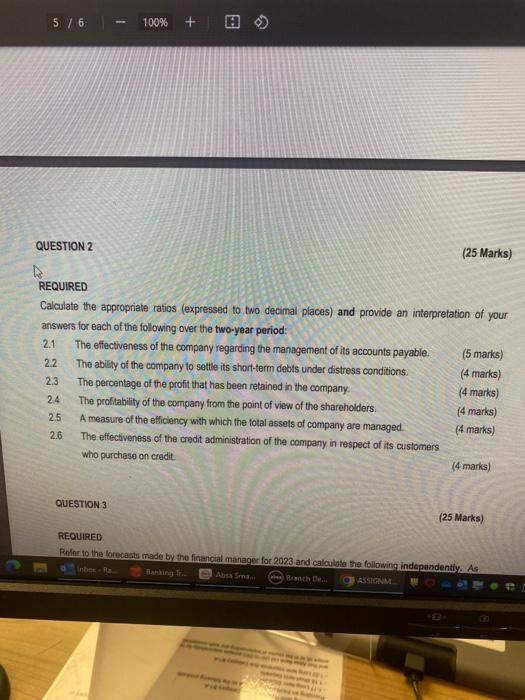

assist with answer 2

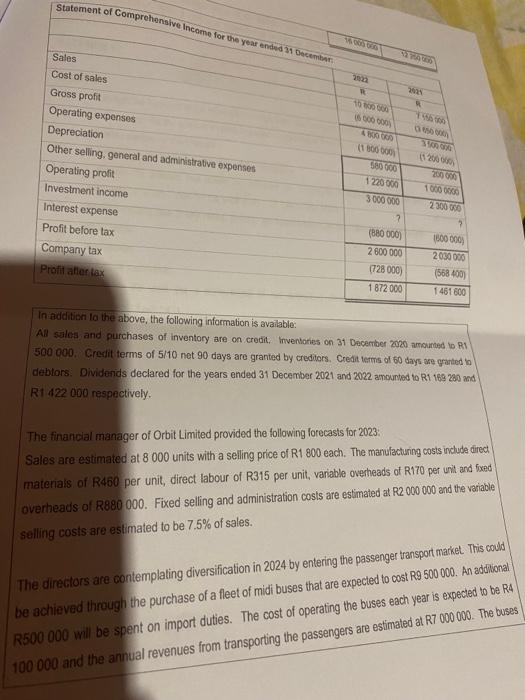

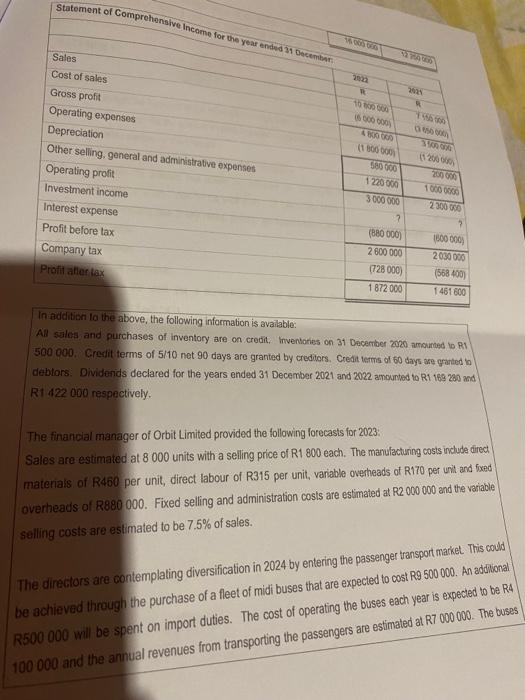

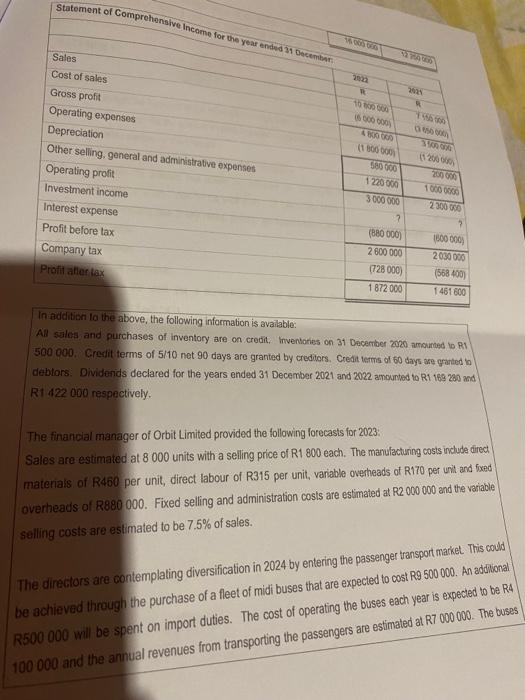

Statement of Compreh In addition lo the above, the following information is available: Ail sales and purchases of inventory are on credit, Inventories on 31 December 2020 amoumed to RI 500 000. Credit terms of 5/10 net 90 days are granted by creditors. Credit lerms of 60 days are grathed b deblars: Dividenids declared for the years ended 31 December 2021 and 2022 amounted 10 R1 169280 and R1 $22000 respectively. The financial manager of Orbit Limited provided the following forecasts for 2023 : Sales are estimated at 8000 units with a selling price of R1 800 each. The manufacturing costs include direct materiais of R460 per unit, direct labour of R315 per unit, variable overheads of R170 per urit and fxed overheads of R880 000. Fixed selling and administration cosis are estimated at R2000000 and the variable solling costs are estimated to be 7.5% of sales. The directors are contemplating diversification in 2024 by entering the passenger transport market. This could be achievad through the purchase of a fleet of midi buses that are expected to cost R9500000. An addiconal R500 000 wil be spent on import duties. The cost of operating the buses each year is expected to be R 100000 and the annual revenues from transporting the passengers are estimated al R7 000000 . The bus Statement of Compreh In addition lo the above, the following information is available: Ail sales and purchases of inventory are on credit, Inventories on 31 December 2020 amoumed to RI 500 000. Credit terms of 5/10 net 90 days are granted by creditors. Credit lerms of 60 days are grathed b deblars: Dividenids declared for the years ended 31 December 2021 and 2022 amounted 10 R1 169280 and R1 $22000 respectively. The financial manager of Orbit Limited provided the following forecasts for 2023 : Sales are estimated at 8000 units with a selling price of R1 800 each. The manufacturing costs include direct materiais of R460 per unit, direct labour of R315 per unit, variable overheads of R170 per urit and fxed overheads of R880 000. Fixed selling and administration cosis are estimated at R2000000 and the variable solling costs are estimated to be 7.5% of sales. The directors are contemplating diversification in 2024 by entering the passenger transport market. This could be achievad through the purchase of a fleet of midi buses that are expected to cost R9500000. An addiconal R500 000 wil be spent on import duties. The cost of operating the buses each year is expected to be R 100000 and the annual revenues from transporting the passengers are estimated al R7 000000 . The bus