Answered step by step

Verified Expert Solution

Question

1 Approved Answer

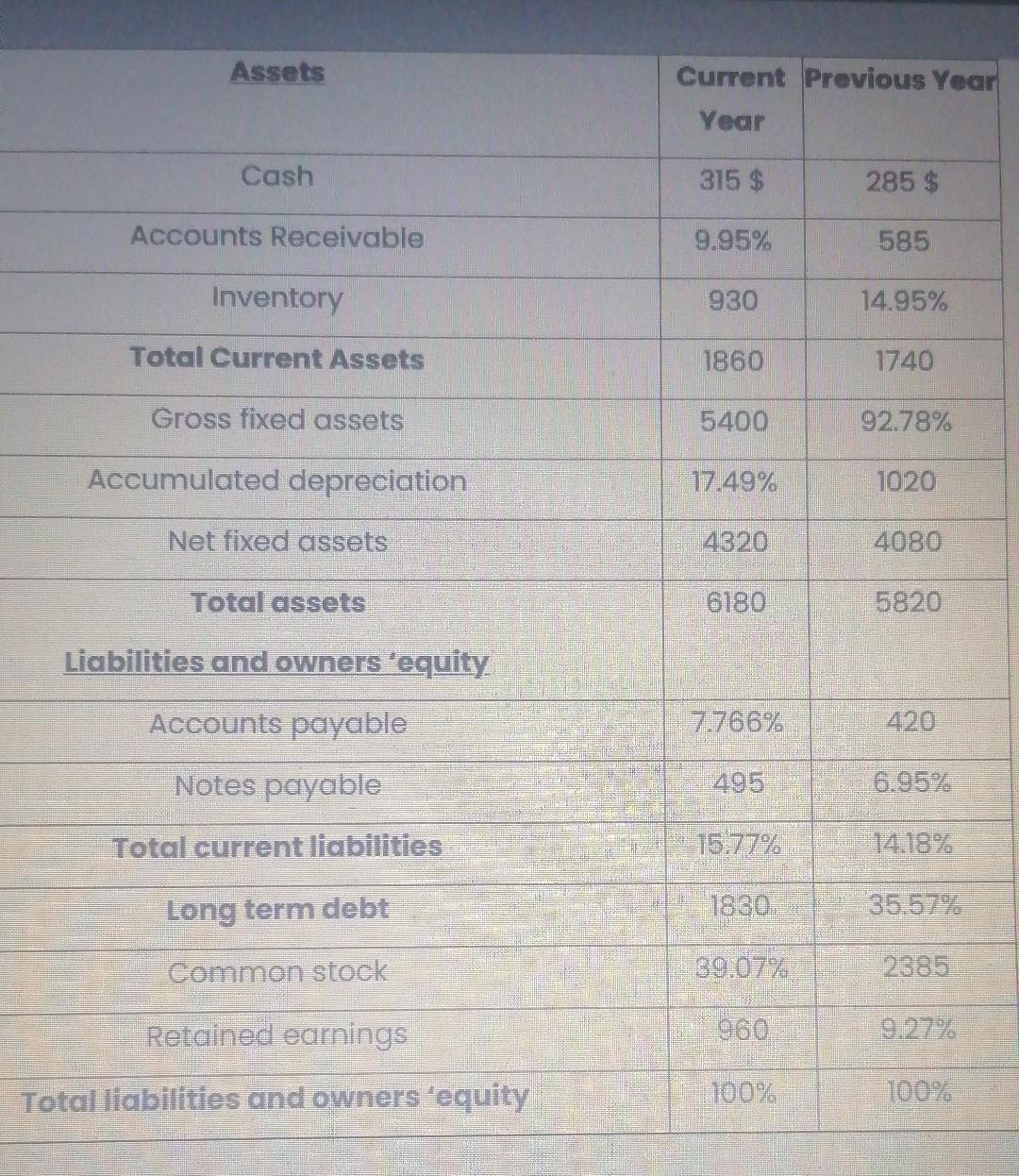

Assets Current Previous Year Year Cash 315 $ 285 $ Accounts Receivable 9.95% 585 Inventory 930 14.95% Total Current Assets 1860 1740 Gross fixed assets

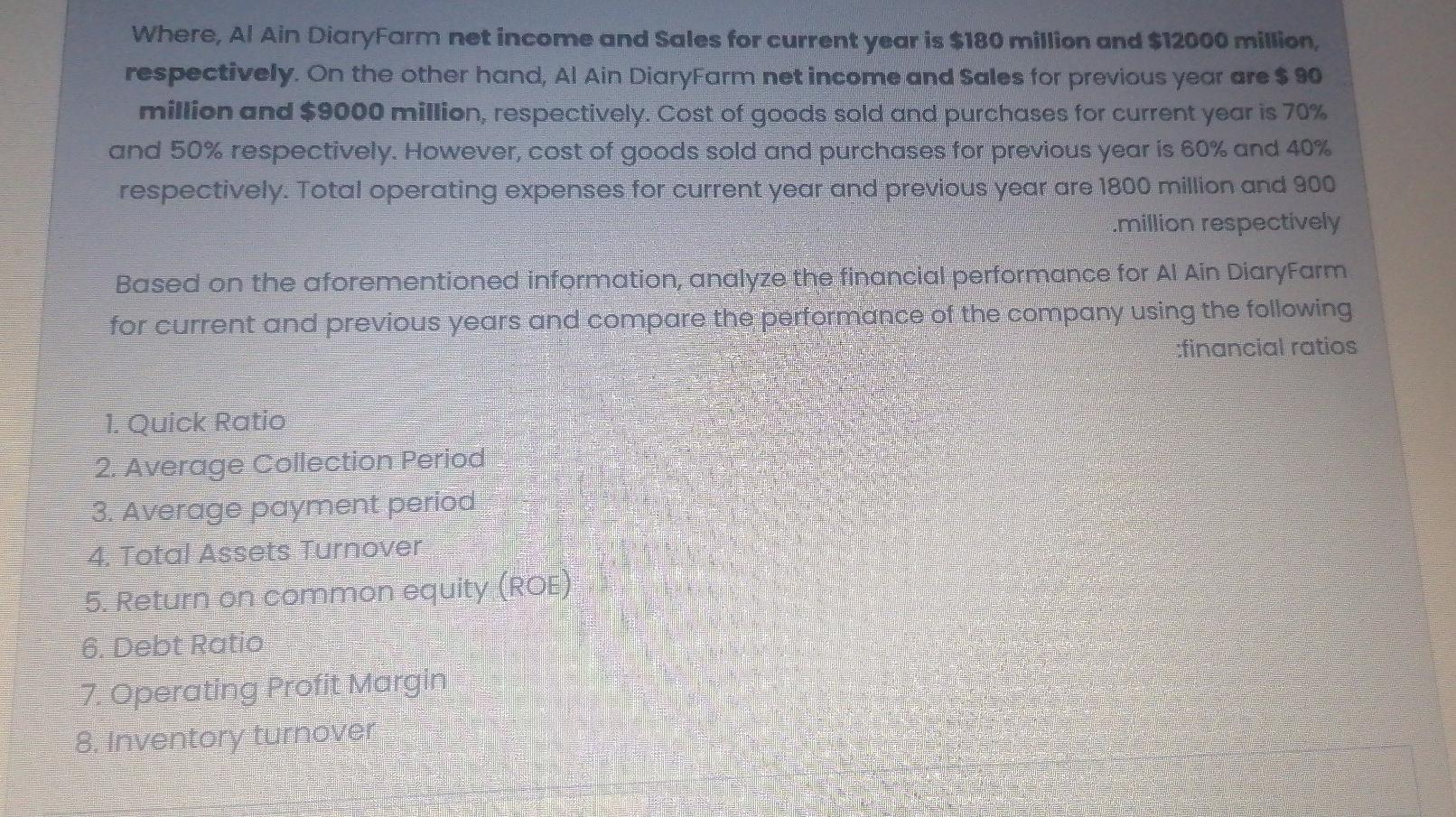

Assets Current Previous Year Year Cash 315 $ 285 $ Accounts Receivable 9.95% 585 Inventory 930 14.95% Total Current Assets 1860 1740 Gross fixed assets 5400 92.78% Accumulated depreciation 17.49% 1020 Net fixed assets 4320 4080 Total assets 6180 5820 Liabilities and owners 'equity. Accounts payable 7.766% 420 Notes payable 495 6.95% Total current liabilities 15,77% 14.18% Long term debt 1830 35.57% Common stock 39.07% 2385 Retained earnings 960 9.27% Total liabilities and owners equity 100% Where, Al Ain DiaryFarm net income and Sales for current year is $180 million and $12000 million, respectively. On the other hand, Al Ain DiaryFarm net income and sales for previous year are $ 90 million and $9000 million, respectively. Cost of goods sold and purchases for current year is 70% and 50% respectively. However, cost of goods sold and purchases for previous year is 60% and 40% respectively. Total operating expenses for current year and previous year are 1800 million and 900 million respectively Based on the aforementioned information, analyze the financial performance for Al Ain DiaryFarm for current and previous years and compare the performance of the company using the following financial ratios 1. Quick Ratio 2. Average Collection Period 3. Average payment period 4. Total Assets Turnover 5. Return on common equity (ROE) 6. Debt Ratio 7. Operating Profit Margin 8. Inventory turnover

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started