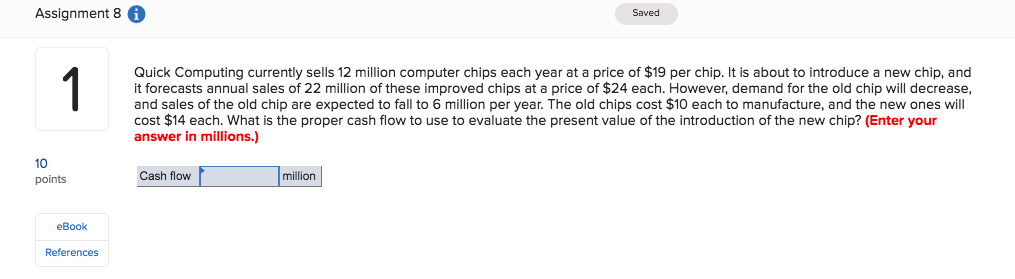

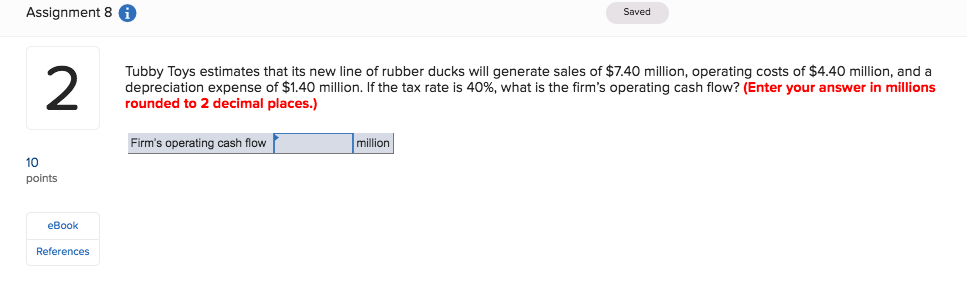

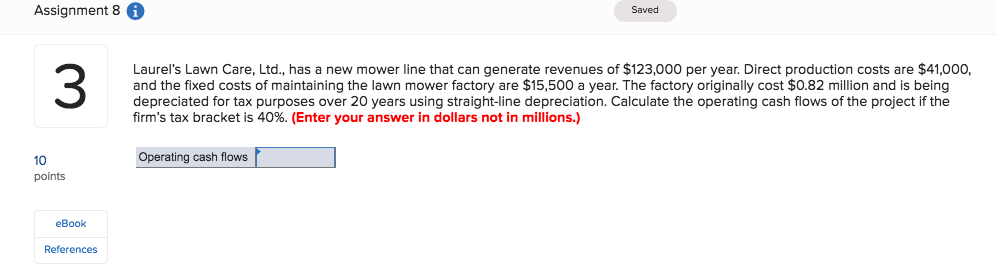

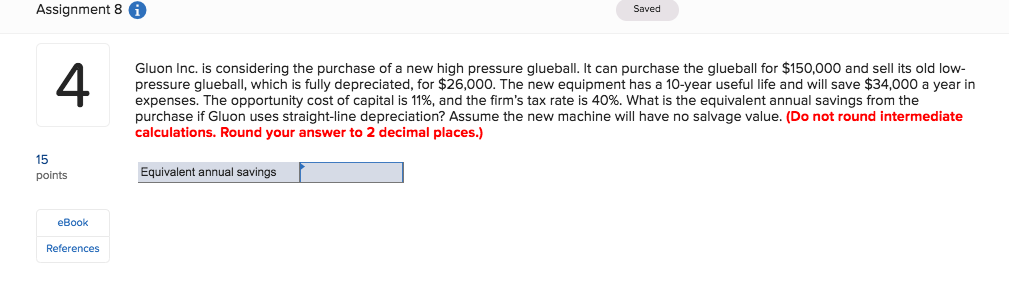

Assignment 8 6 Saved Quick Computing currently sells 12 million computer chips each year at a price of $19 per chip. It is about to introduce a new chip, and it forecasts annual sales of 22 million of these improved chips at a price of $24 each. However, demand for the old chip will decrease, and sales of the old chip are expected to fall to 6 million per year. The old chips cost $10 each to manufacture, and the new ones will cost $14 each. What is the proper cash flow to use to evaluate the present value of the introduction of the new chip? (Enter your answer in millions.) 10 points Cash flow million eBook References Assignment 8 i Saved Tubby Toys estimates that its new line of rubber ducks will generate sales of $7.40 million, operating costs of $4.40 million, and a depreciation expense of $1.40 million. If the tax rate is 40%, what is the firm's operating cash flow?(Enter your answer in millions rounded to 2 decimal places.) Firm's operating cash flow million 10 points eBook References Assignment 8 Saved 3 Laurel's Lawn Care, Ltd., has a new mower line that can generate revenues of $123,000 per year. Direct production costs are $41,000, and the fixed costs of maintaining the lawn mower factory are $15,500 a year. The factory originally cost $0.82 million and is being depreciated for tax purposes over 20 years using straight-line depreciation. Calculate the operating cash flows of the project if the firm's tax bracket is 40%. Enter your answer in dollars not in millions) Operating cash flows 10 points eBook References Assignment 8 Saved Gluon Inc. is considering the purchase of a new high pressure glueball. It can purchase the glueball for $150,000 and sell its old low- pressure glueball, which is fully depreciated, for $26,000. The new equipment has a 10-year useful life and will save $34,000 a year in expenses. The opportunity cost of capital is 11%, and the firm's tax rate is 40%, what is the equivalent annual savings from the purchase if Gluon uses straight-line depreciation? Assume the new machine will have no salvage value. (Do not round intermediate calculations. Round your answer to 2 decimal places.) 15 points Equivalent annual savings eBook References