Question

ASSIGNMENT TASK 1. Please choose ONE (1) annual report for the year ended December 2021. The company should be listed in Bursa Saham Malaysia. 2.

ASSIGNMENT TASK

1. Please choose ONE (1) annual report for the year ended December 2021. The

company should be listed in Bursa Saham Malaysia.

2. You are required to prepare master budget prepared for the first three months

of next year (January, February and March) based on the following information:

A. The Sales Manager has projected the following sales:

January 5,000 units

February 4,000 units

March 6,000 units

Projected selling price is RM35.00/unit.

B. Your Production Manager gave the following information:

Ending Inventory is to be 20% of next months production (rounded to the

nearest 10).

Aprils Projected Sales 5,000 units, May 11,250 units

December 20X0 Ending Inventory was 1,000 units. CONFIDENTIAL CITY UNIVERSITY

C. The Manufacturing Manager has estimated the following:

Each unit will require 4 grams of material

Material in Ending Inventory is 20% of next months needs

Decembers Ending Material Inventory was 4,800g

Project cost of material: RM2.50/gram

D. The Personnel Manager has estimated that Direct Labour will be projected

at:

0.75 hours of Direct Labour per unit

Guaranteed Direct Labour hours were 2,000 hours

Direct Labour Cost: RM8.50/hour

E. The Facilities Manager has estimated that the Manufacturing Overhead

will be projected at:

Overhead is applied to units of product on the basis of Direct Labour

hours.

Variable Overhead Rate to be RM8 per Direct Labour hours

Fixed Overhead Rate to be RM3,000 per month

The manufacturing overhead include monthly of plant and machinery

depreciation that are not cash outflows of the current month

F. The Accounting Department Manager has provided the following

information:

Selling and Administrative Expenses are projected to be a monthly cost

of:

o The variable selling and administrative expenses are RM0.50 per

unit sold.

o Fixed selling and administrative expenses are RM70,000 per

month.

o The fixed selling and administrative expenses include monthly

costs primarily depreciation that are not cash outflows of the

current month.

Cash Receivable:

o Decembers Receivable were ______ (refer from annual report)

o 80% of sales is collected in the month in which they were made

o 20% of sales collected in the following month in which they were

made

o Bad Debts is insignificantCONFIDENTIAL CITY UNIVERSITY

Accounts Payable:

o 80% of Payables is paid for in the current month

o 20% of Payables is paid for in the following month

o Decembers Payables was _______ (refer from annual report)

Federal Income Tax is estimated at 25% average.

G. The Cash Budget

o has a RM20,000 cash balance for the beginning of January

o Maintains a minimum cash balance of RM10,000

o Borrows on the first day of the month and repays loans on the last

day of the month with 15% simple interest

o pays Dividends of ______ (refer from annual report) to be paid in

March

o pays projected Federal Income tax in March

H. Extract figure from the beginning Balance Sheet:

o Land and Building amount will be remaining of total assets and

equities

o Depreciation (Building) = extract from annual report

o Retained Earnings = extract from annual report

o Capital Stock = extract from annual report

3. The report must include the following information:

ITEM

INFORMATION

1. Table of content & page

numbers

Table of content and page number

2. Organization Information

History / background of company / profile

/ mission / objectives / type of industry

and products.

3. Master budget in spread

sheet (excel)

Sales Budget

Cost of Goods Sold Budget

Selling & Administrative Expenses

Budget

Production Budget CONFIDENTIAL CITY UNIVERSITY

Direct Materials Budget plus a

Schedule of Expected Cash

Disbursements

Direct Labour Budget

Manufacturing Overhead Budget

Budgeted Income Statement plus a

Budget of Collections of Accounts

Receivable

Cash Budget

Budgeted Balance Sheet

4. Analysis on each master

budget

Explanation on each functional budget

and master budget of the company.

5. Conclusion

Overall comment on master budget of the

company for the next period by using

spreadsheet.

6. References

The list of references in preparing the

report from website, books, etc.

7. Appendices

Annual report for the year ended

December 2021

8. Format of report writing

8.1 Font: Arial

8.2 Size: 11

8.3 Line Spacing: 1.5

8.4 Paragraph: Justify

DISCLAIMER:

All information will be intended as an education purpose only, it does not useful for

external users purposes.

*this question has been answered by an expert but he/she requested for the annual report to complete the question. whomever the expert who assist, kindly help to complete the question. thank you*- expert reply: "Cash Budget cannot be calculated as december sales figure is not given. Please provide it to complete the question. The rest of the master budget is solved."

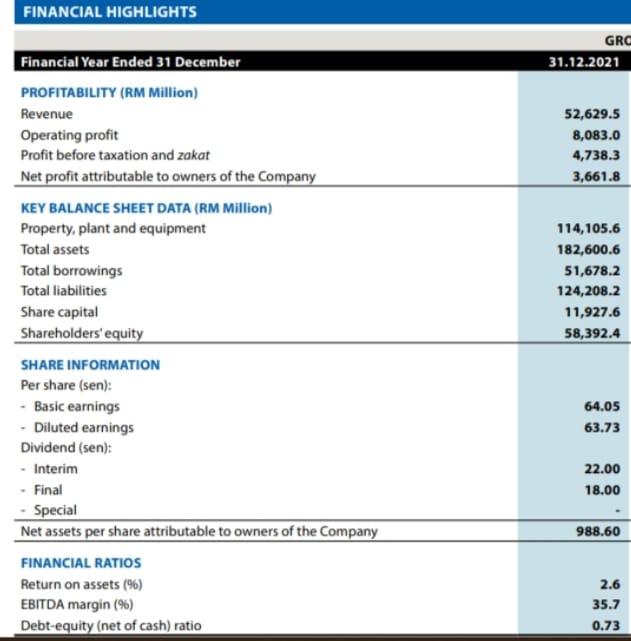

FINANCIAL HIGHLIGHTS FINANCIAL HIGHLIGHTSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started