Question

Assume JetBlue wants to hedge away the risk jet fuel prices will rise, but cannot locate a derivative contract where the underlying asset is jet

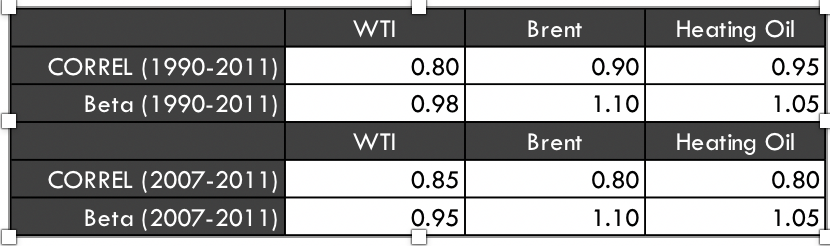

Assume JetBlue wants to hedge away the risk jet fuel prices will rise, but cannot locate a derivative contract where the underlying asset is jet fuel. You can, however, locate contracts on WTI, Brent, and heating oil. This means the company will have to cross hedge. Use the information below for problem 4.

4. Assume JetBlue hedges 60M bbl. of jet fuel. Using the 1990-2011 data, pick the best futures contact (WTI vs. Brent. vs. Heating oil) to hedge with, assuming only WTI and Brent futures are liquid enough. Using your lecture notes, the number of contracts required is closest to (2 points):

A. 1143

B. 1286

C. 1400

D. 1500

E. 1571

WTI Brent Heating Oil CORREL (1990-2011) Beta (1990-2011) 0.90 1.10 0.80 0.95 0.98 1.05 WTI Brent Heating Oil CORREL (2007-2011) Beta (2007-2011) 0.85 0.80 0.80 0.95 1.10 1.05Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started