Question

Assignment 7 USE GAAP CODIFICATION Answer the questions associated with each of the following scenarios. The companies in each scenario are publicly traded, have a

Assignment 7

USE GAAP CODIFICATION

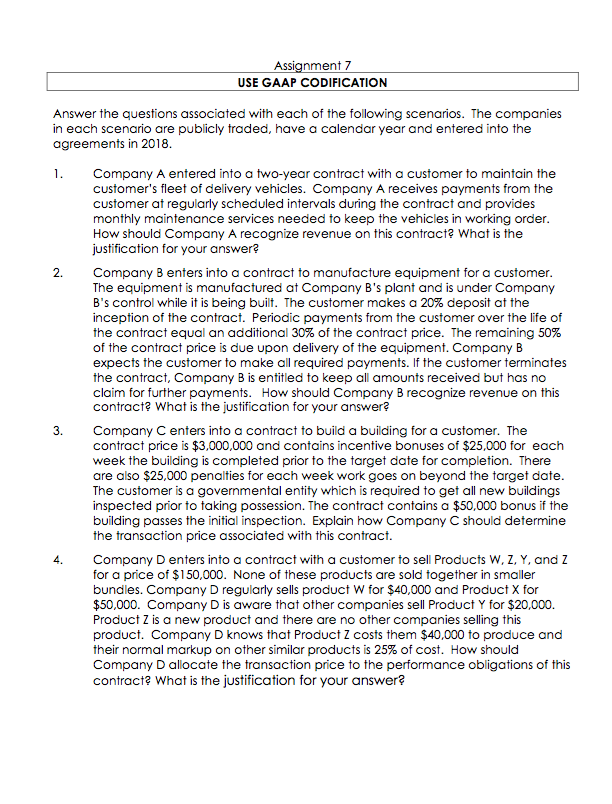

Answer the questions associated with each of the following scenarios. The companies in each scenario are publicly traded, have a calendar year and entered into the agreements in 2018.

1. Company A entered into a two-year contract with a customer to maintain the customers fleet of delivery vehicles. Company A receives payments from the customer at regularly scheduled intervals during the contract and provides monthly maintenance services needed to keep the vehicles in working order.How should Company A recognize revenue on this contract? What is the justification for your answer?

Company A entered into a two-year contract with a customer to maintain the customers fleet of delivery vehicles. Company A receives payments from the customer at regularly scheduled intervals during the contract and provides monthly maintenance services needed to keep the vehicles in working order.How should Company A recognize revenue on this contract? What is the justification for your answer?

2. Company B enters into a contract to manufacture equipment for a customer. The equipment is manufactured at Company Bs plant and is under Company Bs control while it is being built. The customer makes a 20% deposit at the inception of the contract. Periodic payments from the customer over the life of the contract equal an additional 30% of the contract price. The remaining 50% of the contract price is due upon delivery of the equipment. Company B expects the customer to make all required payments. If the customer terminates the contract, Company B is entitled to keep all amounts received but has no claim for further payments. How should Company B recognize revenue on this contract? What is the justification for your answer?

3. Company C enters into a contract to build a building for a customer. The contract price is $3,000,000 and contains incentive bonuses of $25,000 for each week the building is completed prior to the target date for completion. There are also $25,000 penalties for each week work goes on beyond the target date. The customer is a governmental entity which is required to get all new buildings inspected prior to taking possession. The contract contains a $50,000 bonus if the building passes the initial inspection. Explain how Company C should determine the transaction price associated with this contract.

4. Company D enters into a contract with a customer to sell Products W, Z, Y, and Z for a price of $150,000. None of these products are sold together in smaller bundles. Company D regularly sells product W for $40,000 and Product X for $50,000. Company D is aware that other companies sell Product Y for $20,000. Product Z is a new product and there are no other companies selling this product. Company D knows that Product Z costs them $40,000 to produce and their normal markup on other similar products is 25% of cost. How should Company D allocate the transaction price to the performance obligations of this contract? What is the justification for your answer?

Assignment 7 USE GAAP CODIFICATION Answer the questions associated with each of the following scenarios. The companies in each scenario are publicly traded, have a calendar year and entered into the agreements in 2018 1.Company A entered into a two-year contract with a customer to maintain the customer's fleet of delivery vehicles. Company A receives payments from the customer at regularly scheduled intervals during the contract and provides monthly maintenance services needed to keep the vehicles in working order. How should Company A recognize revenue on this contract? What is the justification for your answer? 2.Company B enters into a contract to manufacture equipment for a customer. The equipment is manufactured at Company B's plant and is under Company B's control while it is being built. The customer makes a 20% deposit at the inception of the contract. Periodic payments from the customer over the life of the contract equal an additional 30% of the contract price. The remaining 50% of the contract price is due upon delivery of the equipment. Company B expects the customer to make all required payments. If the customer terminates the contract, Company B is entitled to keep all amounts received but has no claim for further payments. How should Company B recognize revenue on this contract? What is the justification for your answer? 3. Company C enters into a contract to build a building for a customer. The contract price is $3,000,000 and contains incentive bonuses of $25,000 for each week the building is completed prior to the target date for completion. There are also $25,000 penalties for each week work goes on beyond the target date The customer is a governmental entity which is required to get all new buildings inspected prior to taking possession. The contract contains a $50,000 bonus if the building passes the initial inspection. Explain how Company C should determine the transaction price associated with this contract 4. Company D enters into a contract with a customer to sell Products W, Z, Y, and Z for a price of $150,000. None of these products are sold together in smaller bundles. Company D regularly sells product W for $40,000 and Product X for $50,000. Company D is aware that other companies sell Product Y for $20,000. Product Z is a new product and there are no other companies selling this product. Company D knows that Product Z costs them $40,000 to produce and their normal markup on other similar products is 25% of cost. How should Company D allocate the transaction price to the performance obligations of this contract? What is the justification for yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started