Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assistance please QUESTION 2 35 marks The following extract has been taken out of the books of Deep Blue Traders on 31 July 2019 DR

Assistance please

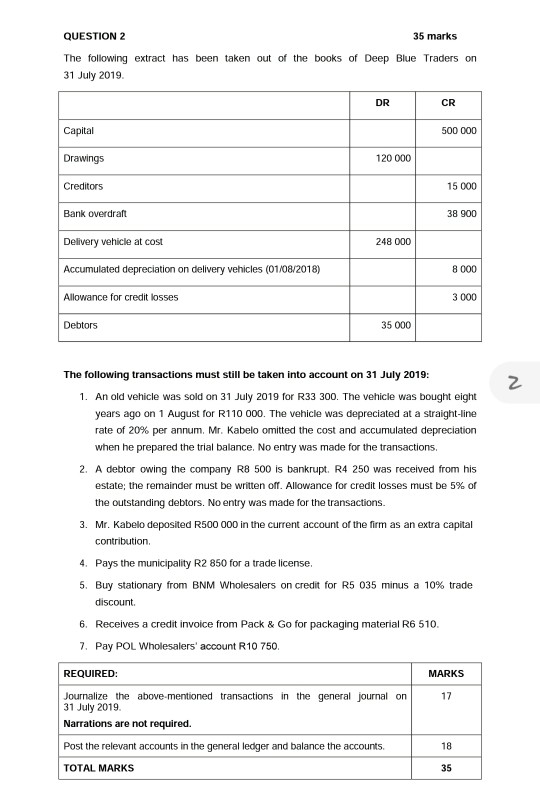

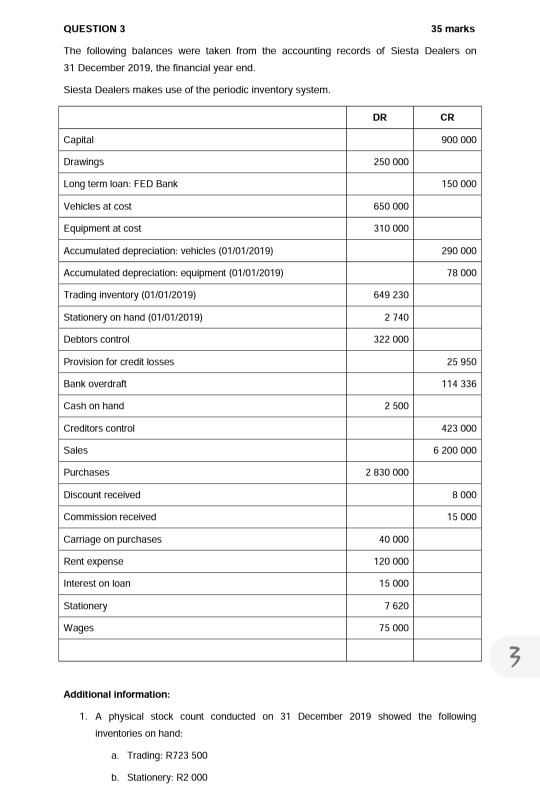

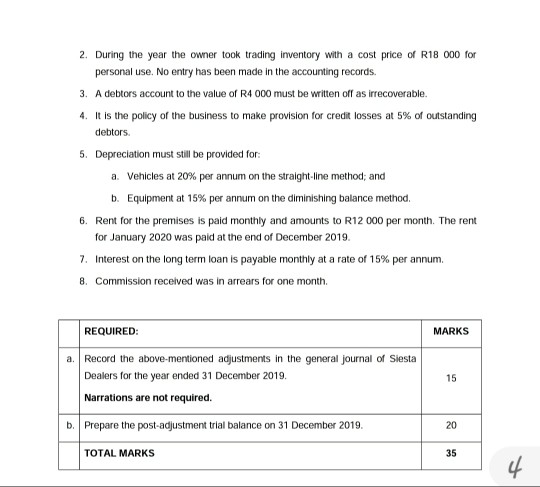

QUESTION 2 35 marks The following extract has been taken out of the books of Deep Blue Traders on 31 July 2019 DR CR Capital 500 000 Drawings 120 000 Creditors 15 000 Bank overdraft 38 900 248 000 Delivery vehicle at cost Accumulated depreciation on delivery vehicles (01/08/2018) Allowance for credit losses 8 000 3 000 Debtors 35 000 2 The following transactions must still be taken into account on 31 July 2019: 1. An old vehicle was sold on 31 July 2019 for R33 300. The vehicle was bought eight years ago on 1 August for R110 000. The vehicle was depreciated at a straight-line rate of 20% per annum. Mr. Kabelo omitted the cost and accumulated depreciation when he prepared the trial balance. No entry was made for the transactions, 2. A debtor owing the company R8 500 is bankrupt. R4 250 was received from his estate; the remainder must be written off. Allowance for credit losses must be 5% of the outstanding debtors. No entry was made for the transactions. 3. Mr. Kabelo deposited R500 000 in the current account of the firm as an extra capital contribution 4. Pays the municipality R2 850 for a trade license, 5. Buy stationary from BNM Wholesalers on credit for R5 035 minus a 10% trade discount 6. Receives a credit invoice from Pack & Go for packaging material R6 510. 7. Pay POL Wholesalers' account R10 750. MARKS 17 REQUIRED: Journalize the above-mentioned transactions in the general journal on 31 July 2019 Narrations are not required. Post the relevant accounts in the general ledger and balance the accounts. TOTAL MARKS 18 35 QUESTION 3 35 marks The following balances were taken from the accounting records of Siesta Dealers on 31 December 2019, the financial year end. Siesta Dealers makes use of the periodic inventory system. DR CR 900 000 250 000 150 000 650 000 310 000 290 000 78 000 Capital Drawings Long term loan: FED Bank Vehicles at cost Equipment at cost Accumulated depreciation: vehicles (01/01/2019) Accumulated depreciation equipment (01/01/2019) Trading inventory (01/01/2019) Stationery on hand (01/01/2019) Debtors control Provision for credit losses Bank overdraft Cash on hand Creditors control 649 230 2 740 322 000 25 950 114 336 2 500 423 000 Sales 6 200 000 2 830 000 8 000 Purchases Discount received Commission received Carriage on purchases 15 000 40 000 Rent expense 120 000 15 000 Interest on loan Stationery 7 620 Wages 75 000 3 Additional information: 1. A physical stock count conducted on 31 December 2019 showed the following Inventories on hand: a. Trading: R723 500 b. Stationery: R2 000 2. During the year the owner took trading inventory with a cost price of R18 000 for personal use. No entry has been made in the accounting records. 3. A debtors account to the value of R4 000 must be written off as irrecoverable. 4. It is the policy of the business to make provision for credit losses at 5% of outstanding debtors 5. Depreciation must still be provided for: a. Vehicles at 20% per annum on the straight-line method and b. Equipment at 15% per annum on the diminishing balance method. 6. Rent for the premises is paid monthly and amounts to R12 000 per month. The rent for January 2020 was paid at the end of December 2019. 7. Interest on the long term loan is payable monthly at a rate of 15% per annum. 8. Commission received was in arrears for one month. REQUIRED: MARKS 15 a. Record the above-mentioned adjustments in the general journal of Siesta Dealers for the year ended 31 December 2019. Narrations are not required. b. Prepare the post-adjustment trial balance on 31 December 2019. 20 TOTAL MARKS 35 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started