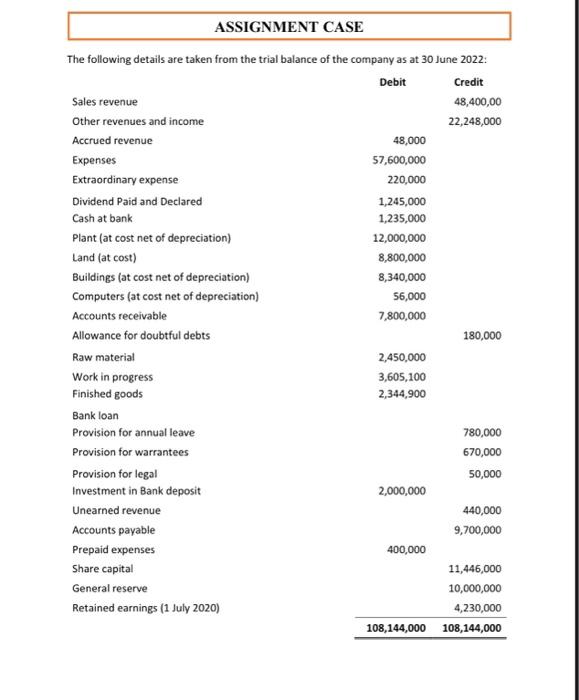

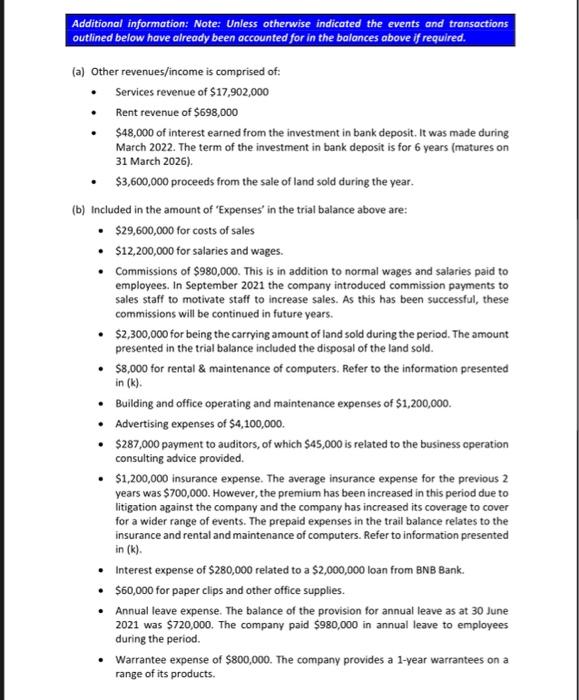

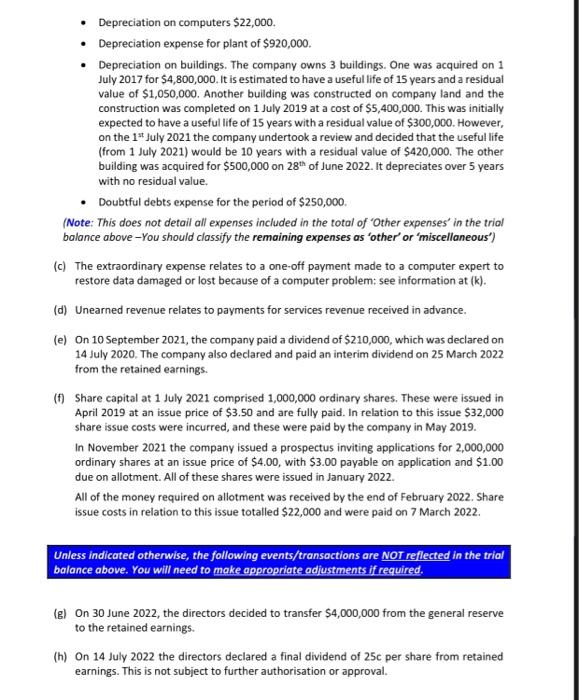

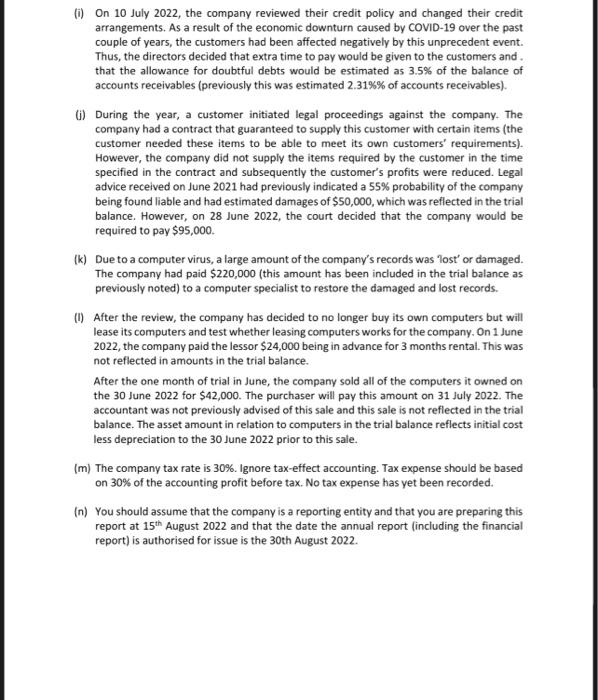

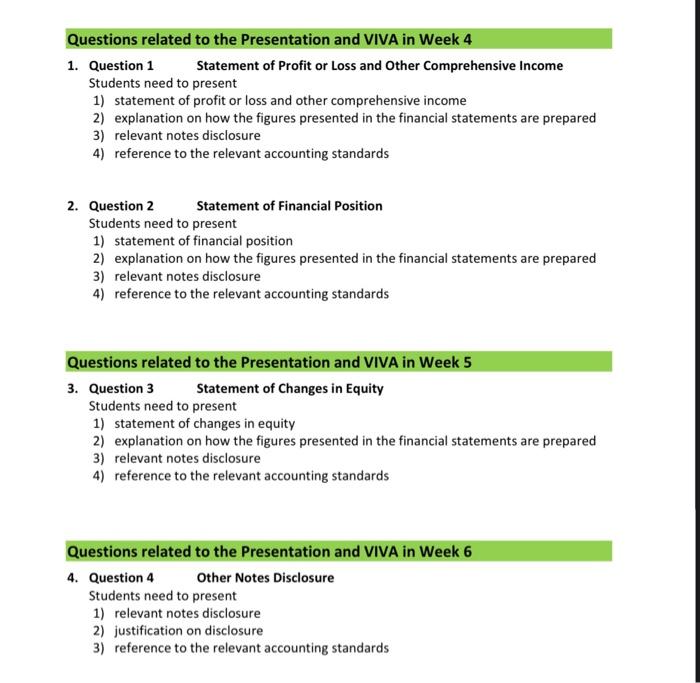

ASSIGNMENT CASE The following details are taken from the trial balance of the company as at 30 June 2022: Sales revenue Other revenues and income Debit22,248,000Credit48,400,00 Accrued revenue 48,000 Expenses 57,600,000 Extraordinary expense 220,000 Dividend Paid and Declared 1,245,000 Cash at bank 1,235,000 Plant (at cost net of depreciation) 12,000,000 Land (at cost) 8,800,000 Buildings (at cost net of depreciation) 8,340,000 Computers (at cost net of depreciation) 56,000 Accounts receivable 7,800,000 Allowance for doubtful debts 180,000 Raw material 2,450,000 Work in progress 3,605,100 Finished goods 2,344,900 Bank loan Provision for annual leave Provision for warrantees Provision for legal Investment in Bank deposit 2,000,000 Unearned revenue Accounts payable Prepaid expenses 400,000 Share capital General reserve General reserve Retained earnings (1 July 2020) Additional information: Note: Unless otherwise indicated the events and transactions outlined below have already been accounted for in the balances above if required. (a) Other revenues/income is comprised of: - Services revenue of $17,902,000 - Rent revenue of $698,000 - $48,000 of interest earned from the investment in bank deposit. It was made during March 2022. The term of the investment in bank deposit is for 6 years (matures on 31 March 2026). - $3,600,000 proceeds from the sale of land sold during the year. (b) Included in the amount of "Expenses' in the trial balance above are: - $29,600,000 for costs of sales - $12,200,000 for salaries and wages. - Commissions of $980,000. This is in addition to normal wages and salaries paid to employees. In September 2021 the company introduced commission payments to sales staff to motivate staff to increase sales. As this has been successful, these commissions will be continued in future years. - $2,300,000 for being the carrying amount of land sold during the period. The amount presented in the trial balance included the disposal of the land sold. - $8,000 for rental & maintenance of computers. Refer to the information presented in (k). - Building and office operating and maintenance expenses of $1,200,000. - Advertising expenses of $4,100,000. - $287,000 payment to auditors, of which $45,000 is related to the business operation consulting advice provided. - $1,200,000 insurance expense. The average insurance expense for the previous 2 years was $700,000. However, the premium has been increased in this period due to litigation against the company and the company has increased its coverage to cover for a wider range of events. The prepaid expenses in the trail balance relates to the insurance and rental and maintenance of computers. Refer to information presented in (k). - Interest expense of $280,000 related to a $2,000,000 loan from BNB Bank. - $60,000 for paper clips and other office supplies. - Annual leave expense. The balance of the provision for annual leave as at 30 June 2021 was $720,000. The company paid $980,000 in annual leave to employees during the period. - Warrantee expense of $800,000. The company provides a 1-year warrantees on a range of its products. - Depreciation on computers $22,000. - Depreciation expense for plant of $920,000. - Depreciation on buildings. The company owns 3 buildings. One was acquired on 1 July 2017 for $4,800,000. It is estimated to have a useful life of 15 years and a residual value of $1,050,000. Another building was constructed on company land and the construction was completed on 1 July 2019 at a cost of $5,400,000. This was initially expected to have a useful life of 15 years with a residual value of $300,000. However, on the 1st July 2021 the company undertook a review and decided that the useful life (from 1 July 2021) would be 10 years with a residual value of $420,000. The other building was acquired for $500,000 on 28th of June 2022. It depreciates over 5 years with no residual value. - Doubtful debts expense for the period of $250,000. (Note: This does not detail all expenses included in the total of 'Other expenses' in the trial balance above -You should classify the remaining expenses as 'other' or 'miscellaneous') (c) The extraordinary expense relates to a one-off payment made to a computer expert to restore data damaged or lost because of a computer problem: see information at (k). (d) Unearned revenue relates to payments for services revenue received in advance. (e) On 10 September 2021, the company paid a dividend of $210,000, which was declared on 14 July 2020 . The company also declared and paid an interim dividend on 25 March 2022 from the retained earnings. (f) Share capital at 1 July 2021 comprised 1,000,000 ordinary shares. These were issued in April 2019 at an issue price of $3.50 and are fully paid. In relation to this issue $32,000 share issue costs were incurred, and these were paid by the company in May 2019. In November 2021 the company issued a prospectus inviting applications for 2,000,000 ordinary shares at an issue price of $4.00, with $3.00 payable on application and $1.00 due on allotment. All of these shares were issued in January 2022. All of the money required on allotment was received by the end of February 2022. Share issue costs in relation to this issue totalled $22,000 and were paid on 7 March 2022. (g) On 30 June 2022, the directors decided to transfer $4,000,000 from the general reserve to the retained earnings. (h) On 14 July 2022 the directors declared a final dividend of 25c per share from retained earnings. This is not subject to further authorisation or approval. (i) On.10 July 2022, the company reviewed their credit policy and changed their credit arrangements. As a result of the economic downturn caused by COVID-19 over the past couple of years, the customers had been affected negatively by this unprecedent event. Thus, the directors decided that extra time to pay would be given to the customers and. that the allowance for doubtful debts would be estimated as 3.5% of the balance of accounts receivables (previously this was estimated 2.31%% of accounts receivables). (j) During the year, a customer initiated legal proceedings against the company. The company had a contract that guaranteed to supply this customer with certain items (the customer needed these items to be able to meet its own customers' requirements). However, the company did not supply the items required by the customer in the time specified in the contract and subsequently the customer's profits were reduced. Legal advice received on June 2021 had previously indicated a 55% probability of the company being found liable and had estimated damages of $50,000, which was reflected in the trial balance. However, on 28 June 2022, the court decided that the company would be required to pay $95,000. (k) Due to a computer virus, a large amount of the company's records was Tost' or damaged. The company had paid $220,000 (this amount has been included in the trial balance as previously noted) to a computer specialist to restore the damaged and lost records. (I) After the review, the company has decided to no longer buy its own computers but will lease its computers and test whether leasing computers works for the company. On 1 June 2022 , the company paid the lessor $24,000 being in advance for 3 months rental. This was not reflected in amounts in the trial balance. After the one month of trial in June, the company sold all of the computers it owned on the 30 June 2022 for $42,000. The purchaser will pay this amount on 31 July 2022 . The accountant was not previously advised of this sale and this sale is not reflected in the trial balance. The asset amount in relation to computers in the trial balance reflects initial cost less depreciation to the 30 June 2022 prior to this sale. (m) The company tax rate is 30%. Ignore tax-effect accounting. Tax expense should be based on 30% of the accounting profit before tax. No tax expense has yet been recorded. (n) You should assume that the company is a reporting entity and that you are preparing this report at 15th August 2022 and that the date the annual report (including the financial report) is authorised for issue is the 30 th August 2022. 1. Question 1 Statement of Profit or Loss and Other Comprehensive Income Students need to present 1) statement of profit or loss and other comprehensive income 2) explanation on how the figures presented in the financial statements are prepared 3) relevant notes disclosure 4) reference to the relevant accounting standards 2. Question 2 Statement of Financial Position Students need to present 1) statement of financial position 2) explanation on how the figures presented in the financial statements are prepared 3) relevant notes disclosure 4) reference to the relevant accounting standards Questions related to the Presentation and VIVA in Week 5 3. Question 3 Statement of Changes in Equity Students need to present 1) statement of changes in equity 2) explanation on how the figures presented in the financial statements are prepared 3) relevant notes disclosure 4) reference to the relevant accounting standards Questions related to the Presentation and VIVA in Week 6 4. Question 4 Other Notes Disclosure Students need to present 1) relevant notes disclosure 2) justification on disclosure 3) reference to the relevant accounting standards ASSIGNMENT CASE The following details are taken from the trial balance of the company as at 30 June 2022: Sales revenue Other revenues and income Debit22,248,000Credit48,400,00 Accrued revenue 48,000 Expenses 57,600,000 Extraordinary expense 220,000 Dividend Paid and Declared 1,245,000 Cash at bank 1,235,000 Plant (at cost net of depreciation) 12,000,000 Land (at cost) 8,800,000 Buildings (at cost net of depreciation) 8,340,000 Computers (at cost net of depreciation) 56,000 Accounts receivable 7,800,000 Allowance for doubtful debts 180,000 Raw material 2,450,000 Work in progress 3,605,100 Finished goods 2,344,900 Bank loan Provision for annual leave Provision for warrantees Provision for legal Investment in Bank deposit 2,000,000 Unearned revenue Accounts payable Prepaid expenses 400,000 Share capital General reserve General reserve Retained earnings (1 July 2020) Additional information: Note: Unless otherwise indicated the events and transactions outlined below have already been accounted for in the balances above if required. (a) Other revenues/income is comprised of: - Services revenue of $17,902,000 - Rent revenue of $698,000 - $48,000 of interest earned from the investment in bank deposit. It was made during March 2022. The term of the investment in bank deposit is for 6 years (matures on 31 March 2026). - $3,600,000 proceeds from the sale of land sold during the year. (b) Included in the amount of "Expenses' in the trial balance above are: - $29,600,000 for costs of sales - $12,200,000 for salaries and wages. - Commissions of $980,000. This is in addition to normal wages and salaries paid to employees. In September 2021 the company introduced commission payments to sales staff to motivate staff to increase sales. As this has been successful, these commissions will be continued in future years. - $2,300,000 for being the carrying amount of land sold during the period. The amount presented in the trial balance included the disposal of the land sold. - $8,000 for rental & maintenance of computers. Refer to the information presented in (k). - Building and office operating and maintenance expenses of $1,200,000. - Advertising expenses of $4,100,000. - $287,000 payment to auditors, of which $45,000 is related to the business operation consulting advice provided. - $1,200,000 insurance expense. The average insurance expense for the previous 2 years was $700,000. However, the premium has been increased in this period due to litigation against the company and the company has increased its coverage to cover for a wider range of events. The prepaid expenses in the trail balance relates to the insurance and rental and maintenance of computers. Refer to information presented in (k). - Interest expense of $280,000 related to a $2,000,000 loan from BNB Bank. - $60,000 for paper clips and other office supplies. - Annual leave expense. The balance of the provision for annual leave as at 30 June 2021 was $720,000. The company paid $980,000 in annual leave to employees during the period. - Warrantee expense of $800,000. The company provides a 1-year warrantees on a range of its products. - Depreciation on computers $22,000. - Depreciation expense for plant of $920,000. - Depreciation on buildings. The company owns 3 buildings. One was acquired on 1 July 2017 for $4,800,000. It is estimated to have a useful life of 15 years and a residual value of $1,050,000. Another building was constructed on company land and the construction was completed on 1 July 2019 at a cost of $5,400,000. This was initially expected to have a useful life of 15 years with a residual value of $300,000. However, on the 1st July 2021 the company undertook a review and decided that the useful life (from 1 July 2021) would be 10 years with a residual value of $420,000. The other building was acquired for $500,000 on 28th of June 2022. It depreciates over 5 years with no residual value. - Doubtful debts expense for the period of $250,000. (Note: This does not detail all expenses included in the total of 'Other expenses' in the trial balance above -You should classify the remaining expenses as 'other' or 'miscellaneous') (c) The extraordinary expense relates to a one-off payment made to a computer expert to restore data damaged or lost because of a computer problem: see information at (k). (d) Unearned revenue relates to payments for services revenue received in advance. (e) On 10 September 2021, the company paid a dividend of $210,000, which was declared on 14 July 2020 . The company also declared and paid an interim dividend on 25 March 2022 from the retained earnings. (f) Share capital at 1 July 2021 comprised 1,000,000 ordinary shares. These were issued in April 2019 at an issue price of $3.50 and are fully paid. In relation to this issue $32,000 share issue costs were incurred, and these were paid by the company in May 2019. In November 2021 the company issued a prospectus inviting applications for 2,000,000 ordinary shares at an issue price of $4.00, with $3.00 payable on application and $1.00 due on allotment. All of these shares were issued in January 2022. All of the money required on allotment was received by the end of February 2022. Share issue costs in relation to this issue totalled $22,000 and were paid on 7 March 2022. (g) On 30 June 2022, the directors decided to transfer $4,000,000 from the general reserve to the retained earnings. (h) On 14 July 2022 the directors declared a final dividend of 25c per share from retained earnings. This is not subject to further authorisation or approval. (i) On.10 July 2022, the company reviewed their credit policy and changed their credit arrangements. As a result of the economic downturn caused by COVID-19 over the past couple of years, the customers had been affected negatively by this unprecedent event. Thus, the directors decided that extra time to pay would be given to the customers and. that the allowance for doubtful debts would be estimated as 3.5% of the balance of accounts receivables (previously this was estimated 2.31%% of accounts receivables). (j) During the year, a customer initiated legal proceedings against the company. The company had a contract that guaranteed to supply this customer with certain items (the customer needed these items to be able to meet its own customers' requirements). However, the company did not supply the items required by the customer in the time specified in the contract and subsequently the customer's profits were reduced. Legal advice received on June 2021 had previously indicated a 55% probability of the company being found liable and had estimated damages of $50,000, which was reflected in the trial balance. However, on 28 June 2022, the court decided that the company would be required to pay $95,000. (k) Due to a computer virus, a large amount of the company's records was Tost' or damaged. The company had paid $220,000 (this amount has been included in the trial balance as previously noted) to a computer specialist to restore the damaged and lost records. (I) After the review, the company has decided to no longer buy its own computers but will lease its computers and test whether leasing computers works for the company. On 1 June 2022 , the company paid the lessor $24,000 being in advance for 3 months rental. This was not reflected in amounts in the trial balance. After the one month of trial in June, the company sold all of the computers it owned on the 30 June 2022 for $42,000. The purchaser will pay this amount on 31 July 2022 . The accountant was not previously advised of this sale and this sale is not reflected in the trial balance. The asset amount in relation to computers in the trial balance reflects initial cost less depreciation to the 30 June 2022 prior to this sale. (m) The company tax rate is 30%. Ignore tax-effect accounting. Tax expense should be based on 30% of the accounting profit before tax. No tax expense has yet been recorded. (n) You should assume that the company is a reporting entity and that you are preparing this report at 15th August 2022 and that the date the annual report (including the financial report) is authorised for issue is the 30 th August 2022. 1. Question 1 Statement of Profit or Loss and Other Comprehensive Income Students need to present 1) statement of profit or loss and other comprehensive income 2) explanation on how the figures presented in the financial statements are prepared 3) relevant notes disclosure 4) reference to the relevant accounting standards 2. Question 2 Statement of Financial Position Students need to present 1) statement of financial position 2) explanation on how the figures presented in the financial statements are prepared 3) relevant notes disclosure 4) reference to the relevant accounting standards Questions related to the Presentation and VIVA in Week 5 3. Question 3 Statement of Changes in Equity Students need to present 1) statement of changes in equity 2) explanation on how the figures presented in the financial statements are prepared 3) relevant notes disclosure 4) reference to the relevant accounting standards Questions related to the Presentation and VIVA in Week 6 4. Question 4 Other Notes Disclosure Students need to present 1) relevant notes disclosure 2) justification on disclosure 3) reference to the relevant accounting standards