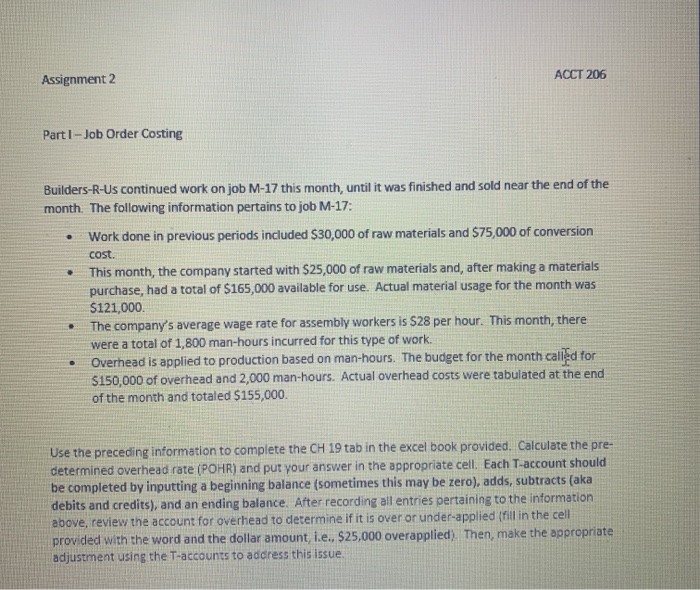

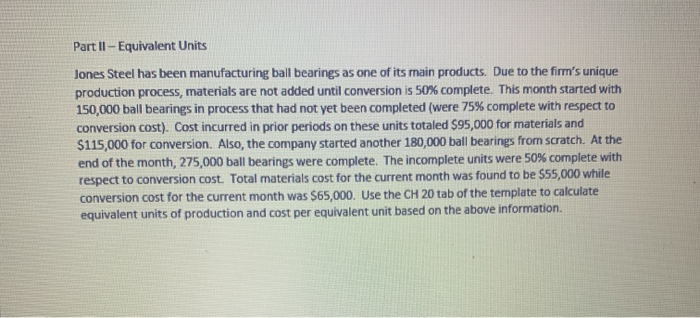

Assignment 2 ACCT 206 Part I - Job Order Costing Builders-R-Us continued work on job M-17 this month, until it was finished and sold near the end of the month. The following information pertains to job M-17: Work done in previous periods included $30,000 of raw materials and $75,000 of conversion cost. This month, the company started with $25,000 of raw materials and, after making a materials purchase, had a total of $165,000 available for use. Actual material usage for the month was $121,000. The company's average wage rate for assembly workers is $28 per hour. This month, there were a total of 1,800 man-hours incurred for this type of work. Overhead is applied to production based on man-hours. The budget for the month called for $150,000 of overhead and 2,000 man-hours. Actual overhead costs were tabulated at the end of the month and totaled $155,000. Use the preceding information to complete the CH 19 tab in the excel book provided. Calculate the pre- determined overhead rate (POHR) and put your answer in the appropriate cell. Each T-account should be completed by inputting a beginning balance (sometimes this may be zero), adds, subtracts (aka debits and credits), and an ending balance. After recording all entries pertaining to the information above, review the account for overhead to determine if it is over or under-applied (fill in the cell provided with the word and the dollar amount i.e., $25,000 overapplied). Then, make the appropriate adjustment using the T-accounts to address this issue. Part II - Equivalent Units Jones Steel has been manufacturing ball bearings as one of its main products. Due to the firm's unique production process, materials are not added until conversion is 50% complete. This month started with 150,000 ball bearings in process that had not yet been completed (were 75% complete with respect to conversion cost). Cost incurred in prior periods on these units totaled $95,000 for materials and $115,000 for conversion. Also, the company started another 180,000 ball bearings from scratch. At the end of the month, 275,000 ball bearings were complete. The incomplete units were 50% complete with respect to conversion cost. Total materials cost for the current month was found to be $55,000 while conversion cost for the current month was $65,000. Use the CH 20 tab of the template to calculate equivalent units of production and cost per equivalent unit based on the above information. Assignment 2 ACCT 206 Part I - Job Order Costing Builders-R-Us continued work on job M-17 this month, until it was finished and sold near the end of the month. The following information pertains to job M-17: Work done in previous periods included $30,000 of raw materials and $75,000 of conversion cost. This month, the company started with $25,000 of raw materials and, after making a materials purchase, had a total of $165,000 available for use. Actual material usage for the month was $121,000. The company's average wage rate for assembly workers is $28 per hour. This month, there were a total of 1,800 man-hours incurred for this type of work. Overhead is applied to production based on man-hours. The budget for the month called for $150,000 of overhead and 2,000 man-hours. Actual overhead costs were tabulated at the end of the month and totaled $155,000. Use the preceding information to complete the CH 19 tab in the excel book provided. Calculate the pre- determined overhead rate (POHR) and put your answer in the appropriate cell. Each T-account should be completed by inputting a beginning balance (sometimes this may be zero), adds, subtracts (aka debits and credits), and an ending balance. After recording all entries pertaining to the information above, review the account for overhead to determine if it is over or under-applied (fill in the cell provided with the word and the dollar amount i.e., $25,000 overapplied). Then, make the appropriate adjustment using the T-accounts to address this issue. Part II - Equivalent Units Jones Steel has been manufacturing ball bearings as one of its main products. Due to the firm's unique production process, materials are not added until conversion is 50% complete. This month started with 150,000 ball bearings in process that had not yet been completed (were 75% complete with respect to conversion cost). Cost incurred in prior periods on these units totaled $95,000 for materials and $115,000 for conversion. Also, the company started another 180,000 ball bearings from scratch. At the end of the month, 275,000 ball bearings were complete. The incomplete units were 50% complete with respect to conversion cost. Total materials cost for the current month was found to be $55,000 while conversion cost for the current month was $65,000. Use the CH 20 tab of the template to calculate equivalent units of production and cost per equivalent unit based on the above information