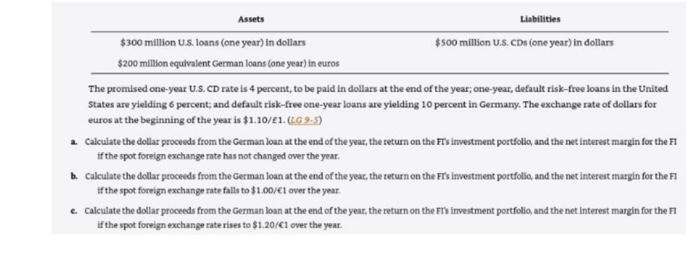

Assets Liabilities $300 mitlion U.S. loans (one year) in dollars $500 million U.S. CDs (one year) in dollars $200 mitlion equivalent Cerman loans (one year) in euros The promised one-year U.S. CD rate is 4 percent, to be pald in dollars at the end of the year; one-year, default risk-free loans in the United States are ylelding 6 percent; and default risk-free one-year loans are yielding 10 percent in Germany. The exchange rate of dollars for euros at the beginning of the year is $1.10/21.(L0.9.5) a. Calculate the dollar proceeds from the German loun at the end of the year, the seturn on the Fis imvestment portfolio and the net interest margin for the FI if the spot foreign exchange rate has not changed over the year. b. Calculate the dollar procecds from the German loan at the end of the yeat, the teturn on the Frs inveitment portfolio, and the net intereit thargin for the FI If the spot foreign exchange rate falls to $1.00/61 over the year c. Calculate the dollar proceeds from the German loan at the end of the year, the return on the Fry inveitment portfolio, and the net interest margin for the fl If the spot forelgn exchange rate rises to $1.20/Cl over the year. Assets Liabilities $300 mitlion U.S. loans (one year) in dollars $500 million U.S. CDs (one year) in dollars $200 mitlion equivalent Cerman loans (one year) in euros The promised one-year U.S. CD rate is 4 percent, to be pald in dollars at the end of the year; one-year, default risk-free loans in the United States are ylelding 6 percent; and default risk-free one-year loans are yielding 10 percent in Germany. The exchange rate of dollars for euros at the beginning of the year is $1.10/21.(L0.9.5) a. Calculate the dollar proceeds from the German loun at the end of the year, the seturn on the Fis imvestment portfolio and the net interest margin for the FI if the spot foreign exchange rate has not changed over the year. b. Calculate the dollar procecds from the German loan at the end of the yeat, the teturn on the Frs inveitment portfolio, and the net intereit thargin for the FI If the spot foreign exchange rate falls to $1.00/61 over the year c. Calculate the dollar proceeds from the German loan at the end of the year, the return on the Fry inveitment portfolio, and the net interest margin for the fl If the spot forelgn exchange rate rises to $1.20/Cl over the year