Answered step by step

Verified Expert Solution

Question

1 Approved Answer

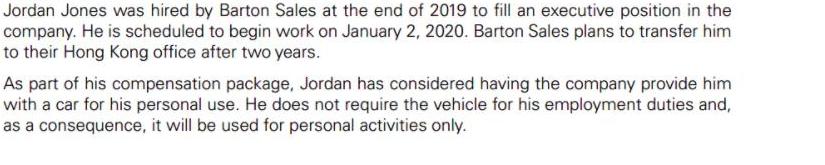

Jordan Jones was hired by Barton Sales at the end of 2019 to fill an executive position in the company. He is scheduled to

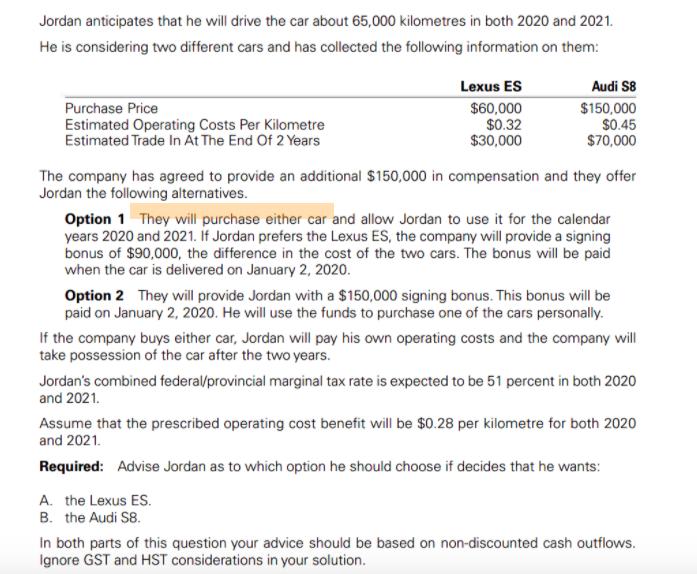

Jordan Jones was hired by Barton Sales at the end of 2019 to fill an executive position in the company. He is scheduled to begin work on January 2, 2020. Barton Sales plans to transfer him to their Hong Kong office after two years. As part of his compensation package, Jordan has considered having the company provide him with a car for his personal use. He does not require the vehicle for his employment duties and, as a consequence, it will be used for personal activities only. Jordan anticipates that he will drive the car about 65,000 kilometres in both 2020 and 2021. He is considering two different cars and has collected the following information on them: Lexus ES Audi S8 Purchase Price Estimated Operating Costs Per Kilometre Estimated Trade In At The End Of 2 Years $60,000 $0.32 $30,000 $150,000 $0.45 $70,000 The company has agreed to provide an additional $150,000 in compensation and they offer Jordan the following alternatives. Option 1 They will purchase either car and allow Jordan to use it for the calendar years 2020 and 2021. If Jordan prefers the Lexus ES, the company will provide a signing bonus of $90,000, the difference in the cost of the two cars. The bonus will be paid when the car is delivered on January 2, 2020. Option 2 They will provide Jordan with a $150,000 signing bonus. This bonus will be paid on January 2, 2020. He will use the funds to purchase one of the cars personally. If the company buys either car, Jordan will pay his own operating costs and the company will take possession of the car after the two years. Jordan's combined federal/provincial marginal tax rate is expected to be 51 percent in both 2020 and 2021. Assume that the prescribed operating cost benefit will be $0.28 per kilometre for both 2020 and 2021. Required: Advise Jordan as to which option he should choose if decides that he wants: A. the Lexus ES. B. the Audi S8. In both parts of this question your advice should be based on non-discounted cash outflows. Ignore GST and HST considerations in your solution.

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

PART1 If he choose Lexus ES Option 1 Option 2 Receipts S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started