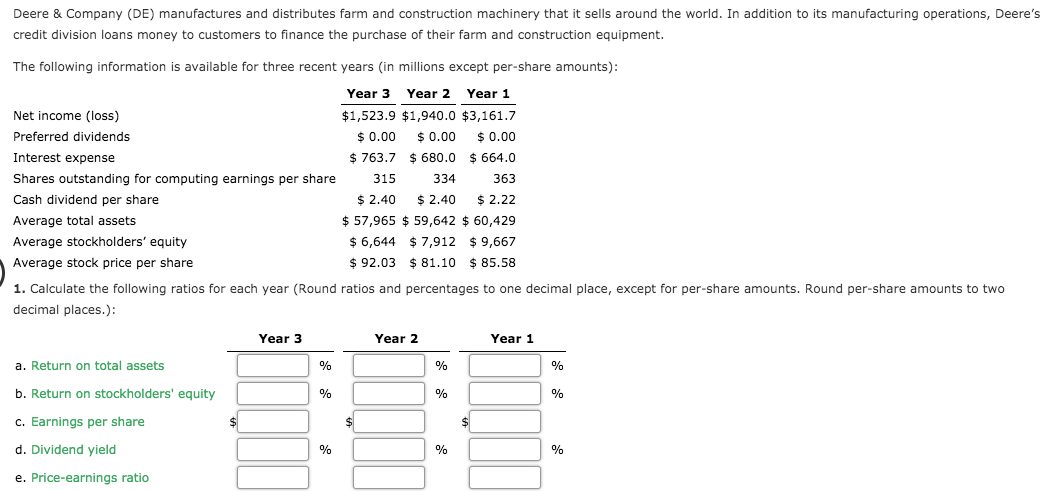

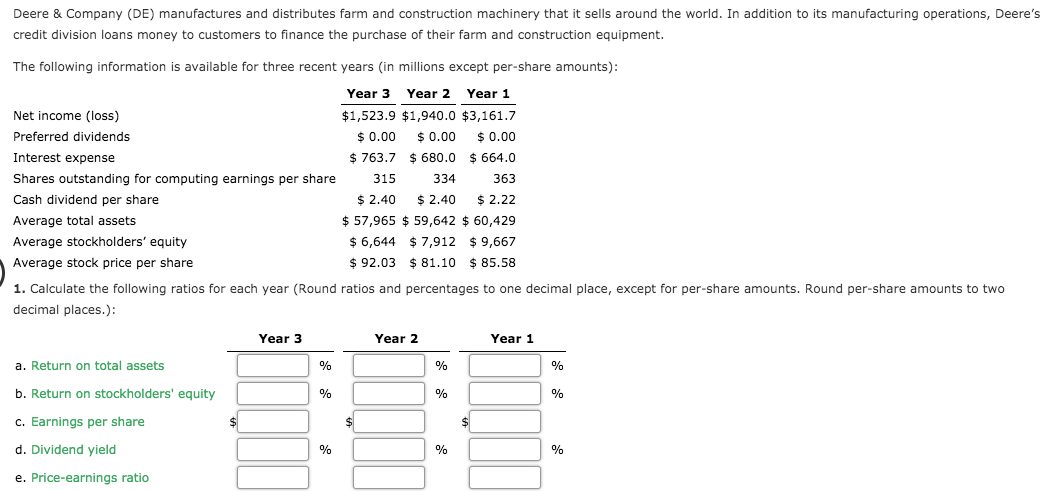

Deere & Company (DE) manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere's credit division loans money to customers to finance the purchase of their farm and construction equipment. The following information is available for three recent years in millions except per-share amounts): Year 3 Year 2 Year 1 Net income (loss) $1,523.9 $1,940.0 $3,161.7 Preferred dividends $ 0.00 $ 0.00 $ 0.00 Interest expense $ 763.7 $ 680.0 $ 664.0 Shares outstanding for computing earnings per share 315 334 363 Cash dividend per share $ 2.40 $ 2.40 $ 2.22 Average total assets $ 57,965 $ 59,642 $ 60,429 Average stockholders' equity $ 6,644 $ 7,912 $ 9,667 Average stock price per share $ 92.03 $ 81.10 $ 85.58 1. Calculate the following ratios for each year (Round ratios and percentages to one decimal place, except for per-share amounts. Round per-share amounts to two decimal places.): Year 3 Year 2 Year 1 1 % % % a. Return on total assets b. Return on stockholders' equity % % % c. Earnings per share $ $ $ d. Dividend yield % % % e. Price-earnings ratio Deere & Company (DE) manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere's credit division loans money to customers to finance the purchase of their farm and construction equipment. The following information is available for three recent years in millions except per-share amounts): Year 3 Year 2 Year 1 Net income (loss) $1,523.9 $1,940.0 $3,161.7 Preferred dividends $ 0.00 $ 0.00 $ 0.00 Interest expense $ 763.7 $ 680.0 $ 664.0 Shares outstanding for computing earnings per share 315 334 363 Cash dividend per share $ 2.40 $ 2.40 $ 2.22 Average total assets $ 57,965 $ 59,642 $ 60,429 Average stockholders' equity $ 6,644 $ 7,912 $ 9,667 Average stock price per share $ 92.03 $ 81.10 $ 85.58 1. Calculate the following ratios for each year (Round ratios and percentages to one decimal place, except for per-share amounts. Round per-share amounts to two decimal places.): Year 3 Year 2 Year 1 1 % % % a. Return on total assets b. Return on stockholders' equity % % % c. Earnings per share $ $ $ d. Dividend yield % % % e. Price-earnings ratio