Answered step by step

Verified Expert Solution

Question

1 Approved Answer

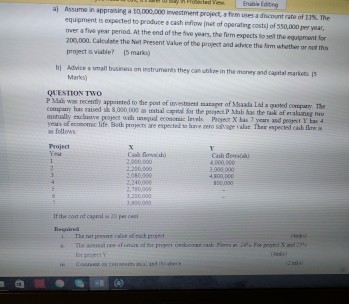

Assume in appraising a 10,000,000 investment project a firm user a discount rate of 13%. The equipment is expected to produce a cash inflow (net

Assume in appraising a 10,000,000 investment project a firm user a discount rate of 13%. The equipment is expected to produce a cash inflow (net of operating costs) of 550,000 per year a five period. All the end of the five years, the firm expects to sell the equipment for 200,000. Calculate the net present value of the project value of the project and active the firm whether or not this project is value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started