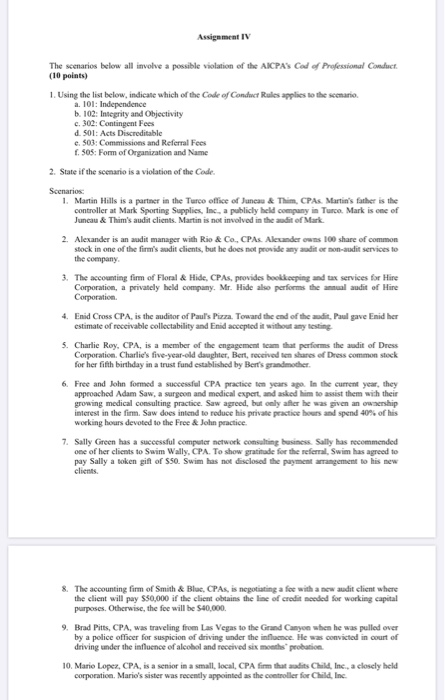

Assignment TV The scenarios below all involve a possible violation of the AICPAS Code of Professional Conduct (10 points) 1. Using the list below, indicate which of the Code of Conduct Rules applies to the scenario 101: Independence 102: Integrity and Objectivity 302: Continentes d. Sol: Acts Discreditable S03: Comm ons and Referral Fees 505: Form of organic and Name 2. State of the scenario is a violation of the Code Scenarios 1. Martin Hills is a part in the Turce office of unc h CPAs Martins father is the controller at Mark Sporting Supplies, Inc. a publicly held u r Mark is one of Junc & Thim's audit clients. Martin is not involved in the ait of Mark 2 Alexander is an audit maaper with Rica, CPA Alder steck in one of the firm's audit clients, but he does not pode the company 100 share of common services to n 3. The accounting firm of Floral & Hide, CPA, provides hakkeping Corporation, a privately held company. Mr. Hideale perform the Corporation tax services for Hire audit of Hire 4. Enid Cross CPA, is the auditor of Paul's Puzza. Toward the end of the audit. Paul gave Enid her estimate of receivable collectability and End accepted it without any testing 5. Charlie Roy, CPA, is a member of the engagement team that performs the audit of Dress Corporation Charlie's five-year-old daughter, Bert, received in shares of Dress common stock for her fifth birthday in a trust fund established by Bert's grandmother 6. Free and John formed a successful CPA practice ten years in the current year, they approached Adam Saw, a surgeon and medical expert asked him to assist them with their growing medical consulting practice. Saw agreed, but only after he was given an ownship interest in the firm. Saw does intend to reduce his private practice on end 40% of this working hours devoted to the Free & John practice. 7 Sally Green has a successful computer network c h ines Sally recommended one of her clients to Swim Wally, CPA. To show made for the final Swim has agreed to pay Sally a token gift of SSO. Swim has not disclosed the payment me to his & The accounting firm of Smith & B , CPA the client will pay $50.000 if the climb purposes. Otherwise, the fee will be 50.000 is negotia with client where the line of credit eded for working capital Brad Pitt, CPA, was traveling from Las Veeas to the Grand Canyo when he was pulled over by a police officer for suspicion of driving under the influence. He wan ted in court of driving under the influence of all and received in th e 10. Marie Lopez, CPA, is a senior in a small local, CPA firm that is CMM Inc. a closely held corporation Mario's sister was recently appointed as the controller for Child, Inc Assignment TV The scenarios below all involve a possible violation of the AICPAS Code of Professional Conduct (10 points) 1. Using the list below, indicate which of the Code of Conduct Rules applies to the scenario 101: Independence 102: Integrity and Objectivity 302: Continentes d. Sol: Acts Discreditable S03: Comm ons and Referral Fees 505: Form of organic and Name 2. State of the scenario is a violation of the Code Scenarios 1. Martin Hills is a part in the Turce office of unc h CPAs Martins father is the controller at Mark Sporting Supplies, Inc. a publicly held u r Mark is one of Junc & Thim's audit clients. Martin is not involved in the ait of Mark 2 Alexander is an audit maaper with Rica, CPA Alder steck in one of the firm's audit clients, but he does not pode the company 100 share of common services to n 3. The accounting firm of Floral & Hide, CPA, provides hakkeping Corporation, a privately held company. Mr. Hideale perform the Corporation tax services for Hire audit of Hire 4. Enid Cross CPA, is the auditor of Paul's Puzza. Toward the end of the audit. Paul gave Enid her estimate of receivable collectability and End accepted it without any testing 5. Charlie Roy, CPA, is a member of the engagement team that performs the audit of Dress Corporation Charlie's five-year-old daughter, Bert, received in shares of Dress common stock for her fifth birthday in a trust fund established by Bert's grandmother 6. Free and John formed a successful CPA practice ten years in the current year, they approached Adam Saw, a surgeon and medical expert asked him to assist them with their growing medical consulting practice. Saw agreed, but only after he was given an ownship interest in the firm. Saw does intend to reduce his private practice on end 40% of this working hours devoted to the Free & John practice. 7 Sally Green has a successful computer network c h ines Sally recommended one of her clients to Swim Wally, CPA. To show made for the final Swim has agreed to pay Sally a token gift of SSO. Swim has not disclosed the payment me to his & The accounting firm of Smith & B , CPA the client will pay $50.000 if the climb purposes. Otherwise, the fee will be 50.000 is negotia with client where the line of credit eded for working capital Brad Pitt, CPA, was traveling from Las Veeas to the Grand Canyo when he was pulled over by a police officer for suspicion of driving under the influence. He wan ted in court of driving under the influence of all and received in th e 10. Marie Lopez, CPA, is a senior in a small local, CPA firm that is CMM Inc. a closely held corporation Mario's sister was recently appointed as the controller for Child, Inc