Answered step by step

Verified Expert Solution

Question

1 Approved Answer

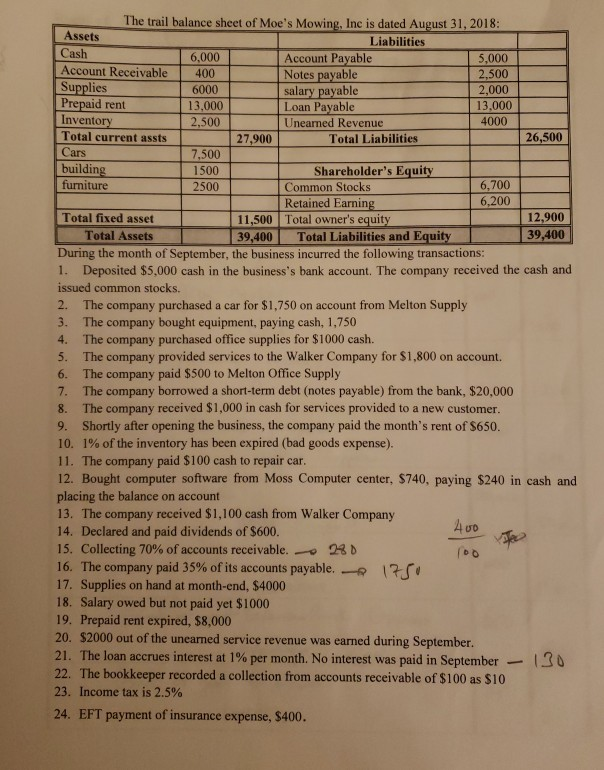

Assets Liabilities 6,000 Account Payable Notes payable Account Receivable 400 Supplies 2,000 13,000 4000 salary payable paid rent Inventory Total current assts 13,000 Unearned Revenue

Assets Liabilities 6,000 Account Payable Notes payable Account Receivable 400 Supplies 2,000 13,000 4000 salary payable paid rent Inventory Total current assts 13,000 Unearned Revenue 26,500 27,900 Total Liabilities buildin furniture Shareholder's Equity 6,700 2500 Common Stocks Retained Earning 12,900 39,400 Total fixed asset Total Assets 11,500 Total owner's equity 39,400Total Liabilities and Equity During the month of September, the business incurred the following transactions: 1. Deposited $5,000 cash in the business's bank account. The company received the cash and issued common stocks. 2. The company purchased a car for $1,750 on account from Melton Supply 3. The company bought equipment, paying cash, 1,750 4. The company purchased office supplies for $1000 cash. 5. The company provided services to the Walker Company for $1,800 on account. 6. The company paid $500 to Melton Office Supply 7. The company borrowed a short-term debt (notes payable) from the bank, $20,000 8. The company received $1,000 in cash for services provided to a new customer 9. Shortly after opening the business, the company paid the month's rent of $650 10. 190 of the inventory has been expired (bad goods expense). 11. The company paid $100 cash to repair car 12. Bought computer software from Moss Computer center, $740, paying $240 in cash and placing the balance on account 13. The company received $1,100 cash from Walker Company 14. Declared and paid dividends of $600 15. Collecting 70% of accounts receivable. " - 28 b 16. The company paid 35% of its accounts payable"--Q 17. Supplies on hand at month-end, $4000 18. Salary owed but not paid yet $1000 19. Prepaid rent expired, $8,000 20. $2000 out of the unearned service revenue was earned during September. 21- The loan accrues interest at 1% per month. No interest was paid in September-1-0 22. The bookkeeper recorded a collection from accounts receivable of $100 as $10 23. Income tax is 2.5% 24. EFT payment of insurance expense, $400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started