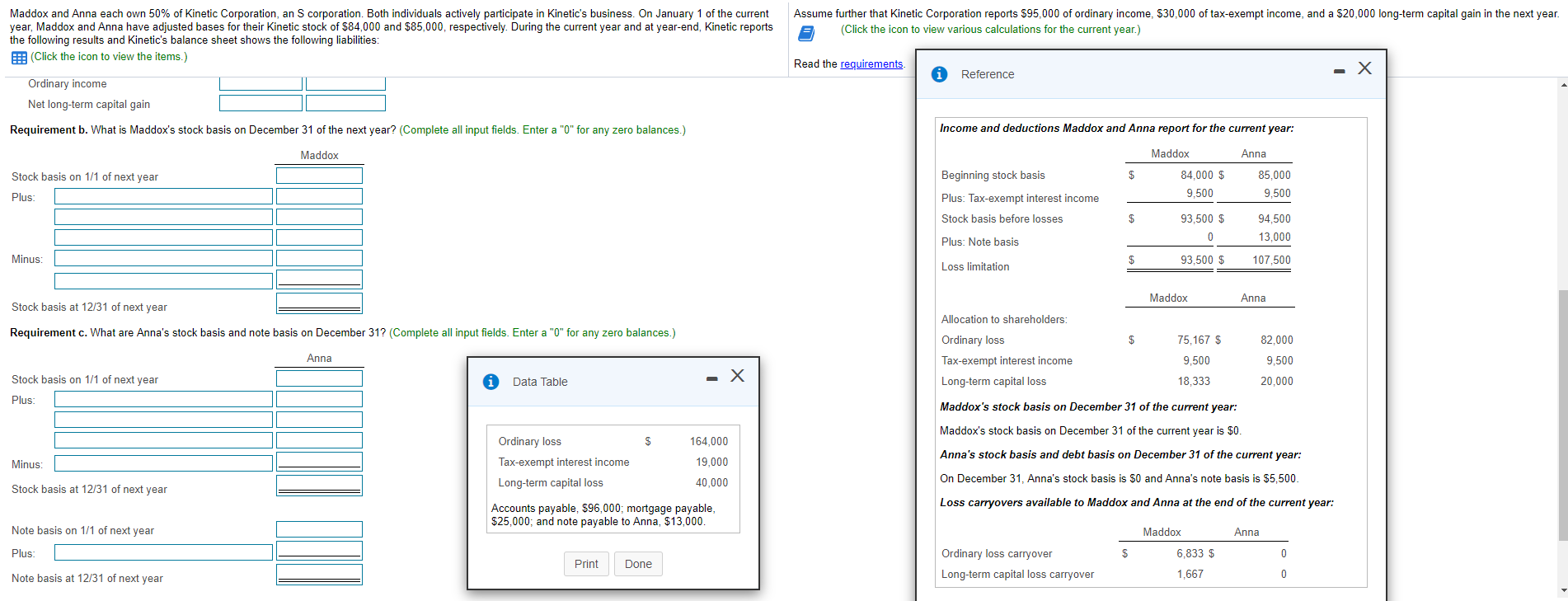

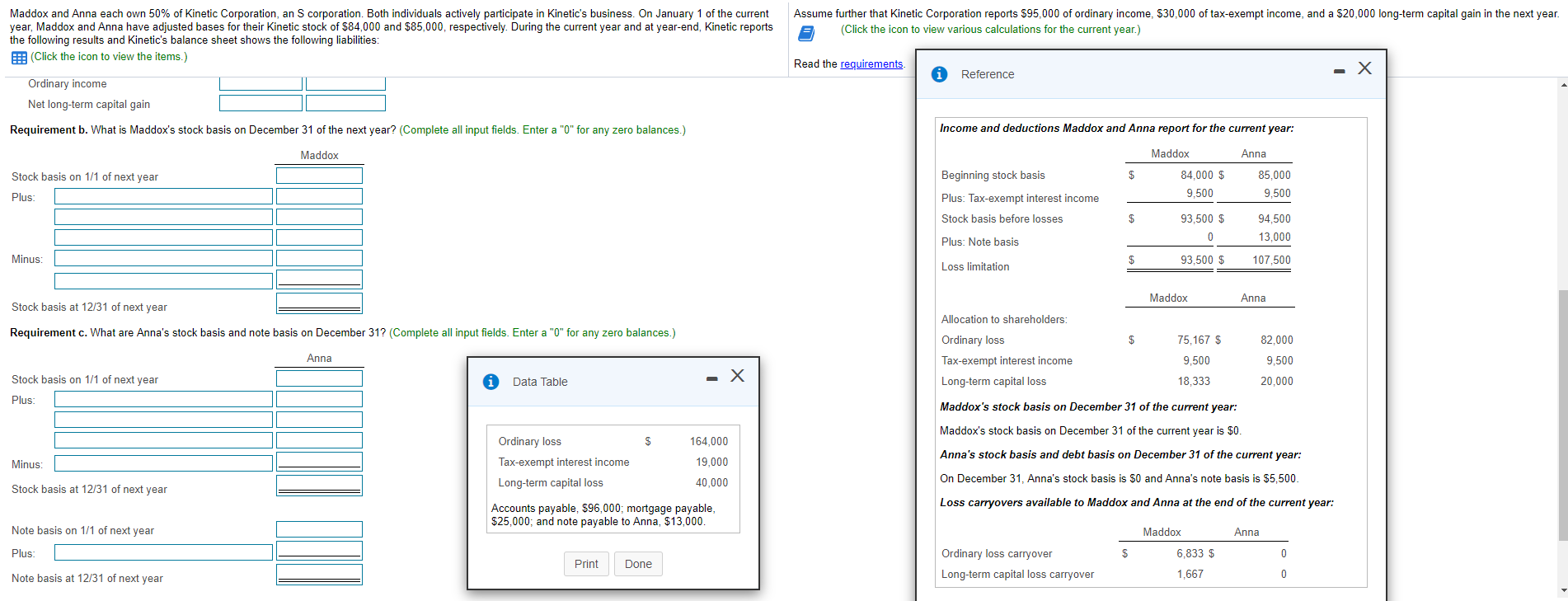

Assume further that Kinetic Corporation reports $95,000 of ordinary income, $30,000 of tax-exempt income, and a $20,000 long-term capital gain in the next year. (Click the icon to view various calculations for the current year.) Maddox and Anna each own 50% of Kinetic Corporation, an S corporation. Both individuals actively participate in Kinetic's business. On January 1 of the current year, Maddox and Anna have adjusted bases for their Kinetic stock of $84,000 and $85,000, respectively. During the current year and at year-end, Kinetic reports the following results and Kinetic's balance sheet shows the following liabilities: (Click the icon to view the items.) Read the requirements x Reference Ordinary income Net long-term capital gain Requirement b. What is Maddox's stock basis on December 31 of the next year? (Complete all input fields. Enter a "O" for any zero balances.) Income and deductions Maddox and Anna report for the current year: Maddox Maddox Anna Beginning stock basis $ Stock basis on 1/1 of next year Plus: 84,000 $ 9,500 85,000 9,500 Plus: Tax-exempt interest income Stock basis before losses $ 93,500 $ 94,500 13,000 0 Plus: Note basis Minus: $ 93,500 $ 107,500 Loss limitation Maddox Anna Stock basis at 12/31 of next year Requirement c. What are Anna's stock basis and note basis on December 31? (Complete all input fields. Enter a "0" for any zero balances.) 75,167 $ 82,000 Allocation to shareholders: Ordinary loss Tax-exempt interest income Long-term capital loss Anna 9,500 9,500 Stock basis on 1/1 of next year Data Table 18,333 20,000 Plus Maddox's stock basis December 31 of the current year: Maddox's stock basis on December 31 of the current year is $0. S 164.000 Anna's stock basis and debt basis on December 31 of the current year: Minus: Ordinary loss Tax-exempt interest income Long-term capital loss 19.000 40.000 On December 31, Anna's stock basis is SO and Anna's note basis is $5,500 Stock basis at 12/31 of next year Loss carryovers available to Maddox and Anna at the end of the current year: Accounts payable, $96,000; mortgage payable, $25,000, and note payable to Anna, $13,000. Note basis on 1/1 of next year Maddox Anna Plus: 6,833 $ 0 Print Done Ordinary loss carryover Long-term capital loss carryover Note basis at 12/31 of next year 1,667 0 Assume further that Kinetic Corporation reports $95,000 of ordinary income, $30,000 of tax-exempt income, and a $20,000 long-term capital gain in the next year. (Click the icon to view various calculations for the current year.) Maddox and Anna each own 50% of Kinetic Corporation, an S corporation. Both individuals actively participate in Kinetic's business. On January 1 of the current year, Maddox and Anna have adjusted bases for their Kinetic stock of $84,000 and $85,000, respectively. During the current year and at year-end, Kinetic reports the following results and Kinetic's balance sheet shows the following liabilities: (Click the icon to view the items.) Read the requirements x Reference Ordinary income Net long-term capital gain Requirement b. What is Maddox's stock basis on December 31 of the next year? (Complete all input fields. Enter a "O" for any zero balances.) Income and deductions Maddox and Anna report for the current year: Maddox Maddox Anna Beginning stock basis $ Stock basis on 1/1 of next year Plus: 84,000 $ 9,500 85,000 9,500 Plus: Tax-exempt interest income Stock basis before losses $ 93,500 $ 94,500 13,000 0 Plus: Note basis Minus: $ 93,500 $ 107,500 Loss limitation Maddox Anna Stock basis at 12/31 of next year Requirement c. What are Anna's stock basis and note basis on December 31? (Complete all input fields. Enter a "0" for any zero balances.) 75,167 $ 82,000 Allocation to shareholders: Ordinary loss Tax-exempt interest income Long-term capital loss Anna 9,500 9,500 Stock basis on 1/1 of next year Data Table 18,333 20,000 Plus Maddox's stock basis December 31 of the current year: Maddox's stock basis on December 31 of the current year is $0. S 164.000 Anna's stock basis and debt basis on December 31 of the current year: Minus: Ordinary loss Tax-exempt interest income Long-term capital loss 19.000 40.000 On December 31, Anna's stock basis is SO and Anna's note basis is $5,500 Stock basis at 12/31 of next year Loss carryovers available to Maddox and Anna at the end of the current year: Accounts payable, $96,000; mortgage payable, $25,000, and note payable to Anna, $13,000. Note basis on 1/1 of next year Maddox Anna Plus: 6,833 $ 0 Print Done Ordinary loss carryover Long-term capital loss carryover Note basis at 12/31 of next year 1,667 0