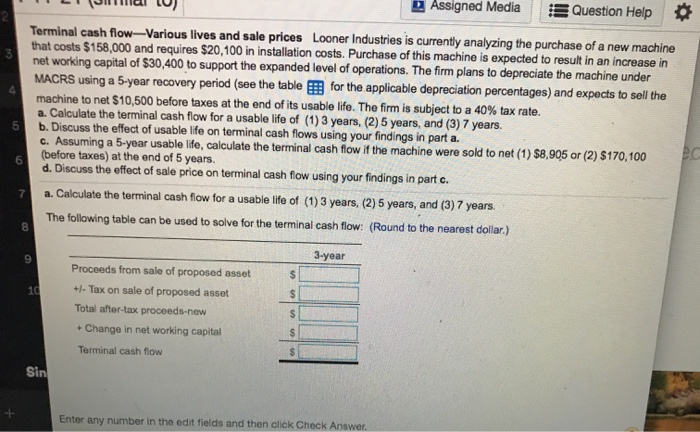

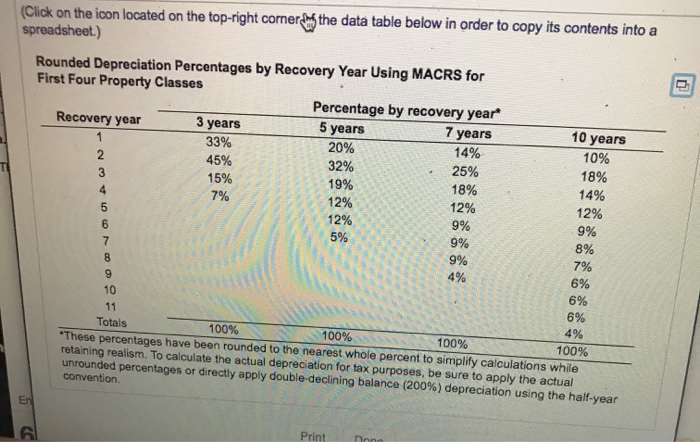

Assigned Media Question Help 0 Terminal cash flow-Various lives and sale prices Looner Industries is currently analyzing the purchase of a new machine that costs $158,000 and requires $20,100 in installation costs. Purchase of this machine is expected to result in an increase in net working capital of $30,400 to support the expanded level of operations. The firm plans to depreciate the machine under MACRS using a 5-year recovery period (see the table for the applicable depreciation percentages) and expects to sell the machine to net $10,500 before taxes at the end of its usable life. The firm is subject to a 40% tax rate. a. Calculate the terminal cash flow for a usable life of (1) 3 years, (2) 5 years, and (3) 7 years. b. Discuss the effect of usable life on terminal cash flows using your findings in part a. c. Assuming a 5-year usable life, calculate the terminal cash flow if the machine were sold to net (1) $8,905 or (2) $170,100 ed (before taxes) at the end of 5 years. d. Discuss the effect of sale price on terminal cash flow using your findings in part c. a. Calculate the terminal cash flow for a usable life of (1) 3 years, (2) 5 years, and (3) 7 years, The following table can be used to solve for the terminal cash flow: (Round to the nearest dollar.) 5 6 7 8 9 3-year $ 10 S Proceeds from sale of proposed asset +/- Tax on sale of proposed asset Total after-tax proceeds-new + Change in net working capital Terminal cash flow $ $ Sin - Enter any number in the edit fields and then click Check Answer 0 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year* Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 7 8% 9% 7% 4% 9 6% 10 6% 11 6% Totals 4% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while 100% 100% retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention En Print Dong