,000. 11) Budgetary and operating statement accounts are closed, and Taxes Receivable and the related Estimated Uncollectible accounts are lesignated as Delinquent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started