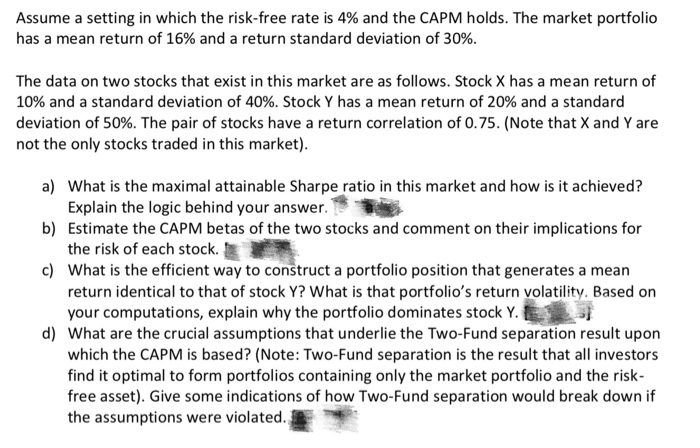

Assume a setting in which the risk-free rate is 4% and the CAPM holds. The market portfolio has a mean return of 16% and a return standard deviation of 30%. The data on two stocks that exist in this market are as follows. Stock X has a mean return of 10% and a standard deviation of 40%. Stock Y has a mean return of 20% and a standard deviation of 50%. The pair of stocks have a return correlation of 0.75. (Note that X and Y are not the only stocks traded in this market). a) What is the maximal attainable Sharpe ratio in this market and how is it achieved? Explain the logic behind your answer. b) Estimate the CAPM betas of the two stocks and comment on their implications for the risk of each stock. c) What is the efficient way to construct a portfolio position that generates a mean return identical to that of stock Y? What is that portfolio's return volatility. Based on your computations, explain why the portfolio dominates stock Y. d) What are the crucial assumptions that underlie the Two-Fund separation result upon which the CAPM is based? (Note: Two-Fund separation is the result that all investors find it optimal to form portfolios containing only the market portfolio and the risk- free asset). Give some indications of how Two-Fund separation would break down if the assumptions were violated. Assume a setting in which the risk-free rate is 4% and the CAPM holds. The market portfolio has a mean return of 16% and a return standard deviation of 30%. The data on two stocks that exist in this market are as follows. Stock X has a mean return of 10% and a standard deviation of 40%. Stock Y has a mean return of 20% and a standard deviation of 50%. The pair of stocks have a return correlation of 0.75. (Note that X and Y are not the only stocks traded in this market). a) What is the maximal attainable Sharpe ratio in this market and how is it achieved? Explain the logic behind your answer. b) Estimate the CAPM betas of the two stocks and comment on their implications for the risk of each stock. c) What is the efficient way to construct a portfolio position that generates a mean return identical to that of stock Y? What is that portfolio's return volatility. Based on your computations, explain why the portfolio dominates stock Y. d) What are the crucial assumptions that underlie the Two-Fund separation result upon which the CAPM is based? (Note: Two-Fund separation is the result that all investors find it optimal to form portfolios containing only the market portfolio and the risk- free asset). Give some indications of how Two-Fund separation would break down if the assumptions were violated