Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASSIB ments 1. You have started a business to take advantage of Victoria's backyard chicken demand. Metrofowl sells point of lay hens in the Victoria/Saanich

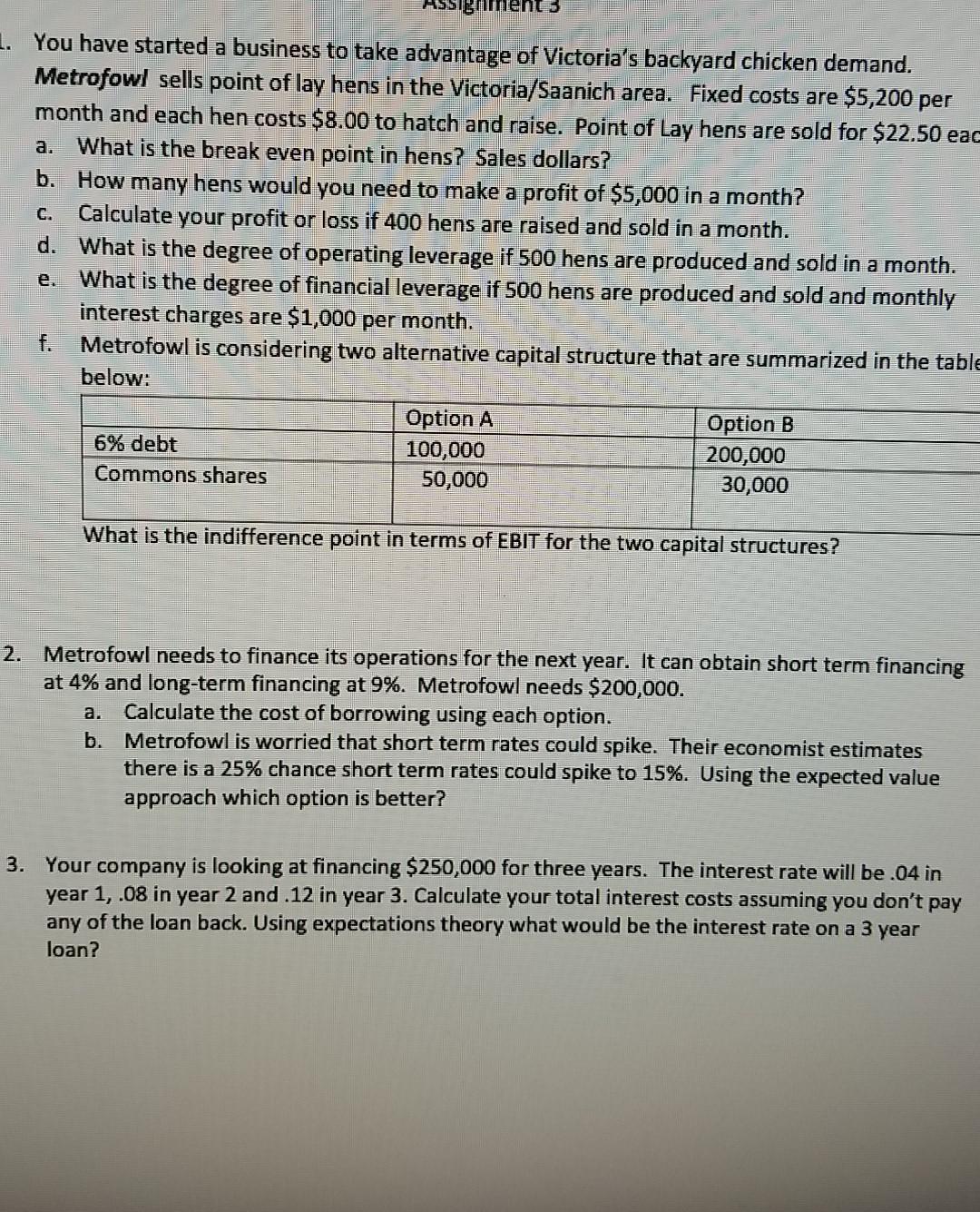

ASSIB ments 1. You have started a business to take advantage of Victoria's backyard chicken demand. Metrofowl sells point of lay hens in the Victoria/Saanich area. Fixed costs are $5,200 per month and each hen costs $8.00 to hatch and raise. Point of Lay hens are sold for $22.50 eac a. What is the break even point in hens? Sales dollars? b. How many hens would you need to make a profit of $5,000 in a month? Calculate your profit or loss if 400 hens are raised and sold in a month. d. What is the degree of operating leverage if 500 hens are produced and sold in a month. What is the degree of financial leverage if 500 hens are produced and sold and monthly interest charges are $1,000 per month. f. Metrofowl is considering two alternative capital structure that are summarized in the table below: Option A Option B 6% debt 100,000 200,000 Commons shares 50,000 30,000 What is the indifference point in terms of EBIT for the two capital structures? 2. Metrofowl needs to finance its operations for the next year. It can obtain short term financing at 4% and long-term financing at 9%. Metrofowl needs $200,000. a. Calculate the cost of borrowing using each option. b. Metrofowl is worried that short term rates could spike. Their economist estimates there is a 25% chance short term rates could spike to 15%. Using the expected value approach which option is better? 3. Your company is looking at financing $250,000 for three years. The interest rate will be .04 in year 1, .08 in year 2 and .12 in year 3. Calculate your total interest costs assuming you don't pay any of the loan back. Using expectations theory what would be the interest rate on a 3 year loan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started