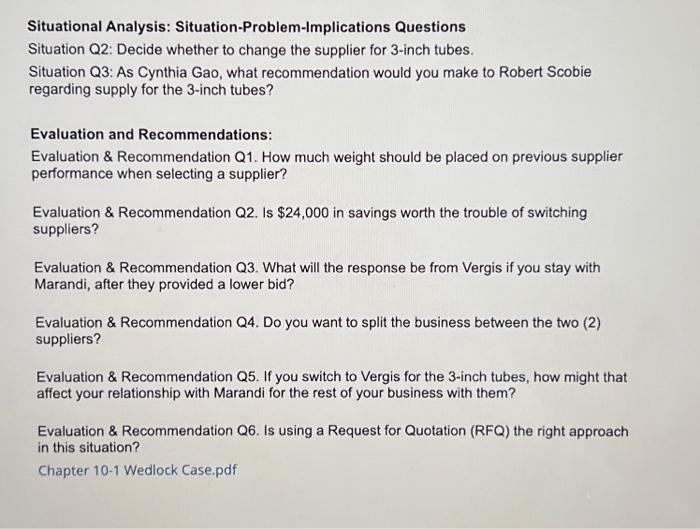

Assignment - Chapter 10 - Price - Case 10-1: Wedlock Engineered Products (17th Ed., pp. 308-309; 16th Ed., pp. 297-299) Basic Issues: - Supplier selection - Supply costs savings - Bid evaluation - Single sourcing - ABC analysis Situation Q1: How do you value a long-standing supplier relationship with a track record of excellent service? It would appear that during its 15 year relationship with Wedlock, Marandi had built a strong relationship with its customer and the motivation for the recent Request for Quotation (RFQ) was to test the market for opportunities to reduce prices, as opposed to any concerns with the incumbent supplier in the areas of delivery, quality or service. The general manager at Marandi was disappointed with the prospect of losing the Wedlock business through an RFQ process that used price as the criterion for supplier selection. An all too common part of major corporate cost reduction initiatives is to look to the purchasing department to deliver a significant part of the savings. In this situation, the savings target of $1.5 million represents approximately 3% of total purchases. In other departments of the company, savings would likely have to come from staff reductions, expense cuts and manufacturing process improvements. Assuming that purchases from suppliers represent 50% of total revenues, total purchases at Wedlock would account for approximately $225 million. A company-wide target of 3% reduction in purchases would be $6.75 million, which represents approximately 13.5% of corporate profits - a fairly significant amount. The $24,000 in savings represents a 2.2% of annual costs of 3 -inch tube purchases. This is not a huge win either in terms of percentage of purchases or total dollars. However, to use a baseball analogy, Cynthia and Robert will need to "hit a lot of singles" to get to the $1.5 million savings target. It is unlikely that there are a lot of homerun opportunities. As a result, the option of switching to Vergis should not be ignored. Situational Analysis: Situation-Problem-Implications Questions Situation Q2: Decide whether to change the supplier for 3-inch tubes. Situation Q3: As Cynthia Gao, what recommendation would you make to Robert Scobie regarding supply for the 3 -inch tubes? Evaluation and Recommendations: Evaluation \& Recommendation Q1. How much weight should be placed on previous supplier performance when selecting a supplier? Evaluation \& Recommendation Q2. Is $24,000 in savings worth the trouble of switching suppliers? Evaluation \& Recommendation Q3. What will the response be from Vergis if you stay with Marandi, after they provided a lower bid? Evaluation \& Recommendation Q4. Do you want to split the business between the two (2) suppliers? Evaluation \& Recommendation Q5. If you switch to Vergis for the 3-inch tubes, how might that affect your relationship with Marandi for the rest of your business with them? Evaluation \& Recommendation Q6. Is using a Request for Quotation (RFQ) the right approach in this situation? Chapter 10-1 Wedlock Case.pdf The current supplier for 3-inch tubing was Marandi Steel (Marandi). Located near Buffalo, Marandi distributed a wide range of carbon, stainless, alloy, and aluminum tubing; pipe products in round, square, and rectangular shapes; and steel plate to manufacturing companies in the eastern United States and Canada. Marandi had been a supplier to the Wedlock Buffalo plant for appraximately 15 years and provided excellent service. Cynthia had a strong working relationship with the general manager at Marandi and could recount several occasions when they reacted quickly to material shortages at the Buffalo plant that helped keep production going. Marandi currently supplied several products, including tubular steel, shapes, and plate, to both the Wedlock Buffalo and Cleveland plants. The supply arrangement with Marandi for the Buffalo plant included just-in-time delivery arrangements, which helped to keep inventory levels at a minimum. Total annual purchases from the supplier were approximately \$3 million for the Buffalo plant and \$2.5 million for the Cleveland plant. In order to test the pricing for 3-inch tubing, Robert Scobie issued a request for quotations (RFQ) the previous month to several steel tubing distributors, including Marandi. The RFQ indicated the expected term of the contract would be two years and include 100 percent of the requirements for both the Buffalo and REVIEWING OPTIONS Robert felt that Vergis should be awarded the contract to supply 3 -inch tubing for the Buffalo and Cleveland plants and was urging Cynthia to accept the proposal. However, Cynthia had concerns. Vergis had attempted unsuccessfully on several other occasions to secure business from Wedlock, and she was worried that Vergis did not have any history with either the Buffalo or Cleveland plants. Delivery and quality performance for 3 -inch tube was critical for the Buffalo plant, and the performance of Marandi in these areas had been outstanding. A check of Vergis's references found that they had a good reputation and there were no problems uncovered. Cynthia was also concerned about the effect of abandoning a long-standing relationship, which might have other cost implications and jeopardize service provided by Marandi. Marandi supplied a number of other products to the Buffalo plant, and Cynthia wondered how awarding the 3-inch tube contract to Vergis would affect the relationship with Marandi. Robert was expecting a decision from Cynthia the following morning regarding which supplier she felt should be awarded the contract for 3-inch tubing. Cynthia knew that she would need strong arguments if she decided not to support his recommendation to switch to Vergis. Cynthia Gao, procurement manager for Wedlock Engineered Products in Buffalo, New York, was reviewing a proposal recommending that the company change suppliers for a critical raw material. It was June 3, and Cynthia needed to dride before the end of the day how she would respond to the proposal. WEDLOCK ENGINEERED PRODUCTS Wedlock Engineered Products (Wedlock) manufactured and distributed hydraulic, power-assisted, air-powered, and standard mechanical shipping and receiving dock levelers, dock seals and shelters, and vehicle restraints. Wedlock had profits of $50 million on sales of $450 million in the most recent fiscal year ending December 31 . The company had enjoyed double-digit growth over the previous decade, supported mainly through an aggressive acquisition strategy. Wedlock's growth masked cost pressures the company was facing in its key markets. The company's annual report indicated that financial results were lower than expected due to price erosion. In February, the CEO, Dmitry Barsukov, announced a corporate cost-reduction initiative aimed at improving the company's competitive position. As part of the announcement, Barsukov specifically mentioned "opportunities for supply chain savings through coordination of purchasing between operating units and divisions." The Buffalo plant manufactured hydraulic dock levelers that were installed in shipping and receiving areas in manufacturing facilities, distribution centers, retail loading and unloading of highway transport trailers. It produced a standard product that was sold in the replacement and new construction markets under the Sloan Leveler brand. The Wedlock plant in Cleveland, Ohio, also manufactured hydraulic levelers, under the brand name Cole Dock Levelers. The Cole line of levelers targeted the customized market, for customers with unique material handling requirements. PURCHASING AT THE BUFFALO PLANT Cynthia Gao, along with Garett MacDonald, buyer, and Adam McEniry, materials planner, comprised the procurement group at the Wedlock plant in Buffalo. Total purchases were $23 million. Cynthia worked closely with Robert Scobie, her counterpart at the Cleveland plant, to coordinate purchases and identify opportunities for costs savings. The Cleveland plant was similar in size to the Buffalo plant, with approximately $25 million in annual purchases. Cynthia and Robert had committed to savings of $1.5 million in the current fiscal year as part of the corporate cost-reduction initiative. They had documented approximately $500,000 so far, measured by year-over-year price reductions from suppliers and based on forecasted annual usage. STEEL TUBING The Buffalo and Cleveland plants purchased 3-inch steel tube with a combined total value of $1.1 million annu- units and divisions." The Buffalo plant manufactured hydraulic dock levelers that were installed in shipping and receiving areas in manufacturing facilities, distribution centers, retail operations, and other facilities required to accommodate STEEL TUBING The Buffalo and Cleveland plants purchased 3-inch stcel tube with a combined total value of $1.1 million annually. The tubing was used on the loading dock platform Chapter 10 Price 309 to support the hinge connected to the lip of the platform that allowed it to lay flat or unfold, in order to connect or disconnect from the transport trailer. The tubing was required to meet specific metallurgical standards or the tubing would warp or crack, causing the loading dock to malfunction. The current supplier for 3 -inch tubing was Marandi Steel (Marandi), Located near Buffalo, Marandi distributed a wide range of carbon, stainless, alloy, and aluminum tubing: pipe products in round, square, and rectangular shapes; and steel plate to manufacturing companies in the eastern United States and Canada. Marandi had been a supplier to the Wedlock Buffalo plant for approximately is years and provided excellent service. Cynthia had a strong working relationship with the general manager at Marandi and could recount several occasions when they reacted quickly to material shortages at the Buffalo plant that helped keep production going. Marandi currently supplied several products, including tubular steel, shapes, and Cleveland plants. The two lowest quotes were from Vergis Tubing (Vergis), located in Erie, Pennsylvania, and Marandi. The quote submitted by Vergis represented an annual cost savings of approximately $24,000 compared to the incumbent supplier. REVIEWING OPTIONS Robert felt that Vergis should be awarded the contract to supply 3-inch tubing for the Buffalo and Cleveland plants and was urging Cynthia to accept the proposal. However. Cynthia had concerns. Vergis had attempted unsuccessfully on several other occasions to secure business from Wedlock, and she was worried that Vergis did not have any history with either the Buffalo or Cleveland plants. Delivery and quality performance for 3 -inch tube was critical for the Buffalo plant, and the performance of Marandi in these areas had been outstanding, A check of Vergis's references found that they had a good reputation and there were no problems uncovered