Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment Dynamic Industrial is a relatively young company, with an unsophisticated accounting system. Dynamic Industrial manufactures two products, X370A, and Z410B. Each of the products

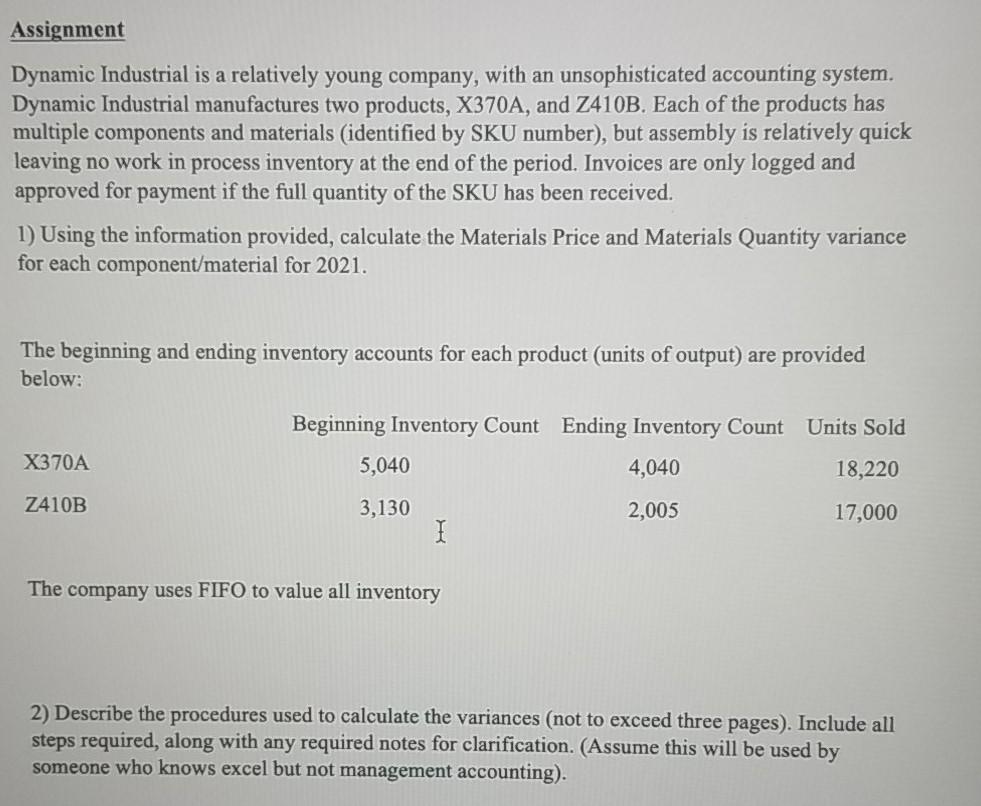

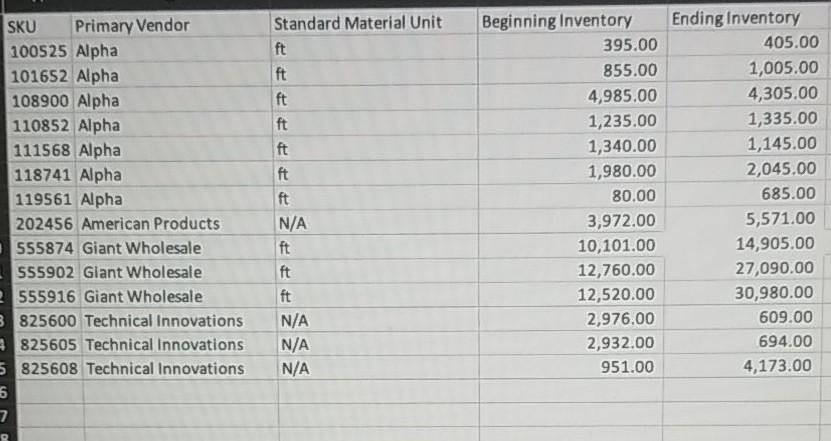

Assignment Dynamic Industrial is a relatively young company, with an unsophisticated accounting system. Dynamic Industrial manufactures two products, X370A, and Z410B. Each of the products has multiple components and materials (identified by SKU number), but assembly is relatively quick leaving no work in process inventory at the end of the period. Invoices are only logged and approved for payment if the full quantity of the SKU has been received. 1) Using the information provided, calculate the Materials Price and Materials Quantity variance for each component/material for 2021. The beginning and ending inventory accounts for each product (units of output) are provided below: DA Beginning Inventory Count Ending Inventory Count Units Sold 5,040 4,040 18,220 3,130 2,005 17,000 I Z410B The company uses FIFO to value all inventory 2) Describe the procedures used to calculate the variances (not to exceed three pages). Include all steps required, along with any required notes for clarification. (Assume this will be used by someone who knows excel but not management accounting). SKU Primary Vendor 100525 Alpha 101652 Alpha 108900 Alpha 110852 Alpha 111568 Alpha 118741 Alpha 119561 Alpha 202456 American Products 555874 Giant Wholesale 555902 Giant Wholesale 555916 Giant Wholesale 3825600 Technical Innovations 825605 Technical Innovations 5 825608 Technical Innovations 5 7 Standard Material Unit ft ft ft ft ft ft ft N/A ft ft ft N/A N/A N/A Beginning Inventory 395.00 855.00 4,985.00 1,235.00 1,340.00 1,980.00 80.00 3,972.00 10,101.00 12,760.00 12,520.00 2,976.00 2,932.00 951.00 Ending Inventory 405.00 1,005.00 4,305.00 1,335.00 1,145.00 2,045.00 685.00 5,571.00 14,905.00 27,090.00 30,980.00 609.00 694.00 4,173.00 Q Assignment Dynamic Industrial is a relatively young company, with an unsophisticated accounting system. Dynamic Industrial manufactures two products, X370A, and Z410B. Each of the products has multiple components and materials (identified by SKU number), but assembly is relatively quick leaving no work in process inventory at the end of the period. Invoices are only logged and approved for payment if the full quantity of the SKU has been received. 1) Using the information provided, calculate the Materials Price and Materials Quantity variance for each component/material for 2021. The beginning and ending inventory accounts for each product (units of output) are provided below: DA Beginning Inventory Count Ending Inventory Count Units Sold 5,040 4,040 18,220 3,130 2,005 17,000 I Z410B The company uses FIFO to value all inventory 2) Describe the procedures used to calculate the variances (not to exceed three pages). Include all steps required, along with any required notes for clarification. (Assume this will be used by someone who knows excel but not management accounting). SKU Primary Vendor 100525 Alpha 101652 Alpha 108900 Alpha 110852 Alpha 111568 Alpha 118741 Alpha 119561 Alpha 202456 American Products 555874 Giant Wholesale 555902 Giant Wholesale 555916 Giant Wholesale 3825600 Technical Innovations 825605 Technical Innovations 5 825608 Technical Innovations 5 7 Standard Material Unit ft ft ft ft ft ft ft N/A ft ft ft N/A N/A N/A Beginning Inventory 395.00 855.00 4,985.00 1,235.00 1,340.00 1,980.00 80.00 3,972.00 10,101.00 12,760.00 12,520.00 2,976.00 2,932.00 951.00 Ending Inventory 405.00 1,005.00 4,305.00 1,335.00 1,145.00 2,045.00 685.00 5,571.00 14,905.00 27,090.00 30,980.00 609.00 694.00 4,173.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started