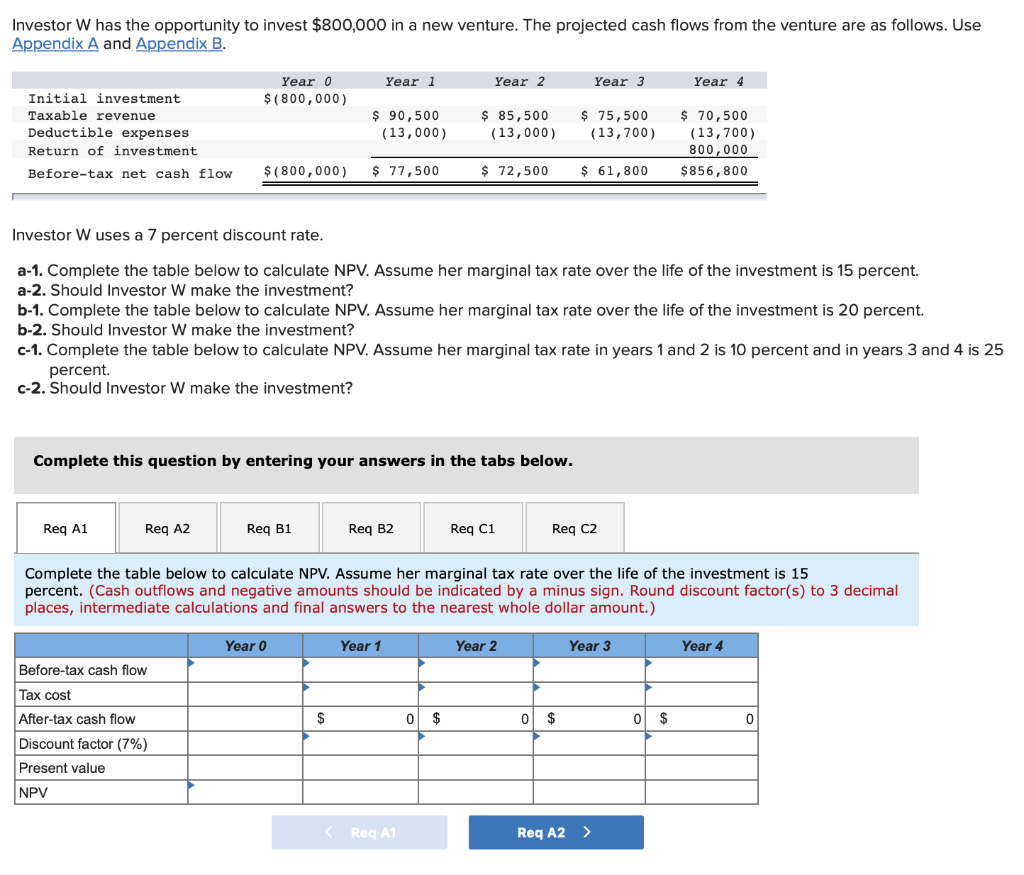

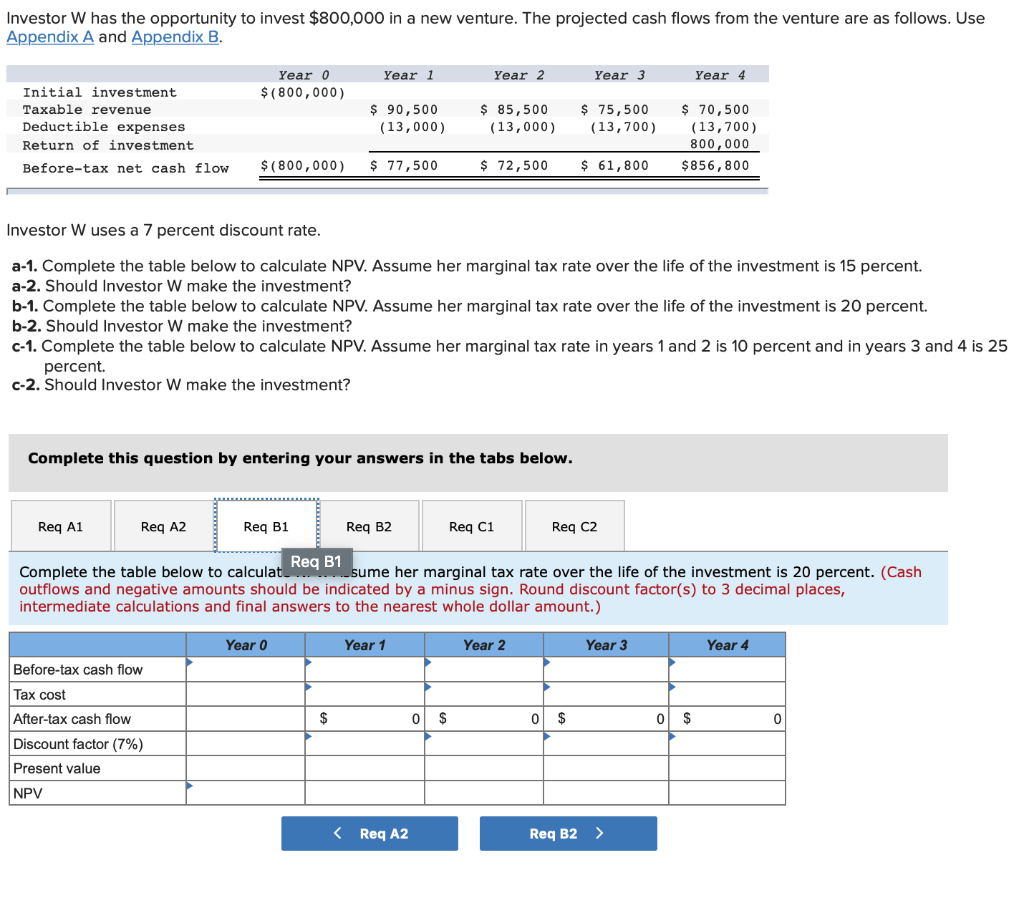

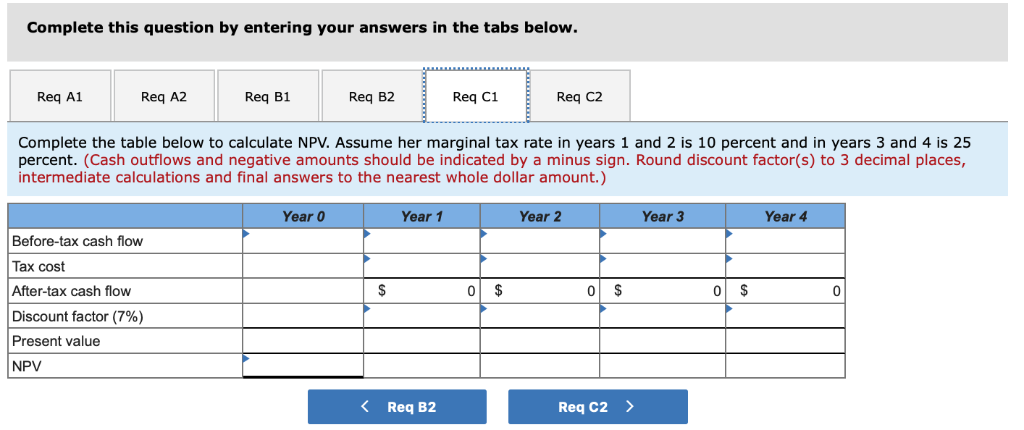

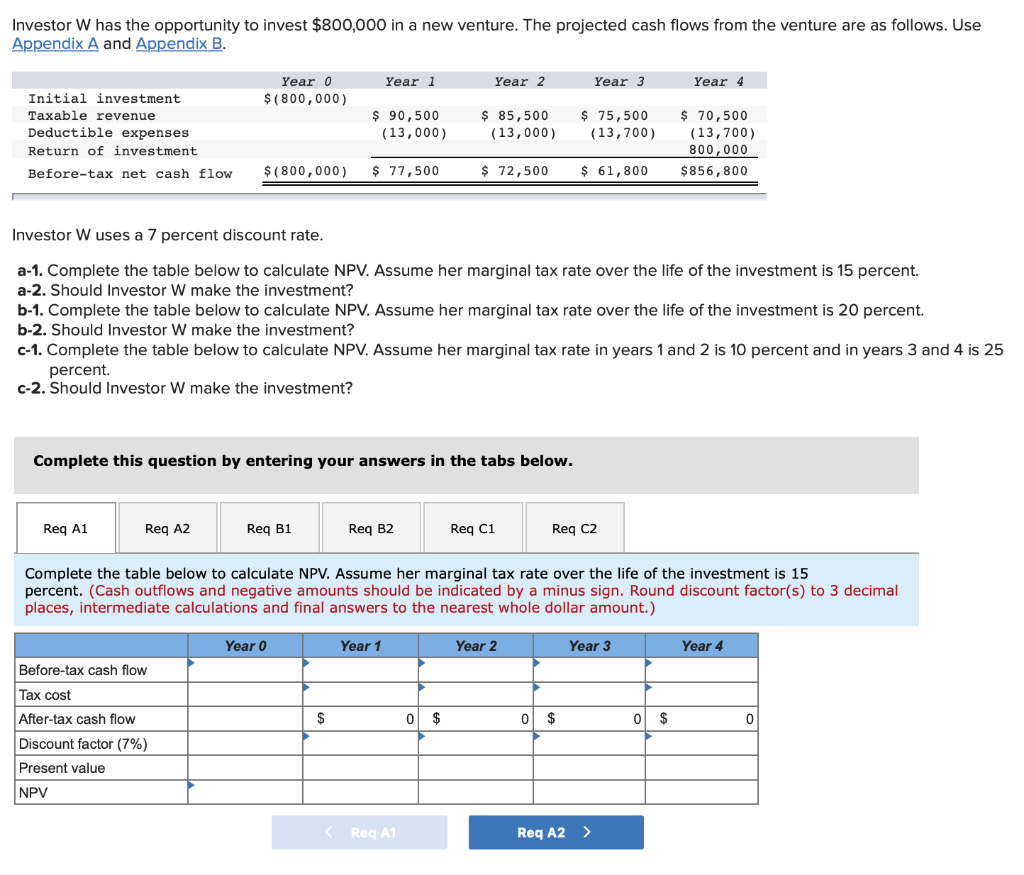

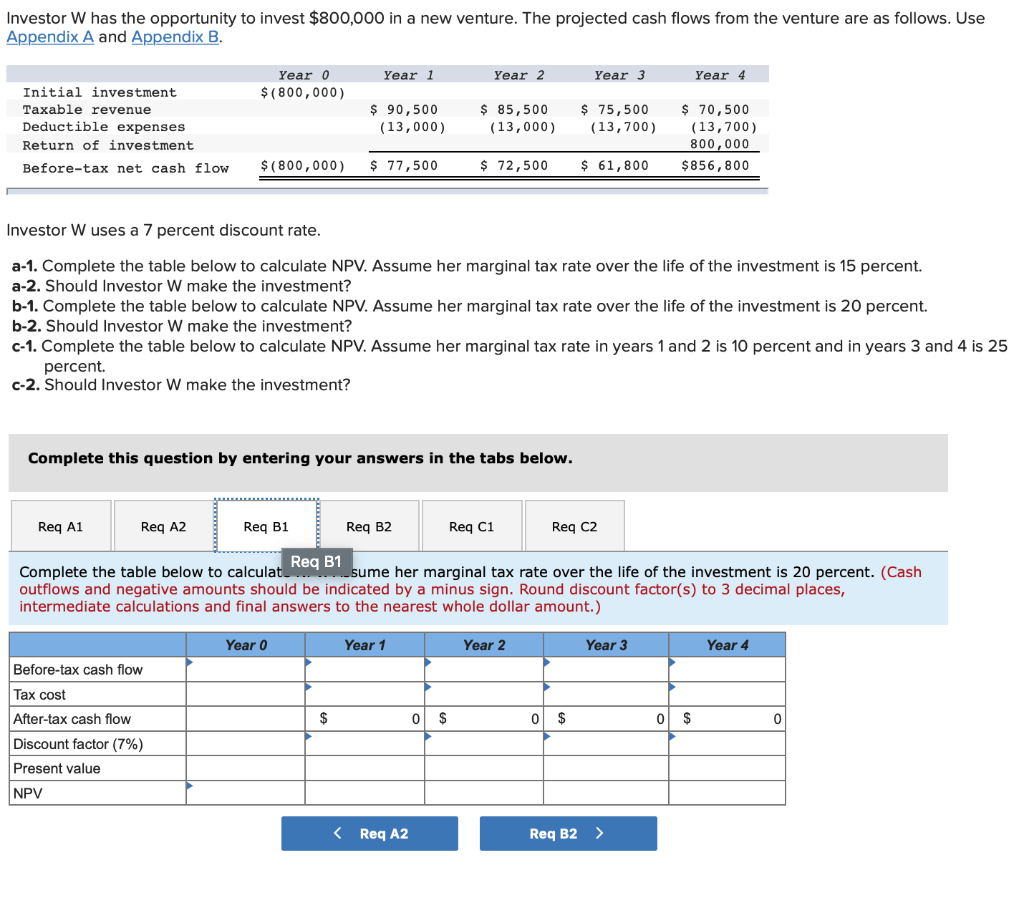

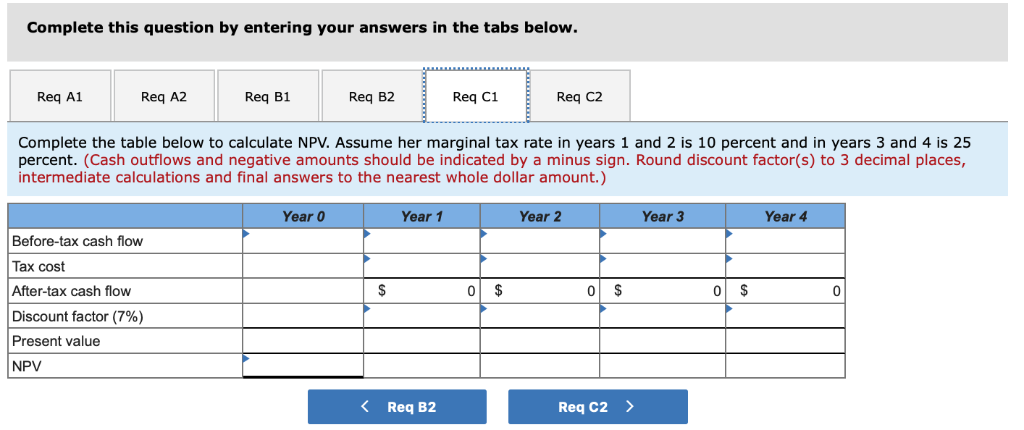

Investor W has the opportunity to invest $800,000 in a new venture. The projected cash flows from the venture are as follows. Use Appendix A and Appendix B Year 4 Year 3 Year 0 Year 1 Year 2 Initial investment $(800,000) $ 90,500 (13,000) $ 75,500 (13,700) Taxable revenue $85,500 (13,000) $70,500 (13,700) 800,000 Deductible expenses Return of investment $ 77,500 $72,500 $856,800 $(800,000) $61,800 Before-tax net cash flow Investor W uses a 7 percent discount rate. a-1. Complete the table below to calculate NPV. Assume her marginal tax rate over the life of the investment is 15 percent. a-2. Should Investor W make the investment? b-1. Complete the table below to calculate NPV. Assume her marginal tax rate over the life of the investment is 20 percent. b-2. Should Investor W make the investment? c-1. Complete the table below to calculate NPV. Assume her marginal tax rate in years 1 and 2 is 10 percent and in years 3 and 4 is 25 percent c-2. Should Investor W make the investment? Complete this question by entering answers in the tabs below. Req A1 Req A2 Req B1 Req B2 Req C1 Req C2 Complete the table below to calculate NPV. Assume her marginal tax rate over the life of the investment is 15 percent. (Cash outflows and negative amounts should be indicated by a minus sign. Round discount factor(s) to 3 decimal places, intermediate calculations and final answers to the nearest whole dollar amount.) Year 0 Year 1 Year 2 Year 3 Year 4 Before-tax cash flow x cost S $ After-tax cash flow 0 0 0 0 Discount factor (7%) Present value NPV Reg A1 Req A2 Investor W has the opportunity to invest $800,000 in a new venture. The projected cash flows from the venture are as follows. Use Appendix A and Appendix B. Year 0 Year 1 Year 2 Year 3 Year 4 Initial investment $(800,000) $ 90,500 $ 85,500 (13,000) $ 75,500 $ 70,500 (13,700) 800,000 Taxable revenue Deductible expenses (13,000) (13,700) Return of investment $ 72,500 $ (800,000) $856,800 $77,500 $61,800 Before-tax net cash flow Investor W uses a 7 percent discount rate. a-1. Complete the table below to calculate NPV. Assume her marginal tax rate over the life of the investment is 15 percent. a-2. Should Investor W make the investment? b-1. Complete the table below to calculate NPV. Assume her marginal tax rate over the life of the investment is 20 percent. b-2. Should Investor W make the investment? c-1. Complete the table below to calculate NPV. Assume her marginal tax rate in years 1 and 2 is 10 percent and in years 3 and 4 is 25 percent c-2. Should Investor W make the investment? Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B2 Req C1 Req C2 Req B1 Complete the table below to calculat Req B1 outflows and negative amounts should be indicated by a minus sign. Round discount factor(s) to 3 decimal places, sume her marginal tax rate over the life of the investment is 20 percent. (Cash Tate intermediate calculations and final answers to the nearest whole dollar amount.) Year 0 Year 1 Year 2 Year 3 Year 4 Before-tax cash flow cost After-tax cash flow 0 S 0 0 Discount factor (7%) Present value NPV Req A2 Req B2 Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B1 Req B2 Req C1 Req C2 Complete the table below to calculate NPV. Assume her marginal tax rate in years 1 and 2 is 10 percent and in years 3 and 4 is 25 percent. (Cash outflows and negative amounts should be indicated by a minus sign. Round discount factor(s) to 3 decimal places, intermediate calculations and final answers to the nearest whole dollar amount.) Year 1 Year 3 Year 0 Year 2 Year 4 Before-tax cash flow Tax cost After-tax cash flow S S 0 0 0 Discount factor (7%) Present value NPV Req C2 Req B2