Question

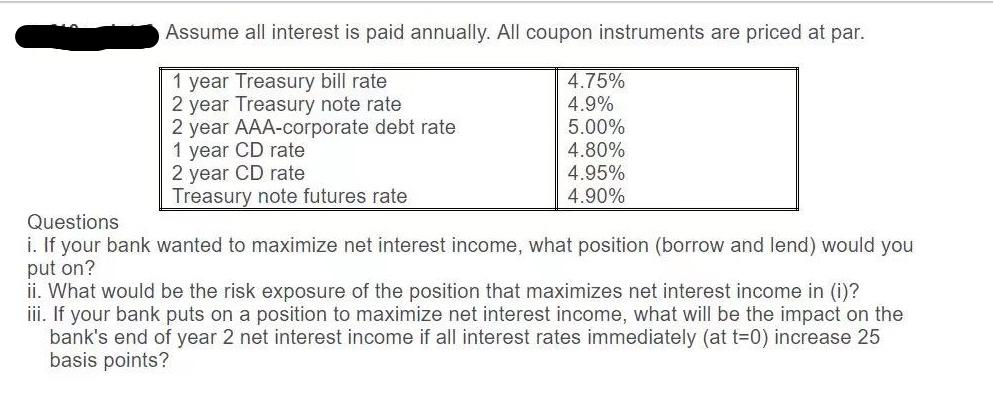

Assume all interest is paid annually. All coupon instruments are priced at par. 1 year Treasury bill rate 2 year Treasury note rate 2

Assume all interest is paid annually. All coupon instruments are priced at par. 1 year Treasury bill rate 2 year Treasury note rate 2 year AAA-corporate debt rate 1 year CD rate 2 year CD rate Treasury note futures rate 4.75% 4.9% 5.00% 4.80% 4.95% 4.90% Questions i. If your bank wanted to maximize net interest income, what position (borrow and lend) would you put on? ii. What would be the risk exposure of the position that maximizes net interest income in (i)? iii. If your bank puts on a position to maximize net interest income, what will be the impact on the bank's end of year 2 net interest income if all interest rates immediately (at t=0) increase 25 basis points?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i To maximize net interest income the bank should borrow funds at the lowest interest rate and lend ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting in an Economic Context

Authors: Jamie Pratt

10th edition

978-1-119-3061, 1119306167, 978-1119444367

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App