Answered step by step

Verified Expert Solution

Question

1 Approved Answer

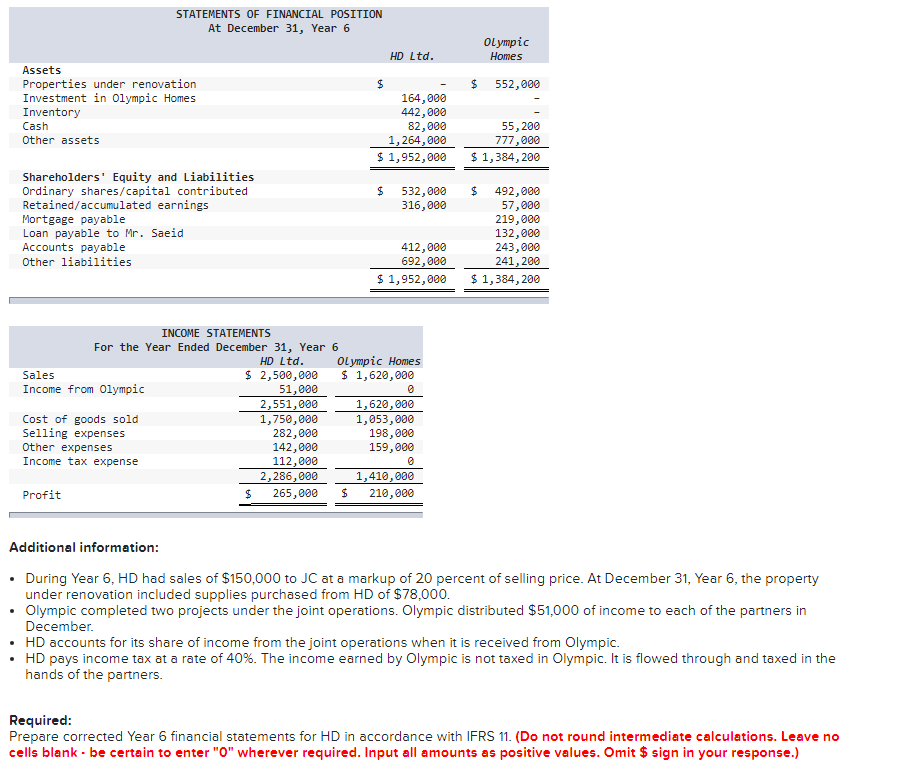

Assets STATEMENTS OF FINANCIAL POSITION At December 31, Year 6 HD Ltd. Olympic Homes $ 552,000 Properties under renovation Investment in Olympic Homes Inventory

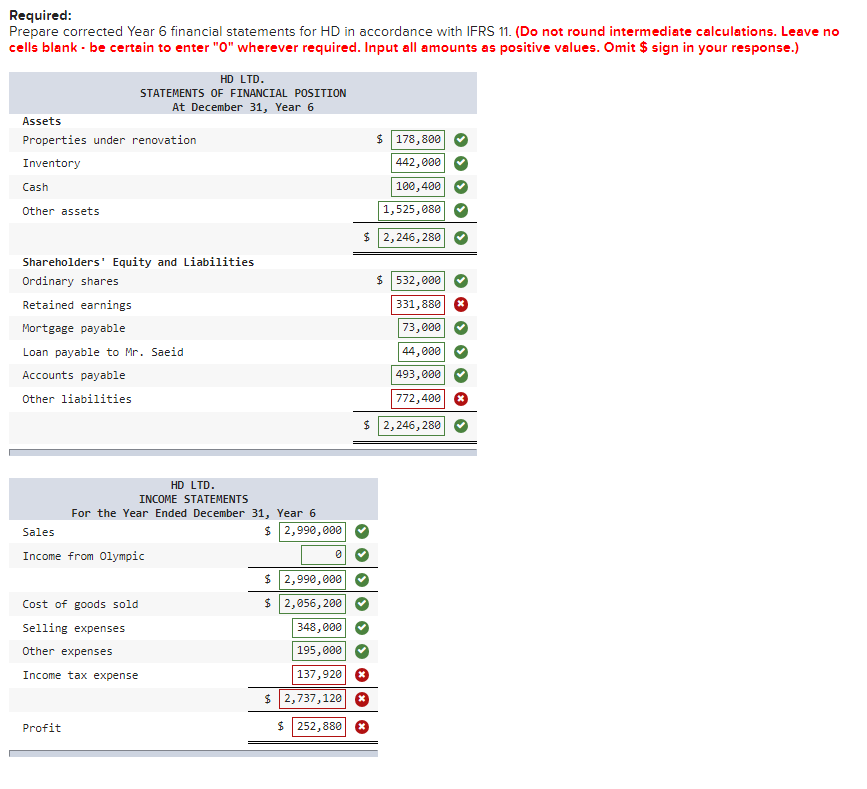

Assets STATEMENTS OF FINANCIAL POSITION At December 31, Year 6 HD Ltd. Olympic Homes $ 552,000 Properties under renovation Investment in Olympic Homes Inventory Cash Other assets Shareholders' Equity and Liabilities Ordinary shares/capital contributed Retained/accumulated earnings Mortgage payable Loan payable to Mr. Saeid Accounts payable Other liabilities $ 164,000 442,000 82,000 1,264,000 $ 1,952,000 55,200 777,000 $ 1,384,200 $ 532,000 $ 492,000 316,000 57,000 219,000 132,000 412,000 243,000 692,000 241,200 $ 1,952,000 $ 1,384,200 Sales INCOME STATEMENTS For the Year Ended December 31, Year 6 Income from Olympic HD Ltd. $ 2,500,000 51,000 2,551,000 1,750,000 Olympic Homes $ 1,620,000 0 1,620,000 Cost of goods sold Selling expenses Other expenses Income tax expense Profit 1,053,000 282,000 142,000 198,000 159,000 112,000 0 2,286,000 1,410,000 $ 265,000 $ 210,000 Additional information: During Year 6, HD had sales of $150,000 to JC at a markup of 20 percent of selling price. At December 31, Year 6, the property under renovation included supplies purchased from HD of $78,000. Olympic completed two projects under the joint operations. Olympic distributed $51,000 of income to each of the partners in December. HD accounts for its share of income from the joint operations when it is received from Olympic. HD pays income tax at a rate of 40%. The income earned by Olympic is not taxed in Olympic. It is flowed through and taxed in the hands of the partners. Required: Prepare corrected Year 6 financial statements for HD in accordance with IFRS 11. (Do not round intermediate calculations. Leave no cells blank - be certain to enter "0" wherever required. Input all amounts as positive values. Omit $ sign in your response.) Required: Prepare corrected Year 6 financial statements for HD in accordance with IFRS 11. (Do not round intermediate calculations. Leave no cells blank - be certain to enter "O" wherever required. Input all amounts as positive values. Omit $ sign in your response.) HD LTD. STATEMENTS OF FINANCIAL POSITION At December 31, Year 6 Assets Properties under renovation $ 178,800 Inventory Cash Other assets Shareholders' Equity and Liabilities Ordinary shares Retained earnings Mortgage payable Loan payable to Mr. Saeid Accounts payable Other liabilities 442,000 100,400 1,525,080 $ 2,246,280 $ 532,000 331,880 73,000 44,000 493,000 772,400 HD LTD. INCOME STATEMENTS For the Year Ended December 31, Year 6 $ 2,990,000 Sales Income from Olympic 0 $ 2,990,000 Cost of goods sold $ 2,056,200 Selling expenses Other expenses Income tax expense 348,000 195,000 137,920 $ 2,737,120 Profit $ 252,880 $ 2,246,280

Step by Step Solution

There are 3 Steps involved in it

Step: 1

HD Ltd STATEMENTS OF FINANCIAL POSITION At December 31 Year 6 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started