Assistance needed with Kellogg Analysis for the following Topics 1. Financial Evaluation: In this section of the report, you will now determine if the three available financial options in the Project Two Financial Assumptions document are appropriate for the business, considering the analysis you did in the first section. You will also explain financing and describe the business's likely future performance. . Financing: Explain how a business finances its operations and expansion. B. Bond Investment: Assess the appropriateness of a bond investment as a financing option for the businesss financial health, using your financial analysis and other financial information to your support claims. C. Capital Equipment: Assess the appropriateness of a capital equipment investment as a financing option for the businesss financial health, using your financial analysis and other financial information to support your claims. D. Capital Lease: Assess the appropriateness of a capital lease purchase as a financing option for the businesss financial health, using your financial analysis and other financial information to support your claims. E. Short-Term Financing: Explain how potential short-term financing sources could help the business raise needed funds for improving its financial health. Base your response on the businesss current financial information. F. Future Financial Considerations: Describe the businesss likely future financial performance based on its current financial well-being and risk levels. Use financial information to support your claims. 1. Financial Recommendations: In this section of the report, you will recommend which financing option(s) are the best for the business to choose depending on its financial health. . Financial Recommendation(s): Recommend the most appropriate financing option(s) based on the businesss financial health, including a rationale for why the option(s) are best.

Assistance needed with Kellogg Analysis for the following Topics 1. Financial Evaluation: In this section of the report, you will now determine if the three available financial options in the Project Two Financial Assumptions document are appropriate for the business, considering the analysis you did in the first section. You will also explain financing and describe the business's likely future performance. . Financing: Explain how a business finances its operations and expansion. B. Bond Investment: Assess the appropriateness of a bond investment as a financing option for the businesss financial health, using your financial analysis and other financial information to your support claims. C. Capital Equipment: Assess the appropriateness of a capital equipment investment as a financing option for the businesss financial health, using your financial analysis and other financial information to support your claims. D. Capital Lease: Assess the appropriateness of a capital lease purchase as a financing option for the businesss financial health, using your financial analysis and other financial information to support your claims. E. Short-Term Financing: Explain how potential short-term financing sources could help the business raise needed funds for improving its financial health. Base your response on the businesss current financial information. F. Future Financial Considerations: Describe the businesss likely future financial performance based on its current financial well-being and risk levels. Use financial information to support your claims. 1. Financial Recommendations: In this section of the report, you will recommend which financing option(s) are the best for the business to choose depending on its financial health. . Financial Recommendation(s): Recommend the most appropriate financing option(s) based on the businesss financial health, including a rationale for why the option(s) are best.

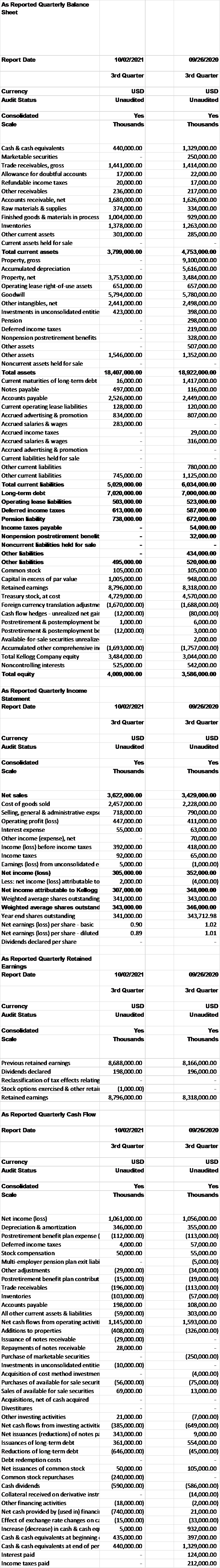

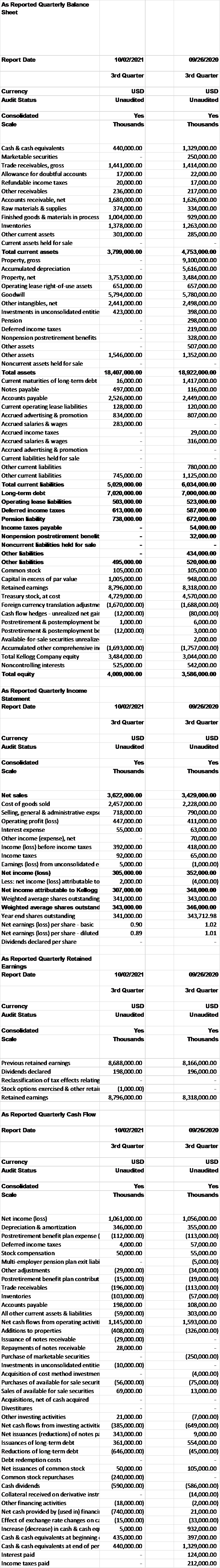

As Reported Quarterly Balance Sheet Report Date 10/02/2021 09/26/2020 3rd Quarter 3rd Quarter Currency Audit Status USD Unaudited USD Unaudited Consolidated Scale Yes Thousands Yes Thousands 1,329,000.00 250,000.00 1,414,000.00 22,000.00 17,000.00 217,000.00 1,626,000.00 334,000.00 929,000.00 1,263,000.00 285,000.00 4,753,000.00 9,100,000.00 5,616,000.00 3,484,000.00 657,000.00 5,780,000.00 2,498,000.00 398,000.00 298,000.00 219,000.00 328,000.00 507,000.00 1,352,000.00 Cash & cash equivalents 440,000.00 Marketable securities Trade receivables, gross 1,441,000.00 Allowance for doubtful accounts 17,000.00 Refundable income taxes 20,000.00 Other receivables 236,000.00 Accounts receivable, net 1,680,000.00 Raw materials & Supplies 374,000.00 Finished goods & materials in process 1,004,000.00 Inventories 1,378,000.00 Other current assets 301,000.00 Current assets held for sale Total current assets 3,799,000.00 Property, gross Accumulated depreciation Property, net 3,753,000.00 Operating lease right-of-use assets 651,000.00 Goodwill 5,794,000.00 Other intangibles, net 2,441,000.00 Investments in unconsolidated entitie 423,000.00 Pension Deferred income taxes Nonpension postretirement benefits Other assets Other assets 1,546,000.00 Noncurrent assets held for sale Total assets 18,407,000.00 Current maturities of long-term debt 16,000.00 Notes payable 497,000.00 Accounts payable 2,526,000.00 Current operating lease liabilities 128,000.00 Accrued advertising & promotion 834,000.00 Accrued salaries & wages 283,000.00 Accrued income taxes Accrued salaries & wages Accrued advertising & promotion Current liabilities held for sale Other current liabilities Other current liabilities 745,000.00 Total current Fabrities 5,029,000.00 Long-term debt 7,020,000.00 Operating lease Fabrities 503,000.00 Deferred income taxes 613,000.00 Pension Lab Tity 738,000.00 Income taxes payable Nonpension postretirement benefit Noncurrent Fabrities held for sale Other Labrities Other tab ties 495,000.00 Common stock 105,000.00 Capital in excess of par value 1,005,000.00 Retained earings 8,796,000.00 Treasury stock, at cost 4,729,000.00 Foreign currency translation adjustme (1,670,000.00) Cash flow hedges - unrealized net gair (12,000.00) Postretirement & postemployment be 1,000.00 Postretirement & postemployment be (12,000.00) Available for-sale securities unrealize Accumulated other comprehensive in (1,693,000.00) Total Kellogg Company equity 3,484,000.00 Noncontrolling interests 525,000.00 Total equity 4,009,000.00 18,922,000.00 1,417,000.00 116,000.00 2,449,000.00 120,000.00 807,000.00 29,000.00 316,000.00 780,000.00 1,125,000.00 6,034,000.00 7,000,000.00 523,000.00 587,000.00 672,000.00 54,000.00 32,000.00 434,000.00 520,000.00 105,000.00 948,000.00 8,318,000.00 4,570,000.00 (1,688,000.00) (80,000.00) 6,000.00 3,000.00 2,000.00 (1,757,000.00) 3,044,000.00 542,000.00 3,586,000.00 As Reported Quarterly Income Statement Report Date 10/02/2021 09/26/2020 3rd Quarter 3rd Quarter Currency Audit Status USD Unaudited USD Unaudited Consolidated Scale Yes Thousands Yes Thousands 3,622,000.00 2,457,000.00 718,000.00 447,000.00 55,000.00 Net sales Cost of goods sold Selling, general & administrative expse Operating profit (loss) Interest expense Other income (expense), net Income (loss) before income taxes Income taxes Earings (loss) from unconsolidated e Net income (loss) Less: net income (loss) attributable to Net income attributable to Kelogg Weighted average shares outstanding Weighted average shares outstand Year end shares outstanding Net earnings (loss) per share - basic Net earnings (loss) per share - diluted Dividends declared per share 392,000.00 92,000.00 5,000.00 305,000.00 2,000.00 307,000.00 341,000.00 343,000.00 341,000.00 0.90 0.89 3,429,000.00 2,228,000.00 790,000.00 411,000.00 63,000.00 70,000.00 418,000.00 65,000.00 (1,000.00) 352,000.00 (4,000.00) 348,000.00 343,000.00 346,000.00 343,712.98 1.02 1.01 As Reported Quarterly Retained Earnings Report Date 10/02/2021 09/26/2020 3rd Quarter 3rd Quarter Currency Audit Status USD Unaudited USD Unaudited Consoidated Scale Yes Thousands Yes Thousands 8,688,000.00 198,000.00 8,166,000.00 196,000.00 Previous retained earnings Dividends declared Reclassification of tax effects relating Stock options exercised & other retail Retained eamings (1,000.00) 8,796,000.00 8,318,000.00 As Reported Quarterly Cash Flow Report Date 10/02/2021 09/26/2020 3rd Quarter 3rd Quarter Currency Audit Status USD Unaudited USD Unaudited Yes Yes Consolidated Scale Thousands Thousands 1,061,000.00 346,000.00 (112,000.00) 4,000.00 50,000.00 (29,000.00) (15,000.00) (196,000.00) (103,000.00) 198,000.00 (59,000.00) 1,145,000.00 (408,000.00) (29,000.00) 28,000.00 1,056,000.00 355,000.00 (113,000.00) 57,000.00 55,000.00 (5,000.00) (34,000.00) (19,000.00) (113,000.00) (57,000.00) 108,000.00 303,000.00 1,593,000.00 (326,000.00) (250,000.00) (10,000.00) Net income (loss) Depreciation & amortization Postretirement benefit plan expense Deferred income taxes Stock compensation Multi-employer pension plan exit liabi Other adjustments Postretirement benefit plan contribut Trade receivables Inventories Accounts payable All other current assets & liabilities Net cash flows from operating activiti Additions to properties Issuance of notes receivable Repayments of notes receivable Purchase of marketable securities Investments in unconsolidated entitie Acquisition of cost method investmen Purchases of available for sale securit Sales of available for sale securities Acquisitions, net of cash acquired Divestitures Other investing activities Net cash flows from investing activitie Net issuances (reductions) of notes pi Issuances of long-term debt Reductions of long-term debt Debt redemption costs Net issuances of common stock Common stock repurchases Cash dividends Collateral received on derivative instr Other financing activities Net cash provided by (used in) financii Effect of exchange rate changes on ca Increase (decrease) in cash & cash eq Cash & cash equivalents at beginning Cash & cash equivalents at end of per Interest paid Income taxes paid (56,000.00) 69,000.00 (4,000.00) (75,000.00) 13,000.00 21,000.00 (385,000.00) 343,000.00 361,000.00 (646,000.00) (7,000.00) (649,000.00) 9,000.00 554,000.00 (45,000.00) 105,000.00 50,000.00 (240,000.00) (590,000.00) (18,000.00) (740,000.00) (15,000.00) 5,000.00 435,000.00 440,000.00 (586,000.00) (14,000.00) (2,000.00) 21,000.00 (33,000.00) 932,000.00 397,000.00 1,329,000.00 124,000.00 212,000.00 As Reported Quarterly Balance Sheet Report Date 10/02/2021 09/26/2020 3rd Quarter 3rd Quarter Currency Audit Status USD Unaudited USD Unaudited Consolidated Scale Yes Thousands Yes Thousands 1,329,000.00 250,000.00 1,414,000.00 22,000.00 17,000.00 217,000.00 1,626,000.00 334,000.00 929,000.00 1,263,000.00 285,000.00 4,753,000.00 9,100,000.00 5,616,000.00 3,484,000.00 657,000.00 5,780,000.00 2,498,000.00 398,000.00 298,000.00 219,000.00 328,000.00 507,000.00 1,352,000.00 Cash & cash equivalents 440,000.00 Marketable securities Trade receivables, gross 1,441,000.00 Allowance for doubtful accounts 17,000.00 Refundable income taxes 20,000.00 Other receivables 236,000.00 Accounts receivable, net 1,680,000.00 Raw materials & Supplies 374,000.00 Finished goods & materials in process 1,004,000.00 Inventories 1,378,000.00 Other current assets 301,000.00 Current assets held for sale Total current assets 3,799,000.00 Property, gross Accumulated depreciation Property, net 3,753,000.00 Operating lease right-of-use assets 651,000.00 Goodwill 5,794,000.00 Other intangibles, net 2,441,000.00 Investments in unconsolidated entitie 423,000.00 Pension Deferred income taxes Nonpension postretirement benefits Other assets Other assets 1,546,000.00 Noncurrent assets held for sale Total assets 18,407,000.00 Current maturities of long-term debt 16,000.00 Notes payable 497,000.00 Accounts payable 2,526,000.00 Current operating lease liabilities 128,000.00 Accrued advertising & promotion 834,000.00 Accrued salaries & wages 283,000.00 Accrued income taxes Accrued salaries & wages Accrued advertising & promotion Current liabilities held for sale Other current liabilities Other current liabilities 745,000.00 Total current Fabrities 5,029,000.00 Long-term debt 7,020,000.00 Operating lease Fabrities 503,000.00 Deferred income taxes 613,000.00 Pension Lab Tity 738,000.00 Income taxes payable Nonpension postretirement benefit Noncurrent Fabrities held for sale Other Labrities Other tab ties 495,000.00 Common stock 105,000.00 Capital in excess of par value 1,005,000.00 Retained earings 8,796,000.00 Treasury stock, at cost 4,729,000.00 Foreign currency translation adjustme (1,670,000.00) Cash flow hedges - unrealized net gair (12,000.00) Postretirement & postemployment be 1,000.00 Postretirement & postemployment be (12,000.00) Available for-sale securities unrealize Accumulated other comprehensive in (1,693,000.00) Total Kellogg Company equity 3,484,000.00 Noncontrolling interests 525,000.00 Total equity 4,009,000.00 18,922,000.00 1,417,000.00 116,000.00 2,449,000.00 120,000.00 807,000.00 29,000.00 316,000.00 780,000.00 1,125,000.00 6,034,000.00 7,000,000.00 523,000.00 587,000.00 672,000.00 54,000.00 32,000.00 434,000.00 520,000.00 105,000.00 948,000.00 8,318,000.00 4,570,000.00 (1,688,000.00) (80,000.00) 6,000.00 3,000.00 2,000.00 (1,757,000.00) 3,044,000.00 542,000.00 3,586,000.00 As Reported Quarterly Income Statement Report Date 10/02/2021 09/26/2020 3rd Quarter 3rd Quarter Currency Audit Status USD Unaudited USD Unaudited Consolidated Scale Yes Thousands Yes Thousands 3,622,000.00 2,457,000.00 718,000.00 447,000.00 55,000.00 Net sales Cost of goods sold Selling, general & administrative expse Operating profit (loss) Interest expense Other income (expense), net Income (loss) before income taxes Income taxes Earings (loss) from unconsolidated e Net income (loss) Less: net income (loss) attributable to Net income attributable to Kelogg Weighted average shares outstanding Weighted average shares outstand Year end shares outstanding Net earnings (loss) per share - basic Net earnings (loss) per share - diluted Dividends declared per share 392,000.00 92,000.00 5,000.00 305,000.00 2,000.00 307,000.00 341,000.00 343,000.00 341,000.00 0.90 0.89 3,429,000.00 2,228,000.00 790,000.00 411,000.00 63,000.00 70,000.00 418,000.00 65,000.00 (1,000.00) 352,000.00 (4,000.00) 348,000.00 343,000.00 346,000.00 343,712.98 1.02 1.01 As Reported Quarterly Retained Earnings Report Date 10/02/2021 09/26/2020 3rd Quarter 3rd Quarter Currency Audit Status USD Unaudited USD Unaudited Consoidated Scale Yes Thousands Yes Thousands 8,688,000.00 198,000.00 8,166,000.00 196,000.00 Previous retained earnings Dividends declared Reclassification of tax effects relating Stock options exercised & other retail Retained eamings (1,000.00) 8,796,000.00 8,318,000.00 As Reported Quarterly Cash Flow Report Date 10/02/2021 09/26/2020 3rd Quarter 3rd Quarter Currency Audit Status USD Unaudited USD Unaudited Yes Yes Consolidated Scale Thousands Thousands 1,061,000.00 346,000.00 (112,000.00) 4,000.00 50,000.00 (29,000.00) (15,000.00) (196,000.00) (103,000.00) 198,000.00 (59,000.00) 1,145,000.00 (408,000.00) (29,000.00) 28,000.00 1,056,000.00 355,000.00 (113,000.00) 57,000.00 55,000.00 (5,000.00) (34,000.00) (19,000.00) (113,000.00) (57,000.00) 108,000.00 303,000.00 1,593,000.00 (326,000.00) (250,000.00) (10,000.00) Net income (loss) Depreciation & amortization Postretirement benefit plan expense Deferred income taxes Stock compensation Multi-employer pension plan exit liabi Other adjustments Postretirement benefit plan contribut Trade receivables Inventories Accounts payable All other current assets & liabilities Net cash flows from operating activiti Additions to properties Issuance of notes receivable Repayments of notes receivable Purchase of marketable securities Investments in unconsolidated entitie Acquisition of cost method investmen Purchases of available for sale securit Sales of available for sale securities Acquisitions, net of cash acquired Divestitures Other investing activities Net cash flows from investing activitie Net issuances (reductions) of notes pi Issuances of long-term debt Reductions of long-term debt Debt redemption costs Net issuances of common stock Common stock repurchases Cash dividends Collateral received on derivative instr Other financing activities Net cash provided by (used in) financii Effect of exchange rate changes on ca Increase (decrease) in cash & cash eq Cash & cash equivalents at beginning Cash & cash equivalents at end of per Interest paid Income taxes paid (56,000.00) 69,000.00 (4,000.00) (75,000.00) 13,000.00 21,000.00 (385,000.00) 343,000.00 361,000.00 (646,000.00) (7,000.00) (649,000.00) 9,000.00 554,000.00 (45,000.00) 105,000.00 50,000.00 (240,000.00) (590,000.00) (18,000.00) (740,000.00) (15,000.00) 5,000.00 435,000.00 440,000.00 (586,000.00) (14,000.00) (2,000.00) 21,000.00 (33,000.00) 932,000.00 397,000.00 1,329,000.00 124,000.00 212,000.00

Assistance needed with Kellogg Analysis for the following Topics 1. Financial Evaluation: In this section of the report, you will now determine if the three available financial options in the Project Two Financial Assumptions document are appropriate for the business, considering the analysis you did in the first section. You will also explain financing and describe the business's likely future performance. . Financing: Explain how a business finances its operations and expansion. B. Bond Investment: Assess the appropriateness of a bond investment as a financing option for the businesss financial health, using your financial analysis and other financial information to your support claims. C. Capital Equipment: Assess the appropriateness of a capital equipment investment as a financing option for the businesss financial health, using your financial analysis and other financial information to support your claims. D. Capital Lease: Assess the appropriateness of a capital lease purchase as a financing option for the businesss financial health, using your financial analysis and other financial information to support your claims. E. Short-Term Financing: Explain how potential short-term financing sources could help the business raise needed funds for improving its financial health. Base your response on the businesss current financial information. F. Future Financial Considerations: Describe the businesss likely future financial performance based on its current financial well-being and risk levels. Use financial information to support your claims. 1. Financial Recommendations: In this section of the report, you will recommend which financing option(s) are the best for the business to choose depending on its financial health. . Financial Recommendation(s): Recommend the most appropriate financing option(s) based on the businesss financial health, including a rationale for why the option(s) are best.

Assistance needed with Kellogg Analysis for the following Topics 1. Financial Evaluation: In this section of the report, you will now determine if the three available financial options in the Project Two Financial Assumptions document are appropriate for the business, considering the analysis you did in the first section. You will also explain financing and describe the business's likely future performance. . Financing: Explain how a business finances its operations and expansion. B. Bond Investment: Assess the appropriateness of a bond investment as a financing option for the businesss financial health, using your financial analysis and other financial information to your support claims. C. Capital Equipment: Assess the appropriateness of a capital equipment investment as a financing option for the businesss financial health, using your financial analysis and other financial information to support your claims. D. Capital Lease: Assess the appropriateness of a capital lease purchase as a financing option for the businesss financial health, using your financial analysis and other financial information to support your claims. E. Short-Term Financing: Explain how potential short-term financing sources could help the business raise needed funds for improving its financial health. Base your response on the businesss current financial information. F. Future Financial Considerations: Describe the businesss likely future financial performance based on its current financial well-being and risk levels. Use financial information to support your claims. 1. Financial Recommendations: In this section of the report, you will recommend which financing option(s) are the best for the business to choose depending on its financial health. . Financial Recommendation(s): Recommend the most appropriate financing option(s) based on the businesss financial health, including a rationale for why the option(s) are best.