Answered step by step

Verified Expert Solution

Question

1 Approved Answer

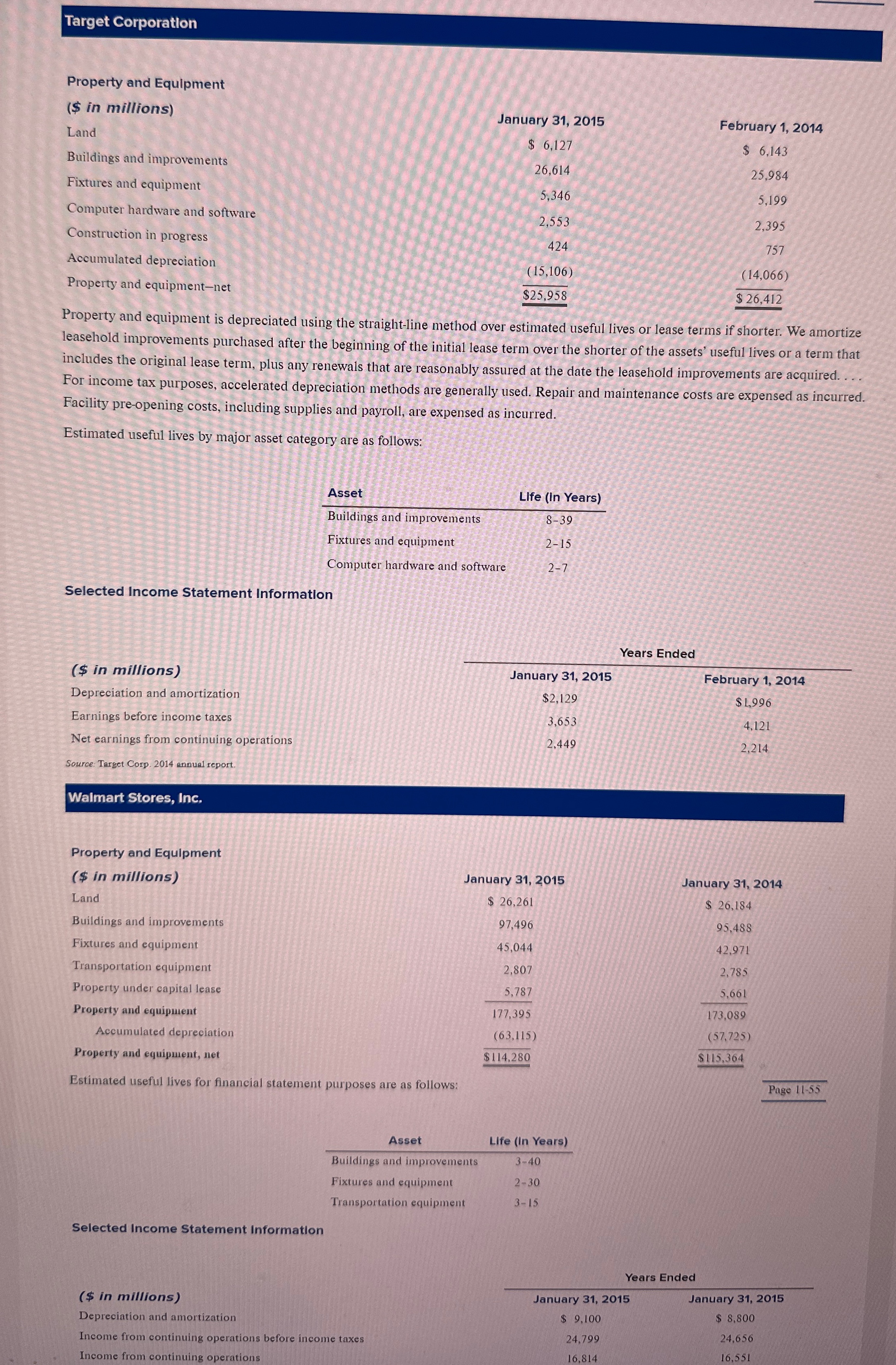

Assume a 3 5 % tax rate. 1 . Estimate the average useful life of each firms long lived assets of January 3 1 ,

Assume a tax rate.

Estimate the average useful life of each firms long lived assets of January

Calculate a revised estimate of Walmart depreciation expense for the year and January using the estimated average useful life of target assets use this amount to recalculate Walmart income before taxes and income from continuing operations for the year ended January

Calculate a revised estimate of target depreciation expense for the year ended January using the estimated average useful life of Walmarts assets use amount to recalculate targets earnings before income taxes and net earnings from continuing operations for the year ended January

Why mighth a financial analyst want to make adjustments in requirment and

What factors will affect the reliability and accuracy of the adjustments performed in requirements and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started