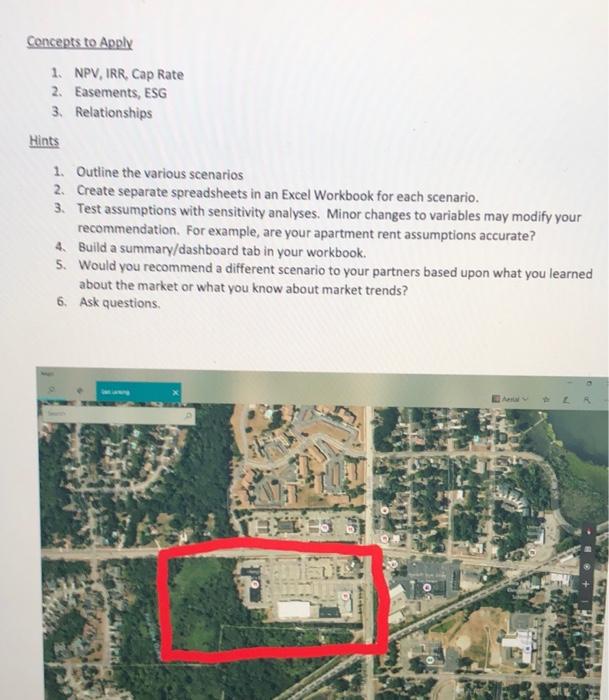

Assignment 1 - Redevelopment of 16,5 Acres at the Southwest Corner of Haslett Road and Marsh Road Assigned Date: September 20, 2021 Due Date: Upload Spreadsheet and Written Recommendation to D2L by September 28, 2021, no later than 11pm Eastern Time Background You and three partners own equal shares in a 16.5 acre land site at the southwest corner of Haslett Road and Marsh Road in Haslett, Michigan. The site is rectangular in shape and enjoys approximately 1,200 feet of frontage along Haslett Road and 600 feet of frontage along Marsh Road. One-half of the site was developed as a single-story retall center with surface parking and improved with five separate buildings In 1985. The other half of the site is not developed. The configuration of the retail buildings is considered functionally obsolete given the sea of surface parking and limited accessibility for delivery vehicles behind the buildings. The retail buildings encompass 175,000 square feet. The site enjoys liberal zoning that allows for the development of commercial, retall, single-family, and multi-family Situation and Choices You and your partners are considering the following options for the redevelopment of the site: 1. Sell the entire site today for $200,000 per acre. 2. Hold the site for three years, then sell for $300,000 per acre at the end of the Year 3. You project you will maintain a 75% vacancy rate in the retail spaces at a net rent after all expenses of $4.00 per square foot. 3. Build 250 apartments at a projected vacancy of 15% and $1,200 per month rent starting at the beginning of Year 2. Apartment rents will grow at 2.5% per year after Year 2. It will take you one year to construct the apartments, so no income for Year 1. Assume 15% vacancy for the entire hold period. You stabilized EBIDTA is 40%. You plan to sell the apartments at the end of Year 5 with selling costs such as attorneys fees and broker commissions at 3% of the transaction cost Financial Considerations 1. You project the cap rate for apartments at the end of year is 5.5% 2. Your basis in the property is $2,500,000. You will pay 20% Long-Term Capital Gains Tax on proceeds above your basis. 3. You and your partners are seeking a 15% return on your invested capital. 4. You borrow 70% of the cost to construct the apartments at a fixed interest rate of 5%, interest only for five years. Other Considerations 1. The City of Haslett is very keen to preserve the green space along Haslett Road, hence the city is offering to purchase a perpetual easement for $100,000 per year to preserve green space along Haslett Road adjacent to the Pine Lake Outlet If you accept this offer the apartment count will be reduced to 225. 2. One of your partners needs $200,000 now due to personal circumstances. Concepts to Apply 1. NPV, IRR. Cap Rate 2. Easements, ESG 3. Relationships Hints 1. Outline the various scenarios 2. Create separate spreadsheets in an Excel Workbook for each scenario. 3. Test assumptions with sensitivity analyses. Minor changes to variables may modify your recommendation. For example, are your apartment rent assumptions accurate? 4. Build a summary/dashboard tab in your workbook. 5. Would you recommend a different scenario to your partners based upon what you learned about the market or what you know about market trends? 6. Ask questions NE WER Assignment 1 - Redevelopment of 16,5 Acres at the Southwest Corner of Haslett Road and Marsh Road Assigned Date: September 20, 2021 Due Date: Upload Spreadsheet and Written Recommendation to D2L by September 28, 2021, no later than 11pm Eastern Time Background You and three partners own equal shares in a 16.5 acre land site at the southwest corner of Haslett Road and Marsh Road in Haslett, Michigan. The site is rectangular in shape and enjoys approximately 1,200 feet of frontage along Haslett Road and 600 feet of frontage along Marsh Road. One-half of the site was developed as a single-story retall center with surface parking and improved with five separate buildings In 1985. The other half of the site is not developed. The configuration of the retail buildings is considered functionally obsolete given the sea of surface parking and limited accessibility for delivery vehicles behind the buildings. The retail buildings encompass 175,000 square feet. The site enjoys liberal zoning that allows for the development of commercial, retall, single-family, and multi-family Situation and Choices You and your partners are considering the following options for the redevelopment of the site: 1. Sell the entire site today for $200,000 per acre. 2. Hold the site for three years, then sell for $300,000 per acre at the end of the Year 3. You project you will maintain a 75% vacancy rate in the retail spaces at a net rent after all expenses of $4.00 per square foot. 3. Build 250 apartments at a projected vacancy of 15% and $1,200 per month rent starting at the beginning of Year 2. Apartment rents will grow at 2.5% per year after Year 2. It will take you one year to construct the apartments, so no income for Year 1. Assume 15% vacancy for the entire hold period. You stabilized EBIDTA is 40%. You plan to sell the apartments at the end of Year 5 with selling costs such as attorneys fees and broker commissions at 3% of the transaction cost Financial Considerations 1. You project the cap rate for apartments at the end of year is 5.5% 2. Your basis in the property is $2,500,000. You will pay 20% Long-Term Capital Gains Tax on proceeds above your basis. 3. You and your partners are seeking a 15% return on your invested capital. 4. You borrow 70% of the cost to construct the apartments at a fixed interest rate of 5%, interest only for five years. Other Considerations 1. The City of Haslett is very keen to preserve the green space along Haslett Road, hence the city is offering to purchase a perpetual easement for $100,000 per year to preserve green space along Haslett Road adjacent to the Pine Lake Outlet If you accept this offer the apartment count will be reduced to 225. 2. One of your partners needs $200,000 now due to personal circumstances. Concepts to Apply 1. NPV, IRR. Cap Rate 2. Easements, ESG 3. Relationships Hints 1. Outline the various scenarios 2. Create separate spreadsheets in an Excel Workbook for each scenario. 3. Test assumptions with sensitivity analyses. Minor changes to variables may modify your recommendation. For example, are your apartment rent assumptions accurate? 4. Build a summary/dashboard tab in your workbook. 5. Would you recommend a different scenario to your partners based upon what you learned about the market or what you know about market trends? 6. Ask questions NE WER