Answered step by step

Verified Expert Solution

Question

1 Approved Answer

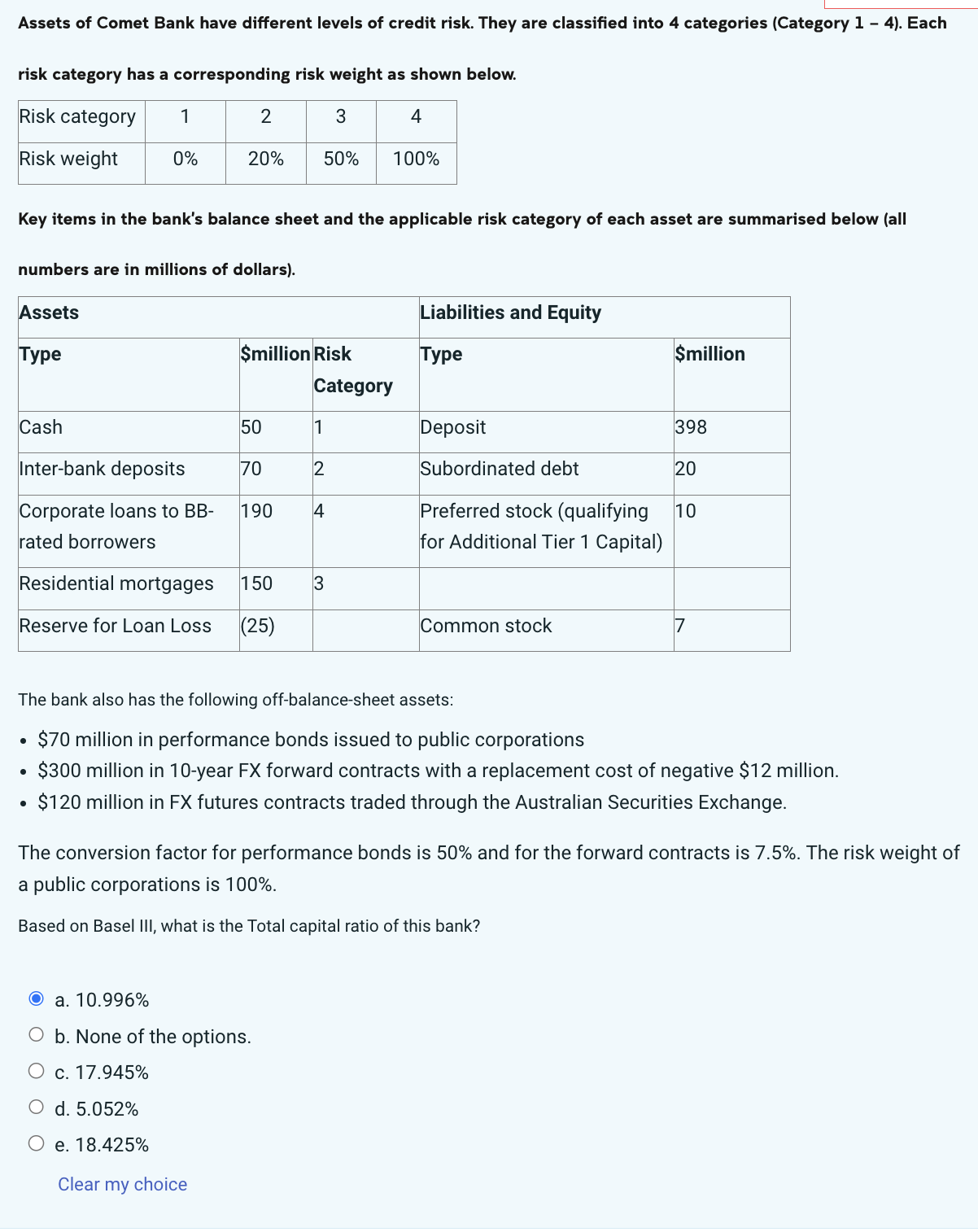

Assets of Comet Bank have different levels of credit risk. They are classified into 4 categories ( Category 1 - 4 ) . Each risk

Assets of Comet Bank have different levels of credit risk. They are classified into categories Category Each

risk category has a corresponding risk weight as shown below.

Key items in the bank's balance sheet and the applicable risk category of each asset are summarised below all

numbers are in millions of dollars

The bank also has the following offbalancesheet assets:

$ million in performance bonds issued to public corporations

$ million in year FX forward contracts with a replacement cost of negative $ million.

$ million in FX futures contracts traded through the Australian Securities Exchange.

The conversion factor for performance bonds is and for the forward contracts is The risk weight of

a public corporations is

Based on Basel III, what is the Total capital ratio of this bank?

a

b None of the options.

c

d

e

Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started