Question

Assignment Objective: Complete variance analysis to analyze management decisions and what caused them. Assess an organization's success by comparing the budgeted plan to actual results.

Assignment Objective: Complete variance analysis to analyze management decisions and what caused them. Assess an organization's success by comparing the budgeted plan to actual results.

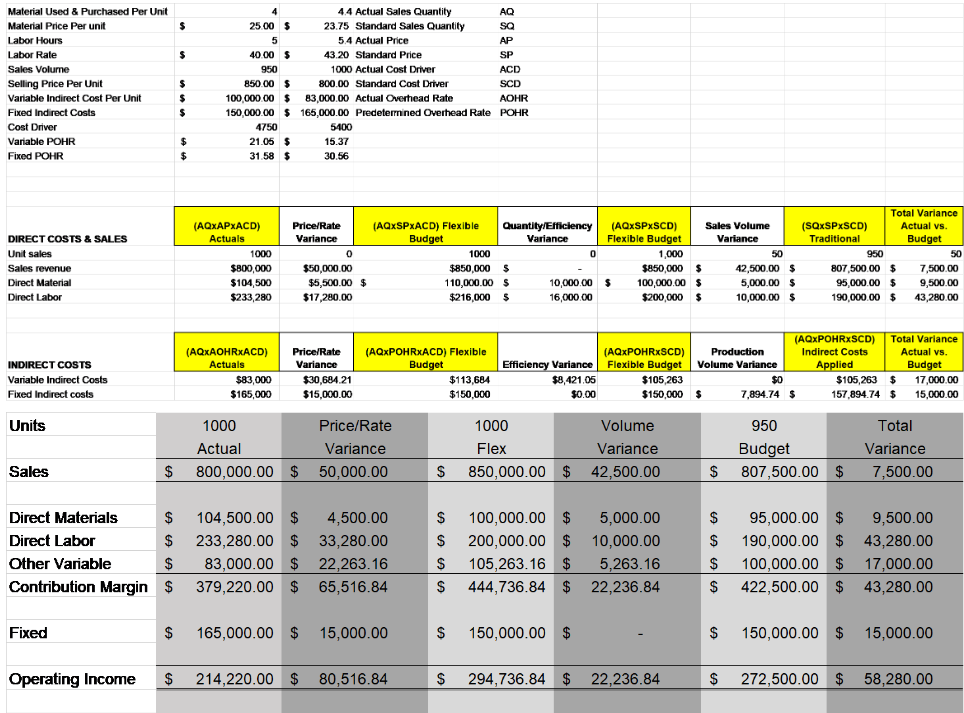

Assignment Details: A variance analysis to compare your budget to your actual results was completed at the end of the first quarter. Solve the variance analysis.

1) The most important number is the $58,280 for total variance operating income. How was this number derived? If its flexed to 1,000 units what would change and what would the operating income be?

2) What is the Sales Volume Variance? Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

3) What is the Selling Price Variance? Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

4) What is the Direct Material Price & Quantity Variances? Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

5) What is the Direct Labor Rate & Wage Variances? Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

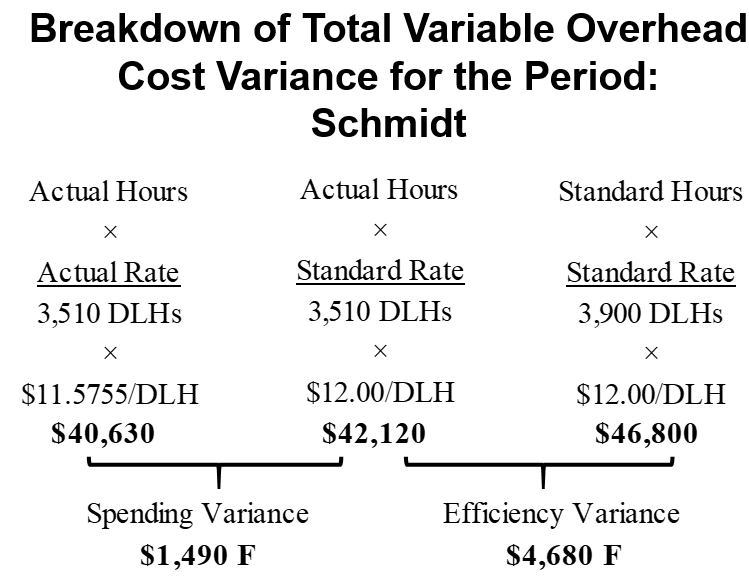

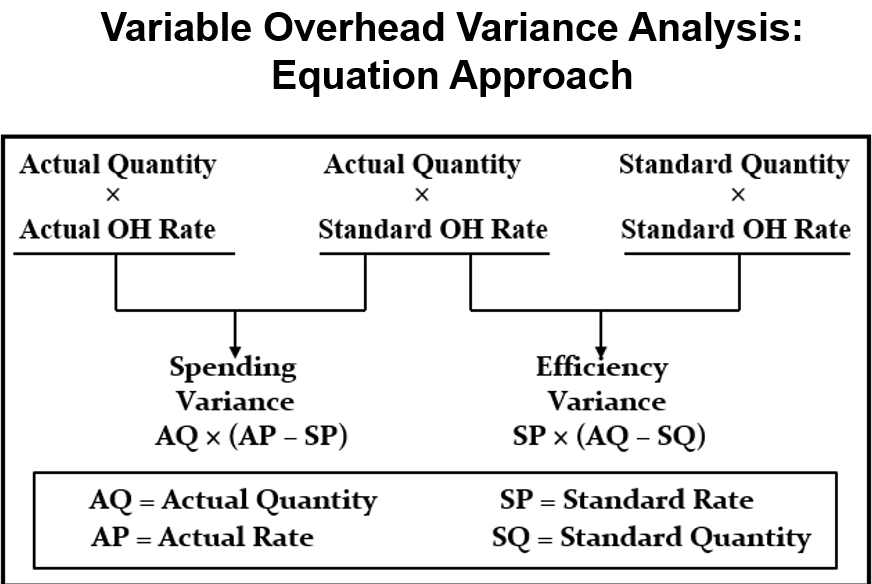

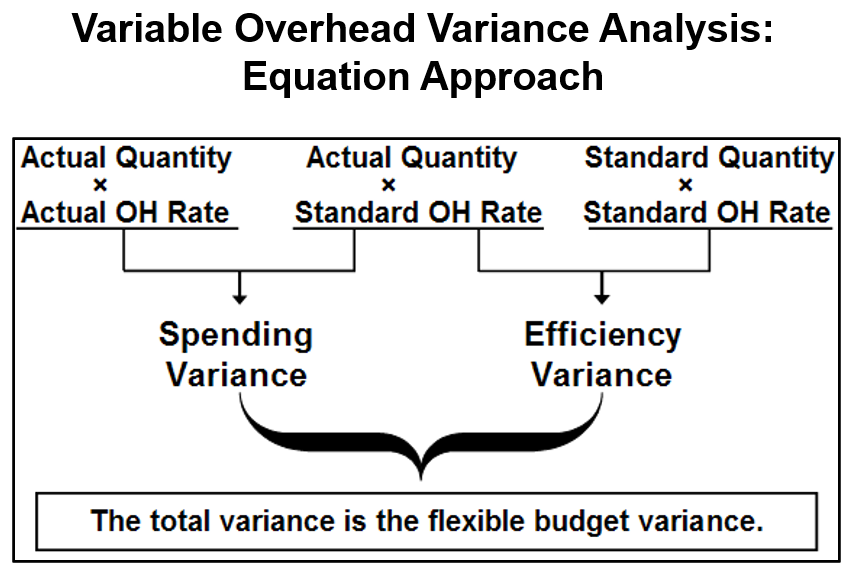

6) What is the Variable Indirect Price & Efficiency Variances? Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

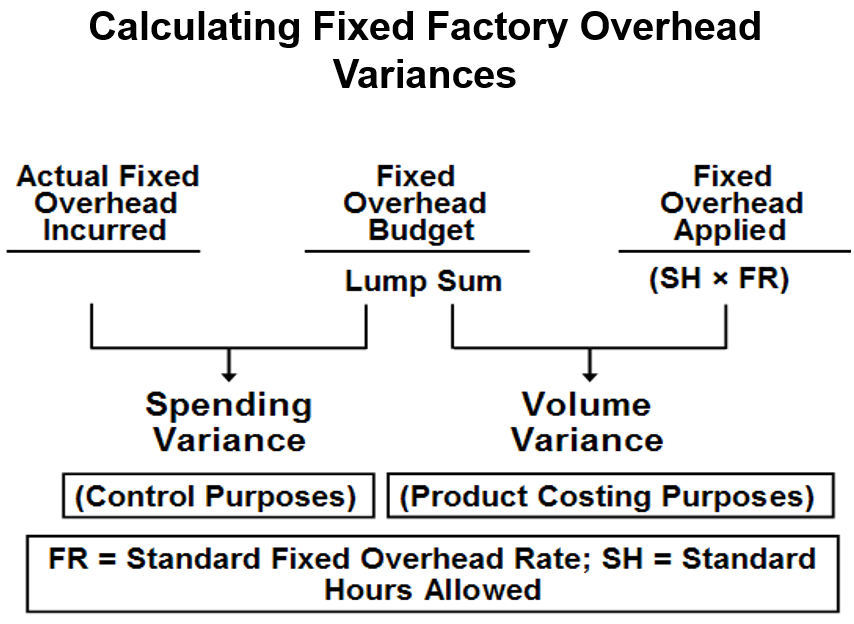

7) What is the Fixed Indirect Price & Volume Variances? Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

Formulas:

Master Budget Variance = Actual Operating Income - Master Budget Operating Income

Flexible Budget Variance = Actual Operating Income - Flexible Budget Operating Income

Sales Volume Variance = Flexible Budget Operating Income - Master Budget Operating Income

Master Budget Variance = Flexible Budget Variance + Sales Volume Variance

Selling Price Variance = Actual Sales $ Flexible Budget Sales $ or = AQ (AP - SP)

Total Fixed Cost Variance = Actual Variable Costs - Flexible Budget

Total Variable Cost Variance = Actual Variable Costs - Flexible Budget Variable Costs

Variable Cost Variance = Actual Variable Costs - Flexible Budget Variable Costs

Total fixed overhead variance analysis = actual fixed overhead costs - fixed overhead cost applied to production (=production volume variance + fixed overhead spending variance

Fixed factory overhead variance analysis = actual fixed overhead - budgeted fixed overhead

Production volume variance = budgeted fixed overhead costs - standard fixed overhead cost assigned to production

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started