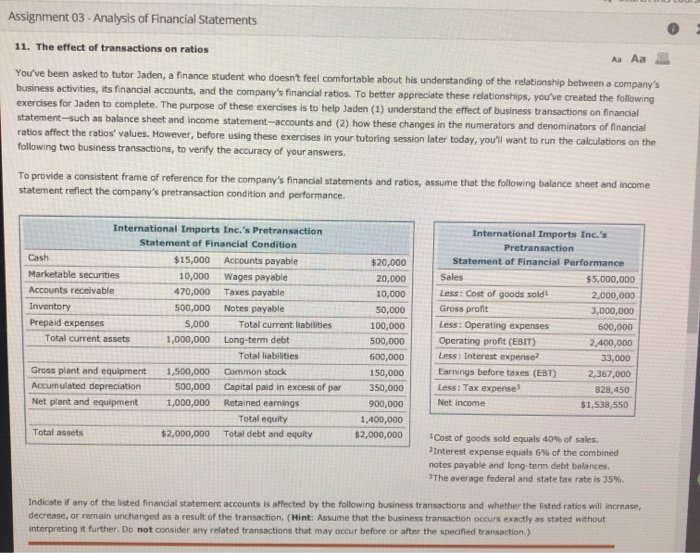

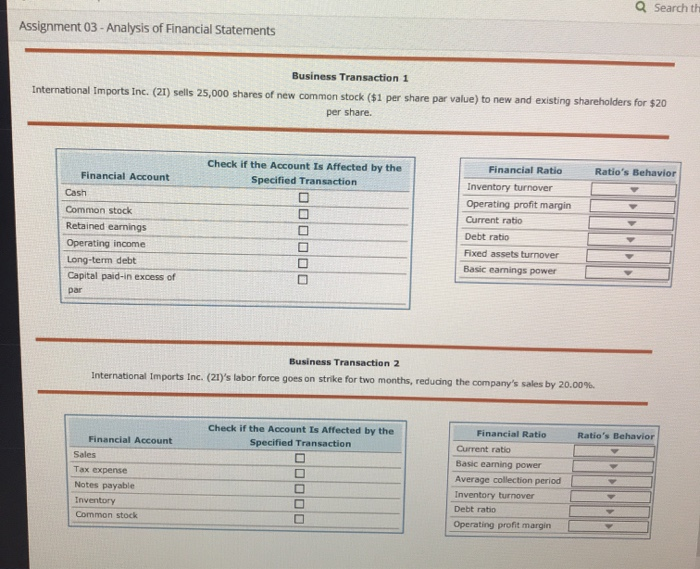

Assignment 03 - Analysis of Financial Statements 11. The effect of transactions on ratios AaAa You've been asked to tutor Jaden, a finance student who doesn't feel comfortable about his understanding of the relationship between a company's business activities, its financial accounts, and the company's financial ratios. To better appreciate these relationships, you've created the following exercises for Jaden to complete. The purpose of these exercises is to help Jaden (1) understand the effect of business transactions on financial statement-such as balance sheet and income statement-accounts and (2) how these changes in the numerators and denominators of financial ratios affect the ratios' values. However, before using these exercises in your tutoring session later today, you'll want to run the calculations on the following two business transactions, to verify the accuracy of your answers. To provide a consistent frame of reference for the company's financial statements and ratios, assume that the following balance sheet and income statement reflect the company's pretransaction condition and performance. International Imports Inc.'s Pretransaction Statement of Financial Condition Cash $15,000 Accounts payable Marketable securities 10,000 Wages payable Accounts receivable 470,000 Taxes payable Inventory 500,000 Notes payable Prepaid expenses 5.000 Total current liabilities Total current assets 1,000,000 Long-term debt Total liabilities Gross plant and equipment 1,500,000 Common stock Accumulated depreciation 500,000 Capital paid in excess of par Net plant and equipment 1,000,000 Retained earnings Total equity Total assets $2,000,000 Total debt and equity $20,000 20,000 10,000 50,000 100,000 500,000 600,000 150,000 350,000 900,000 1,400,000 $2,000,000 International Imports Inc.'s Pretransaction Statement of Financial Performance Sales $5,000,000 Less Cost of goods sold! 2,000,000 Gross profit 3,000,000 Less: Operating expenses 600,000 Operating profit (EBIT) 2,400,000 Lees: Interest expensel 33,000 Earnings before taxes (EBT) 2,367,000 Less: Tax expense 828,450 Net income $1,538,550 Cost of goods sold equals 40% of sales Interest expense equals 6% of the combined notes payable and long-term debt balances. The average federal and state tax rate is 35%. Indicate if any of the listed financial statement accounts is affected by the following business transactions and whether the listed ratios will increase decrease, or remain unchanged as a result of the transaction. (Hint: Assume that the business transaction occurs exactly as stated without interpreting it further. Do not consider any related transactions that may occur before or after the specified transaction.) Search Assignment 03 - Analysis of Financial Statements Business Transaction 1 International Imports Inc. (21) sells 25,000 shares of new common stock ($1 per share par value) to new and existing shareholders for $20 per share Ratio's Behavior Check if the Account Is Affected by the Specified Transaction Financial Account Cash Common stock Retained earnings Operating income 000000 Financial Ratio Inventory turnover Operating profit margin Current ratio Debt ratio Fixed assets turnover Basic earnings power Long-term debt Capital paid in excess of Business Transaction 2 International Imports Inc. (21)'s labor force goes on strike for two months, reducing the company's sales by 20.00% Financial Ratio Ratio's Behavior Check if the Account Is Affected by the Specified Transaction Financial Account Current ratio Sales Basic earning power Tax expense Average collection period Notes payable Inventory turnover Debt ratio Operating profit margin Common stock