Answered step by step

Verified Expert Solution

Question

1 Approved Answer

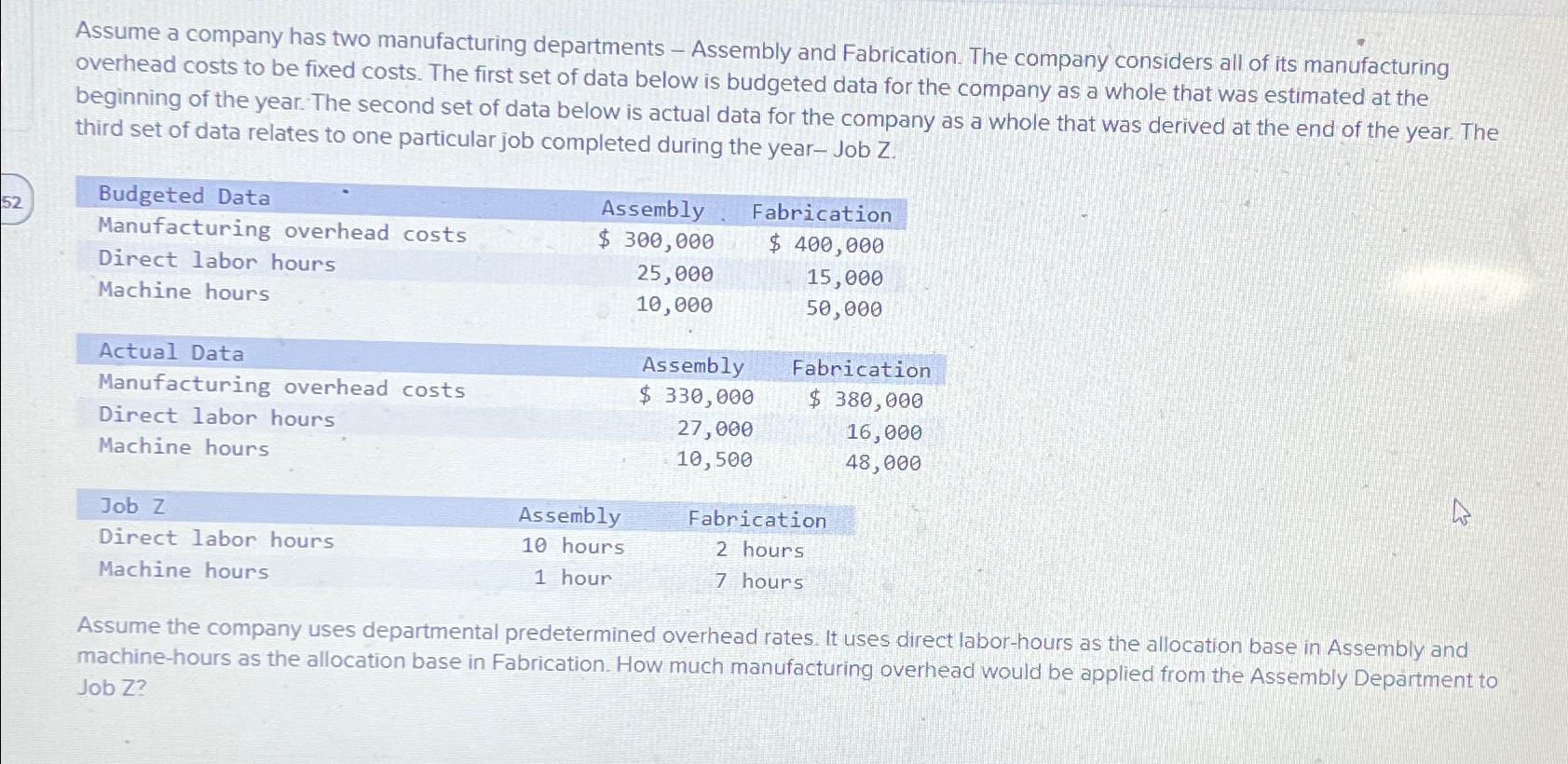

Assume a company has two manufacturing departments - Assembly and Fabrication. The company considers all of its manufacturing overhead costs to be fixed costs.

Assume a company has two manufacturing departments - Assembly and Fabrication. The company considers all of its manufacturing overhead costs to be fixed costs. The first set of data below is budgeted data for the company as a whole that was estimated at the beginning of the year. The second set of data below is actual data for the company as a whole that was derived at the end of the year. The third set of data relates to one particular job completed during the year- Job Z Budgeted Data 52 Manufacturing overhead costs Assembly $ 300,000 Fabrication $ 400,000 Direct labor hours 25,000 Machine hours Actual Data Manufacturing overhead costs Direct labor hours Machine hours Job Z Direct labor hours Machine hours 10,000 Assembly $ 330,000 27,000 10,500 15,000 50,000 Fabrication $ 380,000 Fabrication 16,000 48,000 Assembly 10 hours 1 hour 2 hours 7 hours Assume the company uses departmental predetermined overhead rates. It uses direct labor-hours as the allocation base in Assembly and machine-hours as the allocation base in Fabrication. How much manufacturing overhead would be applied from the Assembly Department to Job Z?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the manufacturing overhead applied from the Assembly Department to Job Z we first ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started