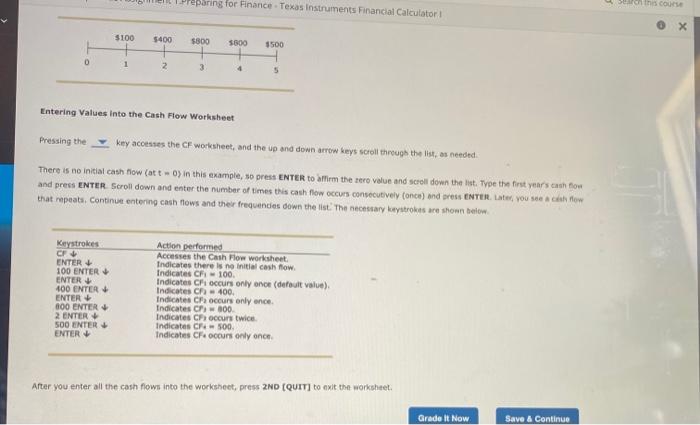

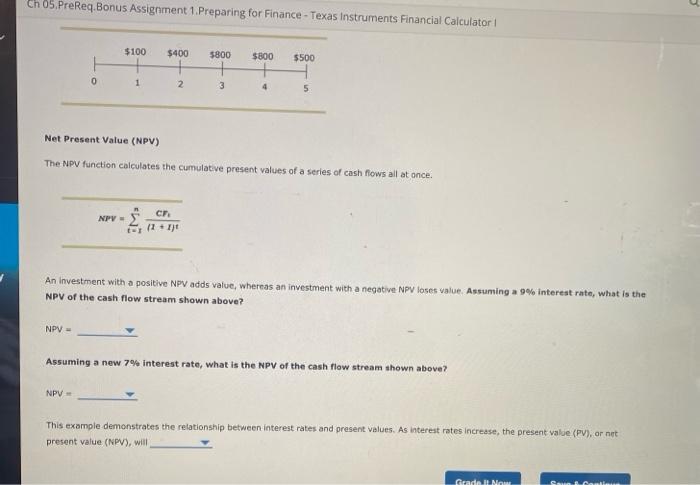

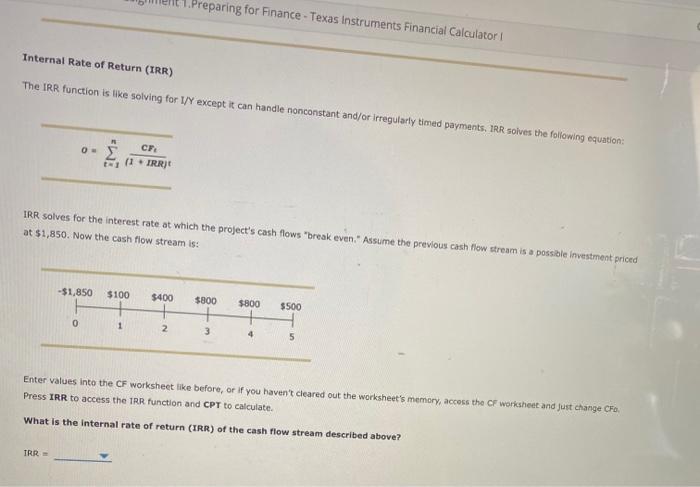

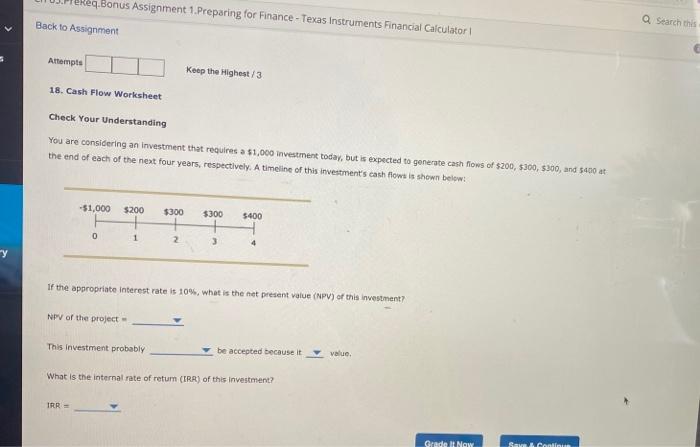

Assignment 1.Preparing for Finance - Texas Instruments Financial Calculator Back to Assignment Attempts Keep the Highest/3 14. Time Value of Money (TVM) worksheet Check Your Understanding As part of his retirement planning, your unde has been offered a security that promises to pay $50,000 at the end of each of the next 20 years. If the Interest rate is 6%, how much should he be willing to pay for this security? Value of the Security You want to be a millionaire when you retire in 60 years. You plan to make 60 equal annual contributions to your investment account starting today, and the last contribution will be made 5 years from today. If your investment account pays 6% Interest every year how tarot must each annual contribution be? Required Annual Contribution- Your daughter was just born today, so that means its time to start saving for her college education. You plan to make 18 annual payments (starting today) of $3,000 each year on her birthday (the last coming on her 17th birthday). You will withdraw the money on her 18th birthday (no payment wat be made this day) and write a check to the college of her choosing, Ir you expect an average investment return of 8%. how much will you have saved up for her college tuition? Total College Savings reparing for Finance - Texas Instruments Financial Calculator Sonths course $400 $800 5600 1500 $100 + 1 0 2 3 4 5 Entering Values into the Cash Flow Worksheet Pressing the key accesses the CF worksheet, and the up and down arrow keys scroll through the lot, as needed. There is no initial cash flow (atto in this example, so press ENTER to affirm the ero value and scroll down the list. Type the first year's cash flow and press ENTER. Scroll down and enter the number of times this cash flow occurs consecutively conce) and press ENTER. Later, you see how that repeats. Continue entering cash flows and their frequences down the list the necessary keystrokes are shown below Keystrokes CF ENTER 100 ENTER ENTER 100 ENTER ENTER 800 ENTER 2 ENTER 500 ENTER ENTER Action performed Accesses the Cash Flow worksheet Indicates there is no initial cash flow Indicaties CF-100 Indicates Chioccurs only once (default value) Indicates Ch.400. Indicates CF occurs only once Indicates C300 Indicates CF occurs twice Indicates CR 500 Indicates CF occurs only once After you enter all the cash flows into the worksheet, press 2ND (QUIT) to exit the worksheet Grade it Now Save & Continue Ch 05. PreReq.Bonus Assignment 1. Preparing for Finance - Texas Instruments Financial Calculator $100 $400 5800 $800 $500 0 1 2 3 4 5 Net Present Value (NPV) The NPV function calculates the cumulative present values of a series of cash flows all at once. NPV CH 12. It An Investment with a positive NPV adds value, whereas an investment with a negative NPV loses value. Assuming a 9% interest rate, what is the NPV of the cash flow stream shown above? NPV Assuming a new 7% Interest rate, what is the NPV of the cash flow stream shown above? NPV This example demonstrates the relationship between interest rates and present values. As interest rates increase, the present value (PV), ar net present value (NPV), will Grad Now Preparing for Finance - Texas Instruments Financial Calculator Internal Rate of Return (IRR) The IRR function is like solving for I/Y except it can handle nonconstant and/or irregularly timed payments. IRR soives the following equation: O- CP * (1 IRRJE IRR solves for the interest rate at which the project's cash flows "break even. Assume the previous cash flow stream is a possible investment priced at $1,850. Now the cash flow stream is: -$1,850 $100 $400 $800 $800 $500 + 0 1 2 3 5 Enter values into the CF worksheet like before, or if you haven't cleared out the worksheet's memory, access the CF worksheet and just change Co. Press IRR to access the IRR function and CPT to calculate What is the Internal rate of return (IRR) of the cash flow stream described above? IRR Req.Bonus Assignment 1. Preparing for Finance - Texas Instruments Financial Calculator a Search this Back to Assignment Attempts Keep the Highest 3 18. Cash Flow Worksheet Check Your Understanding You are considering an investment that requires a $1,000 investment today, but is expected to generate cash flows of $200, $300, $300, and $400 at the end of each of the next four years, respectively. A timeline of this investment's cash flows is shown below! -$1,000 $200 $300 5400 $300 + 3 0 1 2 If the appropriate interest rate is 10%, what is the net present value (NPV) of this investment? NPV of the project This investment probably be accepted because it value What is the internal rate of return (IRR) of this Investment? IRR = Grade It Now Sam Continue ents Financial Calculator AM S- EK TI BAII Plus Image used with permission of copyright owner, Texas Instruments incorporated. Text superimposed on product display by Cengage Learning, Inc does not represent actual display output A portion of loan payments goes toward covering the interest due on the loan, while the rest reduces the loan's balance. Earty in a loansite, its balance is high and a substantial portion goes toward interest, but over time the balance declines, as does the portion paid toward interest. An amortization schedule illustrates how interest is covered and principal repaid by loan payments over time. You have secured an 8%, $500,000 bank loan to be paid off in seven equal end-of-year annual payments. What is the required loan payment? Loan Payment Grade It Now Save & Contin