Answered step by step

Verified Expert Solution

Question

1 Approved Answer

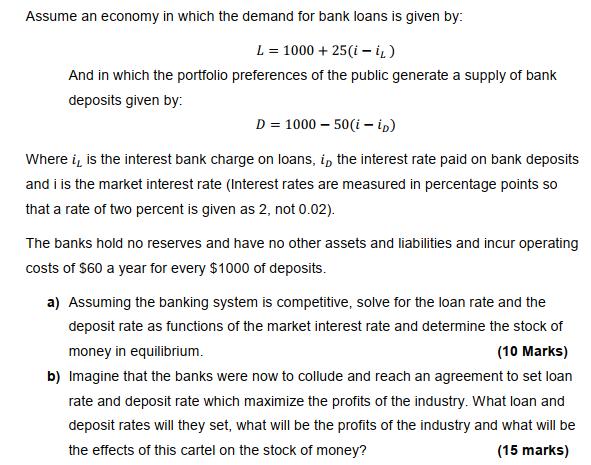

Assume an economy in which the demand for bank loans is given by: L= 1000 + 25(ii) And in which the portfolio preferences of

Assume an economy in which the demand for bank loans is given by: L= 1000 + 25(ii) And in which the portfolio preferences of the public generate a supply of bank deposits given by: D=1000-50(ii) Where i, is the interest bank charge on loans, in the interest rate paid on bank deposits and i is the market interest rate (Interest rates are measured in percentage points so that a rate of two percent is given as 2, not 0.02). The banks hold no reserves and have no other assets and liabilities and incur operating costs of $60 a year for every $1000 of deposits. a) Assuming the banking system is competitive, solve for the loan rate and the deposit rate as functions of the market interest rate and determine the stock of money in equilibrium. (10 Marks) b) Imagine that the banks were now to collude and reach an agreement to set loan rate and deposit rate which maximize the profits of the industry. What loan and deposit rates will they set, what will be the profits of the industry and what will be the effects of this cartel on the stock of money? (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started