Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with this question. Please explain if possible 9. The Seymour Corp. attempted to increase sales rapidly in 20X1 by offering a new, low-cost

Need help with this question. Please explain if possible

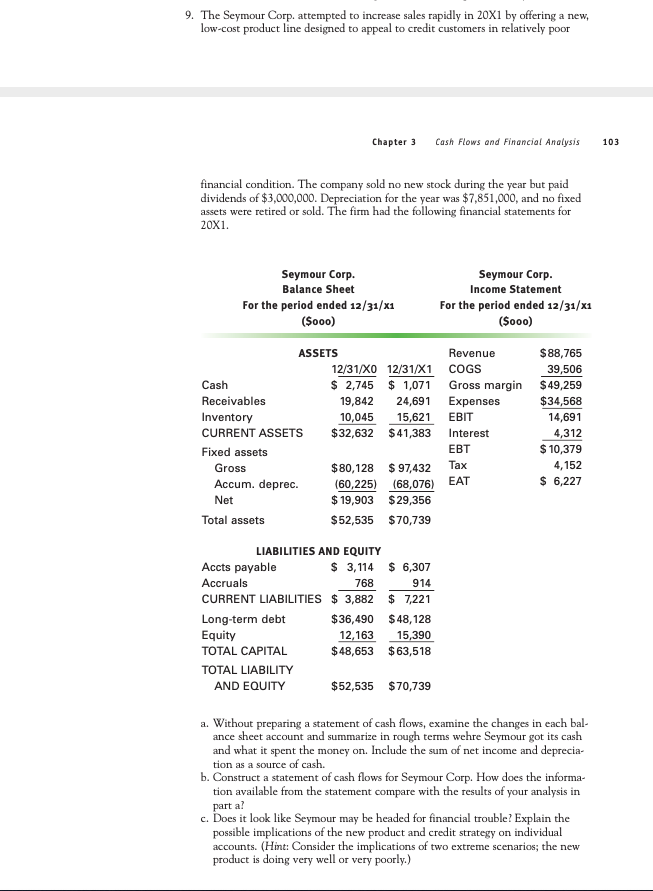

9. The Seymour Corp. attempted to increase sales rapidly in 20X1 by offering a new, low-cost product line designed to appeal to credit customers in relatively poor Chapter 3 Cash Flows and Financial Analysis 103 financial condition. The company sold no new stock during the year but paid dividends of $3,000,000. Depreciation for the year was $7,851,000, and no fixed assets were retired or sold. The firm had the following financial statements for 20X1. Seymour Corp. Balance Sheet For the period ended 12/31/X1 ($000) Seymour Corp. Income Statement For the period ended 12/31/X1 (5000) ASSETS 12/31/XO 12/31/X1 Cash $ 2,745 $ 1,071 Receivables 19,842 24,691 Inventory 10,045 15,621 CURRENT ASSETS $32,632 $ 41,383 Fixed assets $80,128 $ 97,432 Accum. deprec. (60,225) (68,076) Net $ 19,903 $29,356 Total assets $52,535 $70,739 Revenue $88,765 COGS 39,506 Gross margin $49,259 Expenses $34,568 EBIT 14,691 Interest 4,312 EBT $ 10,379 Tax 4,152 EAT $ 6,227 Gross LIABILITIES AND EQUITY Accts payable $ 3,114 $ 6,307 Accruals 768 914 CURRENT LIABILITIES $ 3,882 $ 7,221 Long-term debt $36,490 $ 48,128 Equity 12,163 15,390 TOTAL CAPITAL $ 48,653 $63,518 TOTAL LIABILITY AND EQUITY $52,535 $70,739 a. Without preparing a statement of cash flows, examine the changes in each bal- ance sheet account and summarize in rough terms wehre Seymour got its cash and what it spent the money on. Include the sum of net income and deprecia- tion as a source of cash. b. Construct a statement of cash flows for Seymour Corp. How does the informa- tion available from the statement compare with the results of your analysis in part a? c. Does it look like Seymour may be headed for financial trouble? Explain the possible implications of the new product and credit strategy on individual accounts. (Hint: Consider the implications of two extreme scenarios; the new product is doing very well or very poorly.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started