Question

Suppose that a stock price starts at $800 at time 0. At time 1 (one day later), the stock will either be worth $850

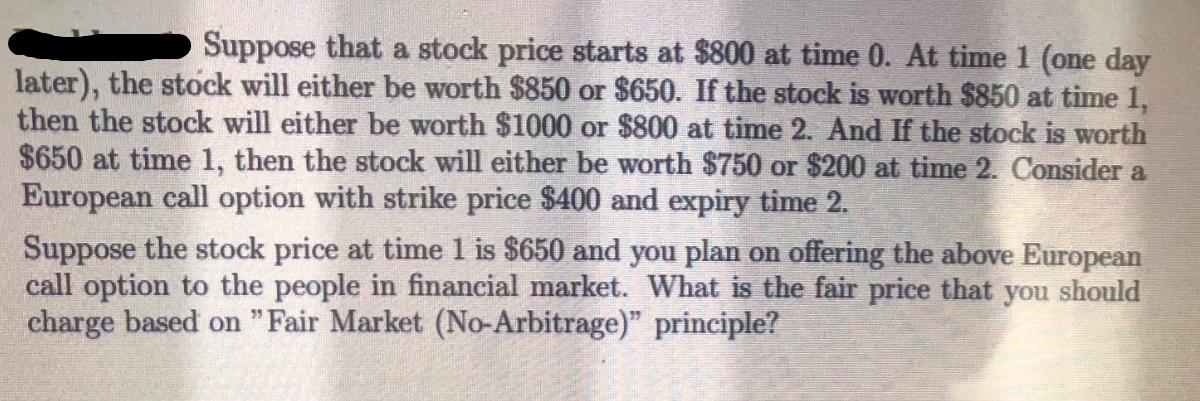

Suppose that a stock price starts at $800 at time 0. At time 1 (one day later), the stock will either be worth $850 or $650. If the stock is worth $850 at time 1, then the stock will either be worth $1000 or $800 at time 2. And If the stock is worth $650 at time 1, then the stock will either be worth $750 or $200 at time 2. Consider a European call option with strike price $400 and expiry time 2. Suppose the stock price at time 1 is $650 and you plan on offering the above European call option to the people in financial market. What is the fair price that you should charge based on "Fair Market (No-Arbitrage)" principle?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the fair price of the European call option based on the Fair Market NoArbitrage princip...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

A Pathway To Introductory Statistics

Authors: Jay Lehmann

1st Edition

0134107179, 978-0134107172

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App