Answered step by step

Verified Expert Solution

Question

1 Approved Answer

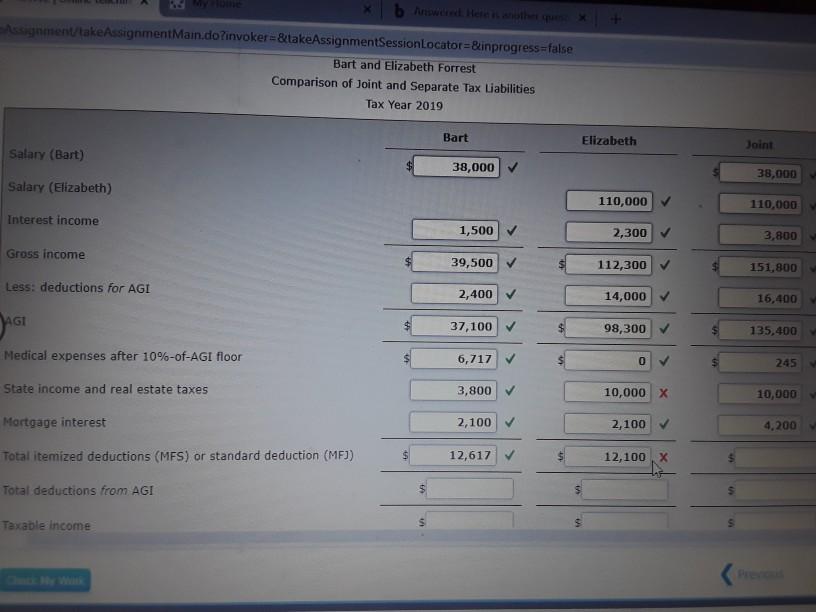

Assignment/takeAssignment Main.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Bart and Elizabeth Forrest Comparison of Joint and Separate Tax Liabilities Tax Year 2019 Bart Elizabeth Joint Salary (Bart) 38,000 38,000 Salary (Elizabeth)

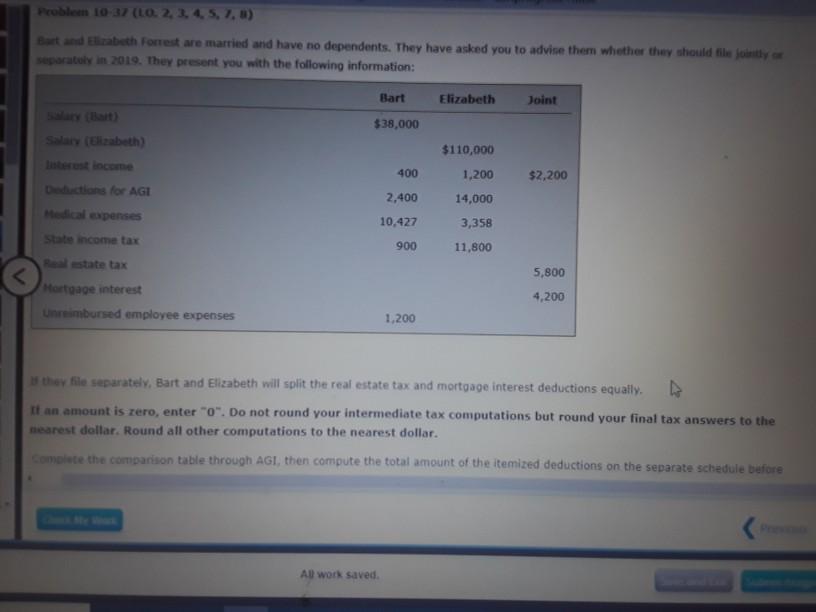

Assignment/takeAssignment Main.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Bart and Elizabeth Forrest Comparison of Joint and Separate Tax Liabilities Tax Year 2019 Bart Elizabeth Joint Salary (Bart) 38,000 38,000 Salary (Elizabeth) 110,000 110,000 Interest income 1,500 2,300 3,800 Gross income 39,500 112,300 151,800 Less: deductions for AGI 2,400 14,000 16,400 AGI 37,100 $ 98,300 135,400 Medical expenses after 10%-of-AGI floor 6,717 0 245 State income and real estate taxes 3,800 10,000 x 10,000 Mortgage interest 2,100 2,100 4,200 Total itemized deductions (MFS) or standard deduction (MF) 12,617 12,100 Total deductions from AGI $ Taxable income $ Problem 10-37 (LO. 2.3.4.5, 7, 8) Bad Elizabeth Forrest are married and have no dependents. They have asked you to advise them whether they should file Joly partly in 2019. The present you with the following information: Bart Elizabeth Joint $38,000 Shizabeth) $110,000 400 1,200 $2,200 Dictions for AGI 14,000 al expenses State income tax 2.400 10.427 3,358 900 11,800 state tax 5,800 Mortgage interest Urimbursed employee expenses 4,200 1,200 the file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally. If an amount is rero, enter "0". Do not round your intermediate tax computations but round your final tax answers to the nearest dollar. Round all other computations to the nearest dollar. mote the comparison table through AGI, then compute the total amount of the itemized deductions on the separate schedule before All work saved Assignment/takeAssignment Main.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Bart and Elizabeth Forrest Comparison of Joint and Separate Tax Liabilities Tax Year 2019 Bart Elizabeth Joint Salary (Bart) 38,000 38,000 Salary (Elizabeth) 110,000 110,000 Interest income 1,500 2,300 3,800 Gross income 39,500 112,300 151,800 Less: deductions for AGI 2,400 14,000 16,400 AGI 37,100 $ 98,300 135,400 Medical expenses after 10%-of-AGI floor 6,717 0 245 State income and real estate taxes 3,800 10,000 x 10,000 Mortgage interest 2,100 2,100 4,200 Total itemized deductions (MFS) or standard deduction (MF) 12,617 12,100 Total deductions from AGI $ Taxable income $ Problem 10-37 (LO. 2.3.4.5, 7, 8) Bad Elizabeth Forrest are married and have no dependents. They have asked you to advise them whether they should file Joly partly in 2019. The present you with the following information: Bart Elizabeth Joint $38,000 Shizabeth) $110,000 400 1,200 $2,200 Dictions for AGI 14,000 al expenses State income tax 2.400 10.427 3,358 900 11,800 state tax 5,800 Mortgage interest Urimbursed employee expenses 4,200 1,200 the file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally. If an amount is rero, enter "0". Do not round your intermediate tax computations but round your final tax answers to the nearest dollar. Round all other computations to the nearest dollar. mote the comparison table through AGI, then compute the total amount of the itemized deductions on the separate schedule before All work saved

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started