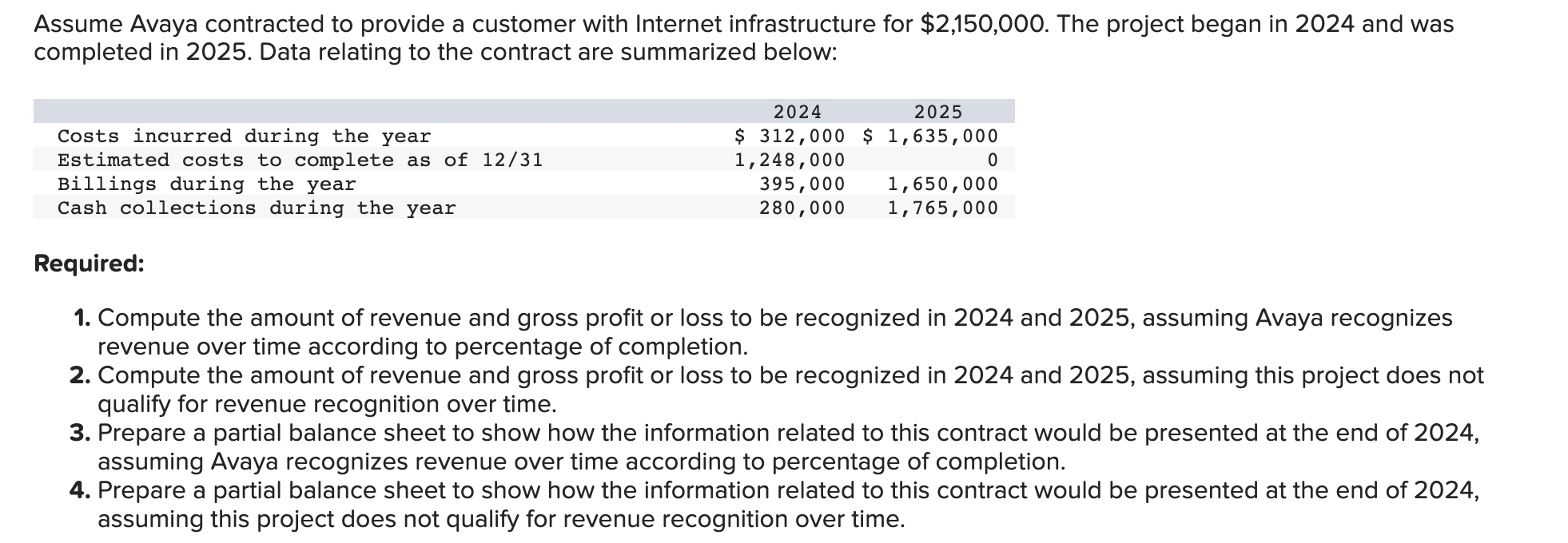

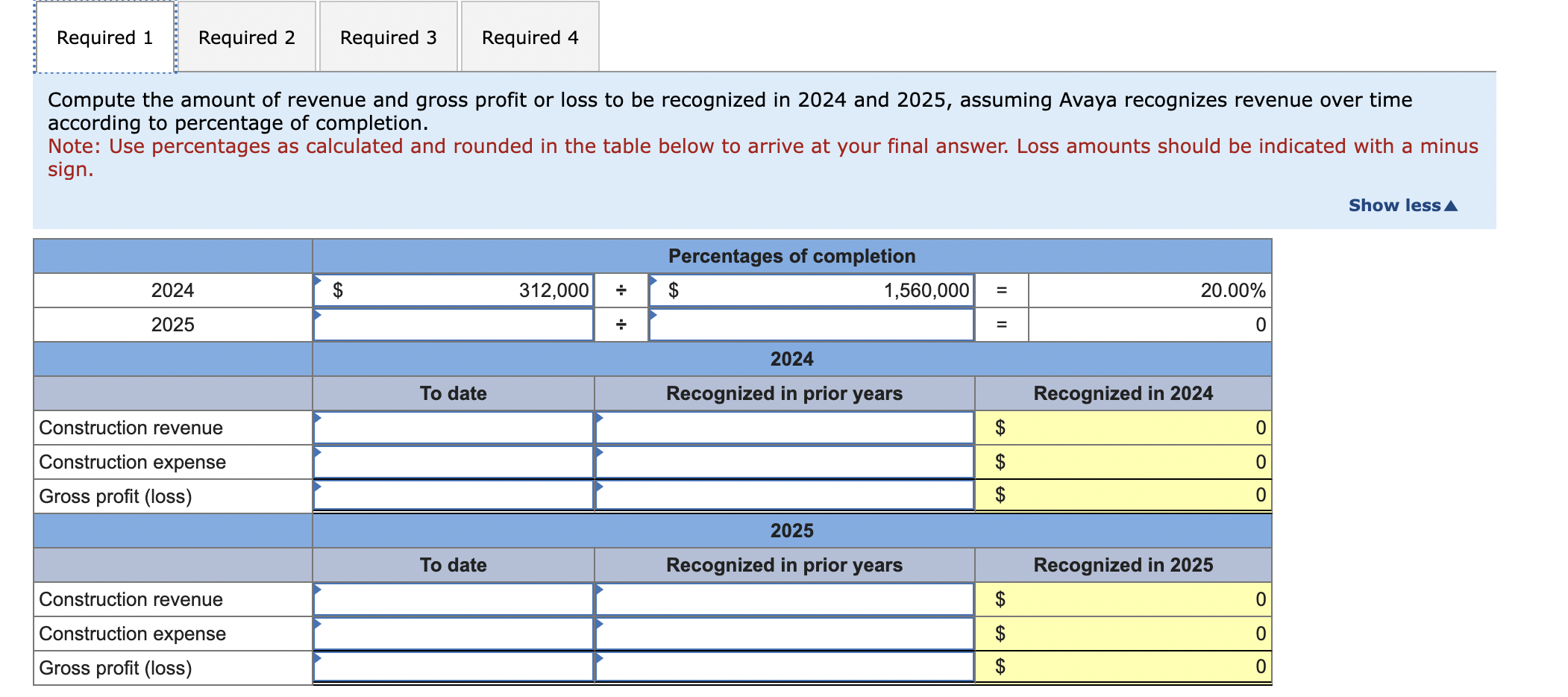

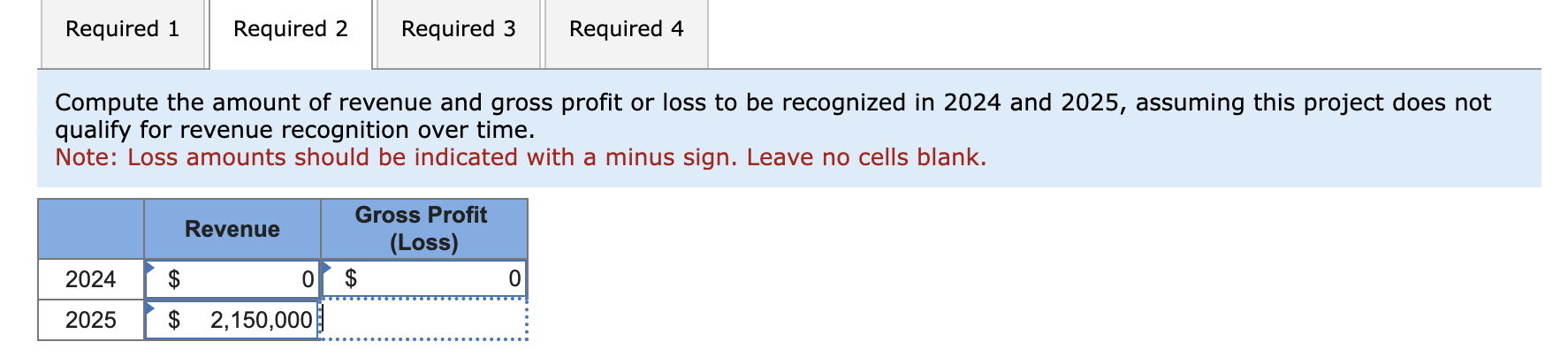

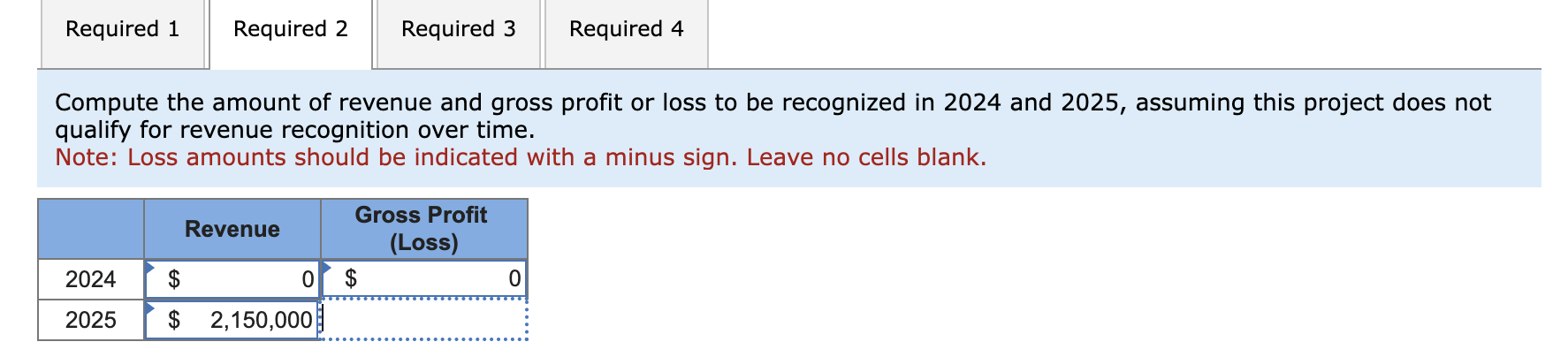

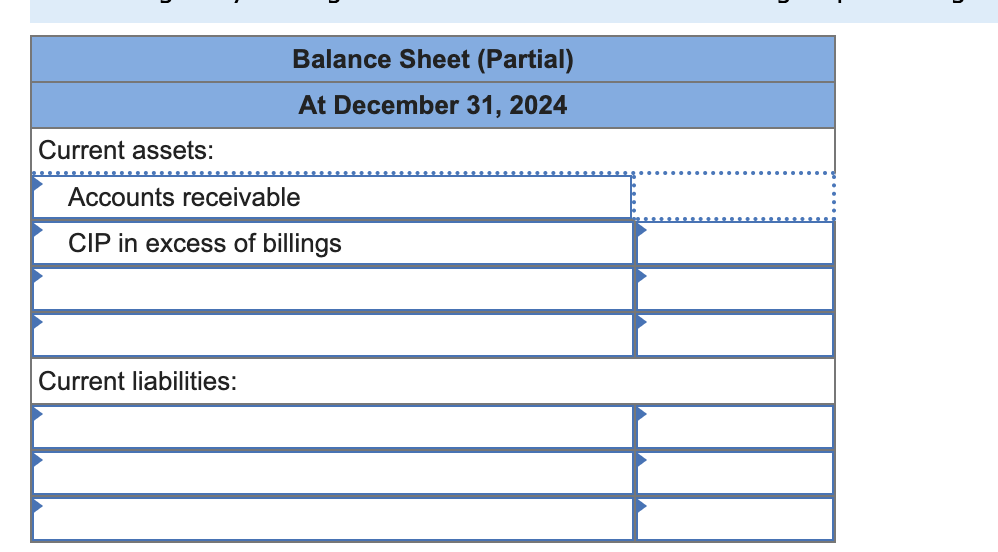

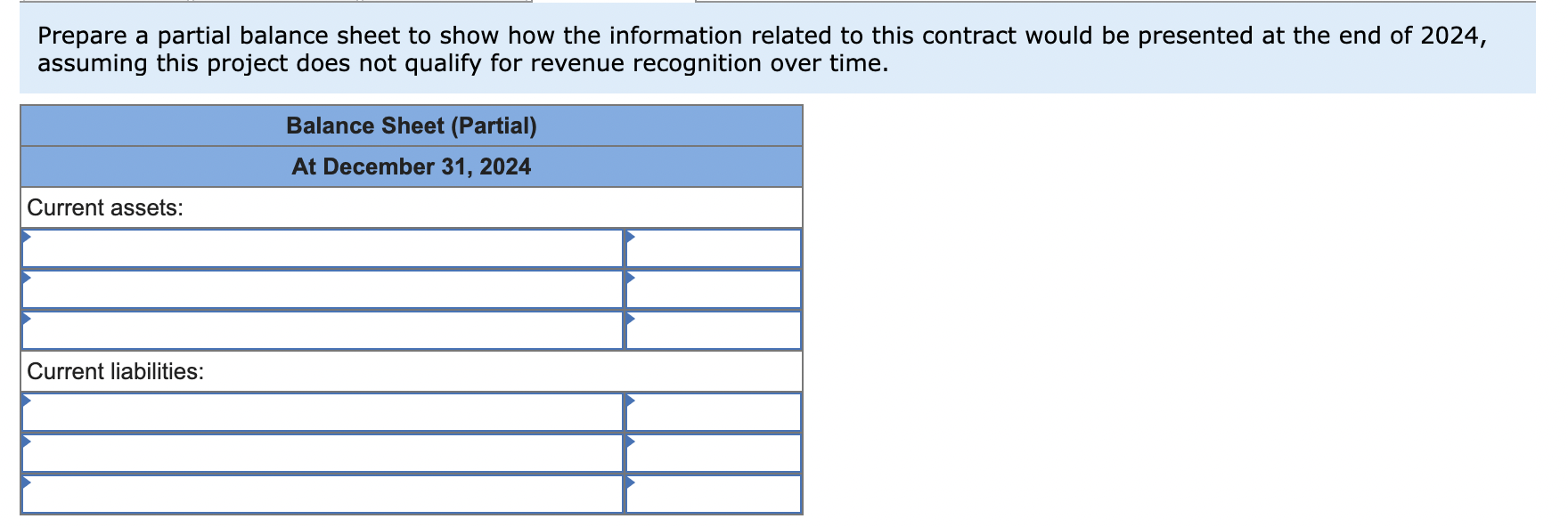

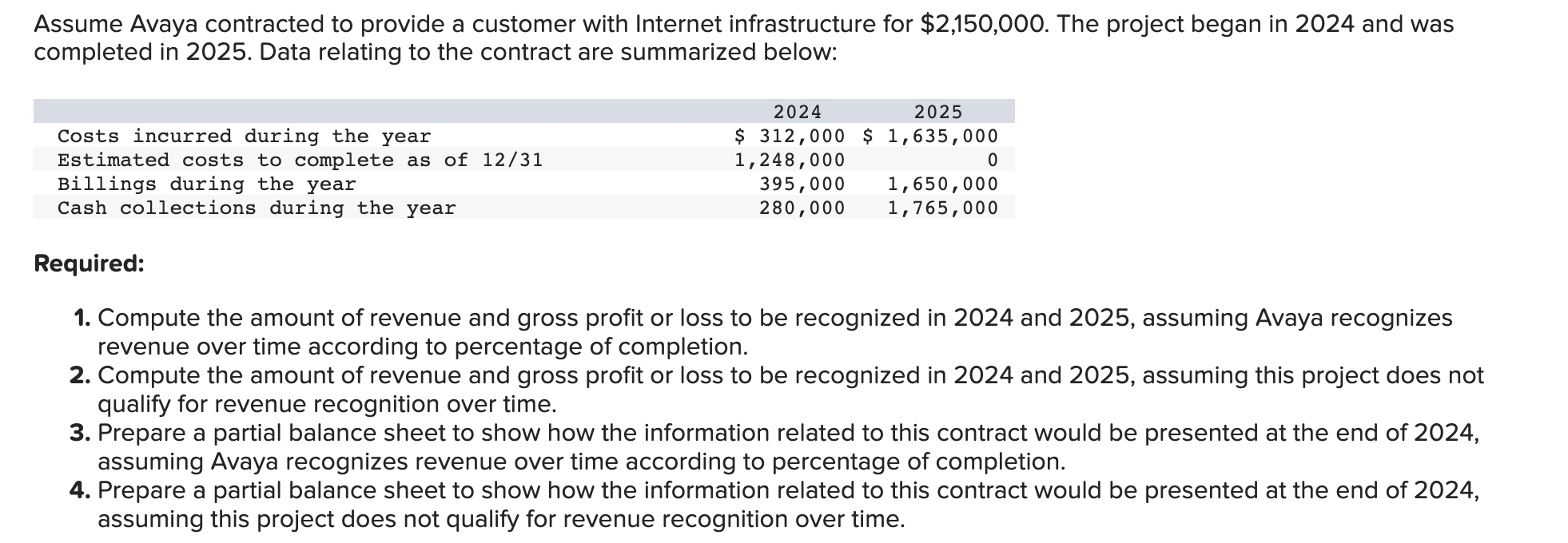

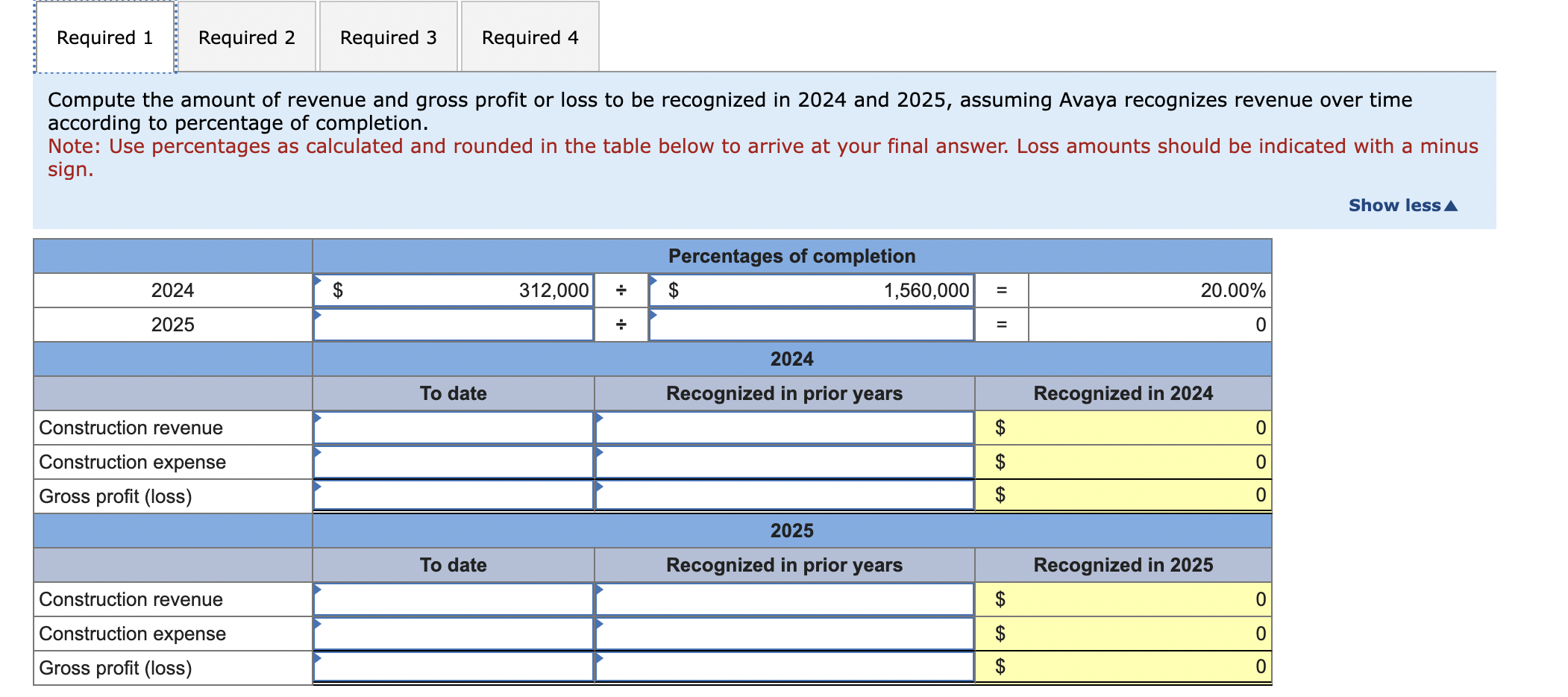

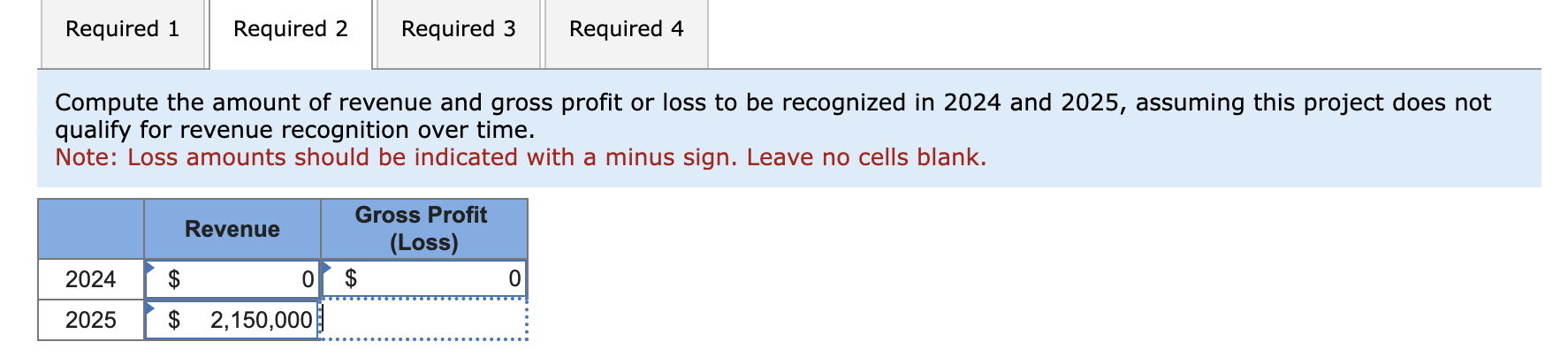

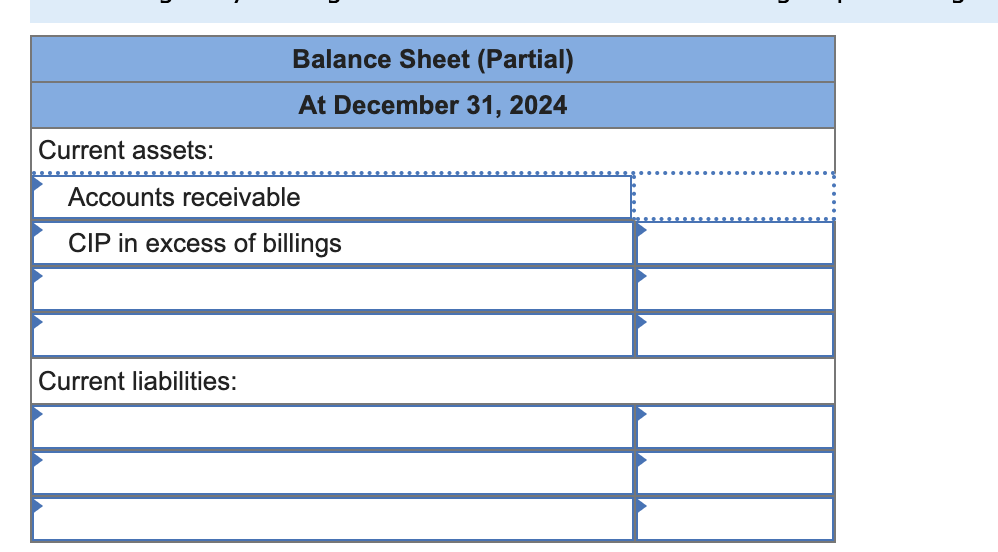

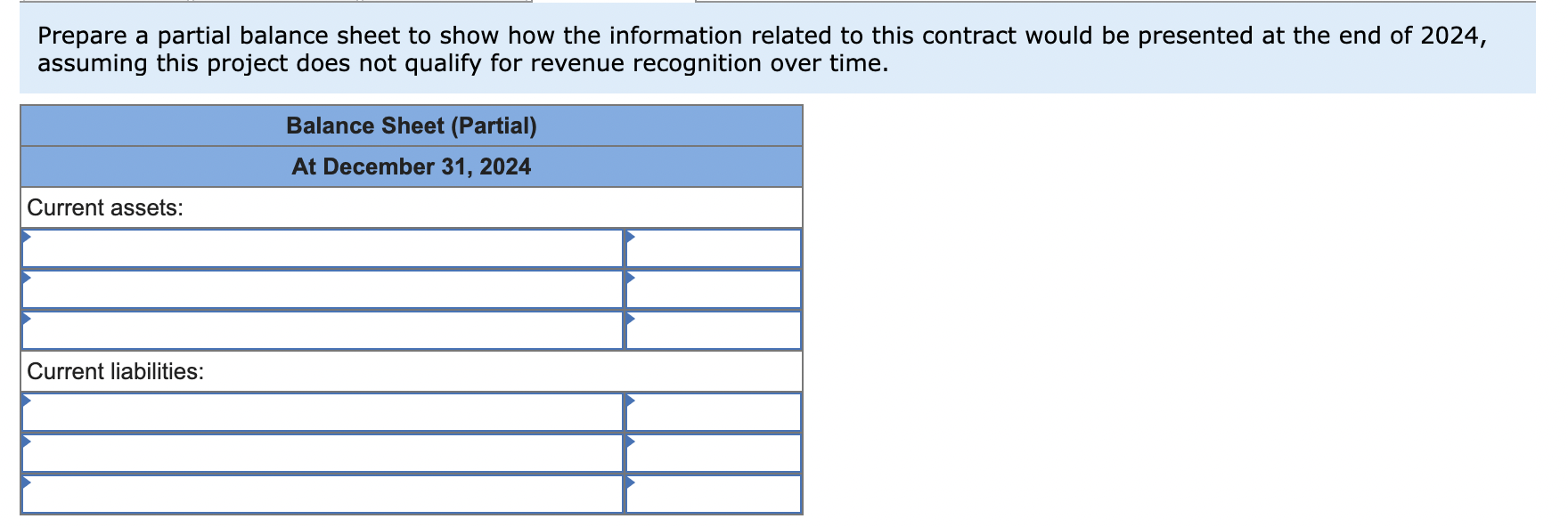

Assume Avaya contracted to provide a customer with Internet infrastructure for $2,150,000. The project began in 2024 and was completed in 2025. Data relating to the contract are summarized below: Required: 1. Compute the amount of revenue and gross profit or loss to be recognized in 2024 and 2025 , assuming Avaya recognizes revenue over time according to percentage of completion. 2. Compute the amount of revenue and gross profit or loss to be recognized in 2024 and 2025 , assuming this project does not qualify for revenue recognition over time. 3. Prepare a partial balance sheet to show how the information related to this contract would be presented at the end of 2024 , assuming Avaya recognizes revenue over time according to percentage of completion. 4. Prepare a partial balance sheet to show how the information related to this contract would be presented at the end of 2024 , assuming this project does not qualify for revenue recognition over time. Compute the amount of revenue and gross profit or loss to be recognized in 2024 and 2025 , assuming Avaya recognizes revenue over time according to percentage of completion. Note: Use percentages as calculated and rounded in the table below to arrive at your final answer. Loss amounts should be indicated sign. Compute the amount of revenue and gross profit or loss to be recognized in 2024 and 2025 , assuming this project does not qualify for revenue recognition over time. Note: Loss amounts should be indicated with a minus sign. Leave no cells blank. Compute the amount of revenue and gross profit or loss to be recognized in 2024 and 2025 , assuming this project does not qualify for revenue recognition over time. Note: Loss amounts should be indicated with a minus sign. Leave no cells blank. \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Balance Sheet (Partial) } \\ \hline At December 31,2024 \\ \hline Current assets: \\ \hline Accounts receivable \\ \hline CIP in excess of billings \\ \hline & Current liabilities: \\ \hline & \\ \hline & \\ \hline \end{tabular} Prepare a partial balance sheet to show how the information related to this contract would be presented at the end of 2024 , assuming this project does not qualify for revenue recognition over time