Answered step by step

Verified Expert Solution

Question

1 Approved Answer

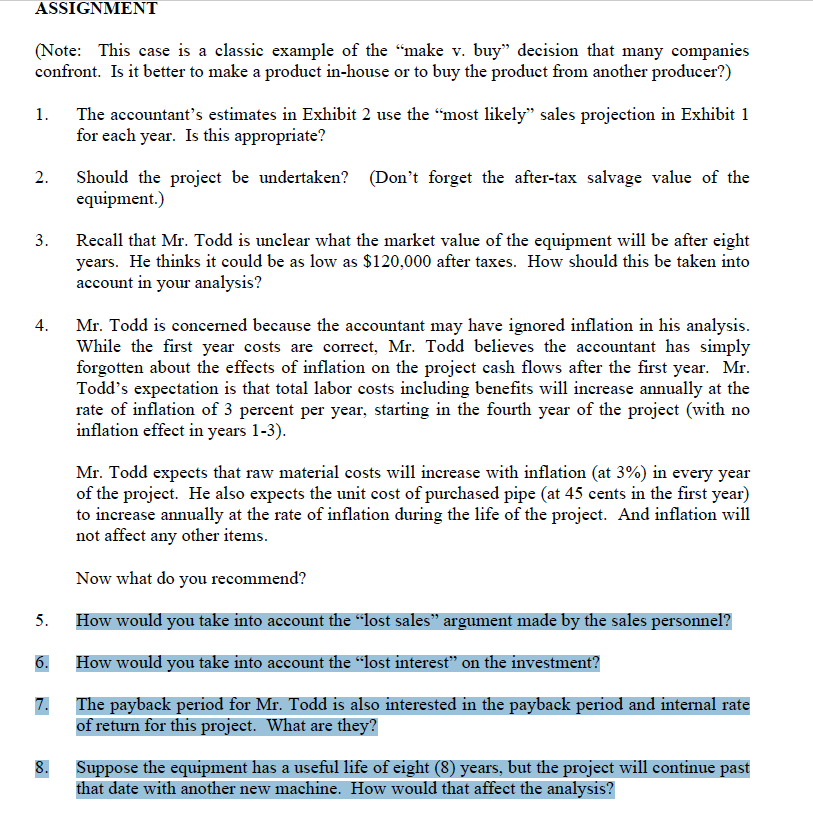

ASSIGNMENT (Note: This case is a classic example of the make v. buy decision that many companies confront. Is it better to make a

ASSIGNMENT (Note: This case is a classic example of the "make v. buy" decision that many companies confront. Is it better to make a product in-house or to buy the product from another producer?) 1. The accountant's estimates in Exhibit 2 use the most likely sales projection in Exhibit 1 for each year. Is this appropriate? 2. Should the project be undertaken? (Don't forget the after-tax salvage value of the equipment.) 3. Recall that Mr. Todd is unclear what the market value of the equipment will be after eight years. He thinks it could be as low as $120,000 after taxes. How should this be taken into account in your analysis? 4. 5. 6. 7. 8. Mr. Todd is concerned because the accountant may have ignored inflation in his analysis. While the first year costs are correct, Mr. Todd believes the accountant has simply forgotten about the effects of inflation on the project cash flows after the first year. Mr. Todd's expectation is that total labor costs including benefits will increase annually at the rate of inflation of 3 percent per year, starting in the fourth year of the project (with no inflation effect in years 1-3). Mr. Todd expects that raw material costs will increase with inflation (at 3%) in every year of the project. He also expects the unit cost of purchased pipe (at 45 cents in the first year) to increase annually at the rate of inflation during the life of the project. And inflation will not affect any other items. Now what do you recommend? How would you take into account the lost sales argument made by the sales personnel? How would you take into account the lost interest on the investment? The payback period for Mr. Todd is also interested in the payback period and internal rate of return for this project. What are they? Suppose the equipment has a useful life of eight (8) years, but the project will continue past that date with another new machine. How would that affect the analysis?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To approach this assignment well address each question systematically Ill provide a concise explanation for each step and calculation 5 Lost Sales Arg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started