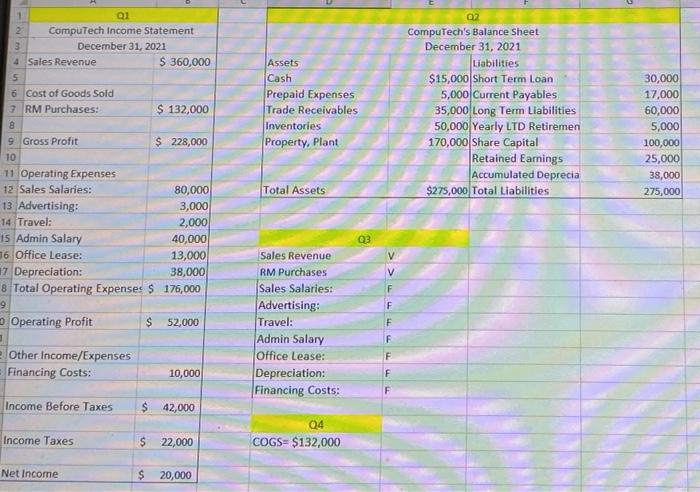

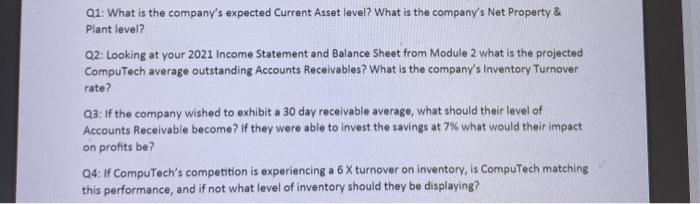

Assets Cash Prepaid Expenses Trade Receivables Inventories Property, Plant 1 01 2 CompuTech Income Statement 3 December 31, 2021 4 Sales Revenue S 360,000 5 6 Cost of Goods Sold 7 RM Purchases: $ 132,000 8 9 Gross Profit $ 228,000 10 11 Operating Expenses 12 Sales Salaries: 80,000 13 Advertising: 3,000 14 Travel: 2,000 15 Admin Salary 40,000 16 Office Lease: 13,000 17 Depreciation: 38,000 8 Total Operating Expenses S 176,000 9 Operating Profit 52,000 02 CompuTech's Balance Sheet December 31, 2021 Liabilities $15,000 Short Term Loan 5,000 Current Payables 35,000 Long Term Liabilities 50,000 Yearly LTD Retiremen 170,000 Share Capital Retained Earnings Accumulated Deprecia $275,000 Total Liabilities 30,000 17,000 60,000 5,000 100,000 25,000 38,000 275,000 Total Assets Q3 V F F Sales Revenue RM Purchases Sales Salaries: Advertising: Travel: Admin Salary Office Lease: Depreciation: Financing Costs: F F F Other Income/Expenses Financing Costs: 10,000 F F Income Before Taxes $ 42,000 Income Taxes $ 22,000 04 COGS=$132,000 Net Income S 20,000 Q1: What is the company's expected Current Asset level? What is the company's Net Property & Plant level? Q2: Looking at your 2021 Income Statement and Balance Sheet from Module 2 what is the projected CompuTech average outstanding Accounts Receivables? What is the company's Inventory Turnover rate? Q3: If the company wished to exhibit a 30 day receivable average, what should their level of Accounts Receivable become? if they were able to invest the savings at 7% What would their impact on profits be? Q4: If CompuTech's competition is experiencing a 6 X turnover on inventory, is CompuTech matching this performance, and if not what level of inventory should they be displaying? Assets Cash Prepaid Expenses Trade Receivables Inventories Property, Plant 1 01 2 CompuTech Income Statement 3 December 31, 2021 4 Sales Revenue S 360,000 5 6 Cost of Goods Sold 7 RM Purchases: $ 132,000 8 9 Gross Profit $ 228,000 10 11 Operating Expenses 12 Sales Salaries: 80,000 13 Advertising: 3,000 14 Travel: 2,000 15 Admin Salary 40,000 16 Office Lease: 13,000 17 Depreciation: 38,000 8 Total Operating Expenses S 176,000 9 Operating Profit 52,000 02 CompuTech's Balance Sheet December 31, 2021 Liabilities $15,000 Short Term Loan 5,000 Current Payables 35,000 Long Term Liabilities 50,000 Yearly LTD Retiremen 170,000 Share Capital Retained Earnings Accumulated Deprecia $275,000 Total Liabilities 30,000 17,000 60,000 5,000 100,000 25,000 38,000 275,000 Total Assets Q3 V F F Sales Revenue RM Purchases Sales Salaries: Advertising: Travel: Admin Salary Office Lease: Depreciation: Financing Costs: F F F Other Income/Expenses Financing Costs: 10,000 F F Income Before Taxes $ 42,000 Income Taxes $ 22,000 04 COGS=$132,000 Net Income S 20,000 Q1: What is the company's expected Current Asset level? What is the company's Net Property & Plant level? Q2: Looking at your 2021 Income Statement and Balance Sheet from Module 2 what is the projected CompuTech average outstanding Accounts Receivables? What is the company's Inventory Turnover rate? Q3: If the company wished to exhibit a 30 day receivable average, what should their level of Accounts Receivable become? if they were able to invest the savings at 7% What would their impact on profits be? Q4: If CompuTech's competition is experiencing a 6 X turnover on inventory, is CompuTech matching this performance, and if not what level of inventory should they be displaying