Answered step by step

Verified Expert Solution

Question

1 Approved Answer

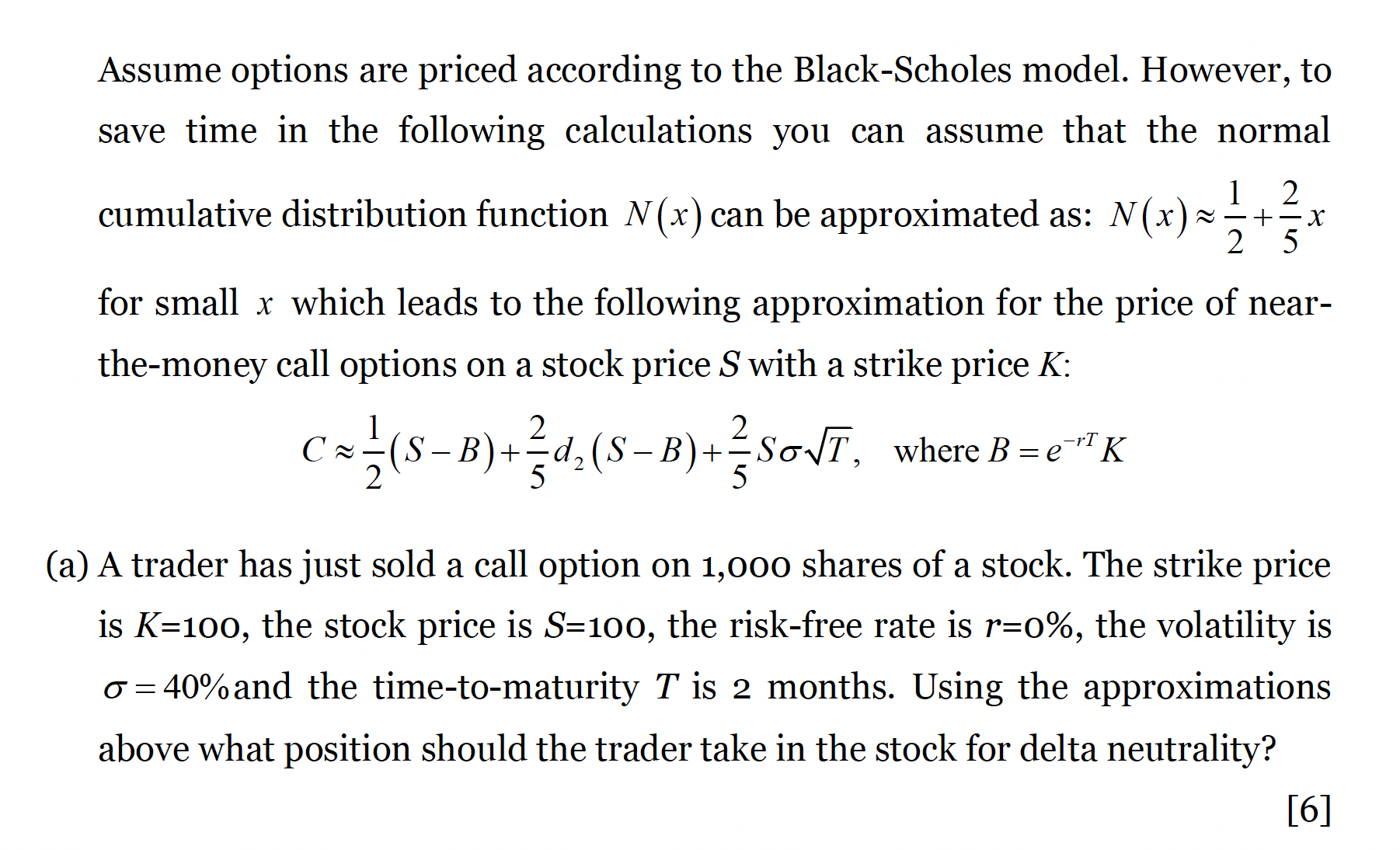

Assume options are priced according to the Black-Scholes model. However, to save time in the following calculations you can assume that the normal cumulative distribution

Assume options are priced according to the Black-Scholes model. However, to save time in the following calculations you can assume that the normal cumulative distribution function N(x) can be approximated as: N(x)21+52x for small x which leads to the following approximation for the price of nearthe-money call options on a stock price S with a strike price K : C21(SB)+52d2(SB)+52ST,whereB=erTK (a) A trader has just sold a call option on 1,00o shares of a stock. The strike price is K=100, the stock price is S=100, the risk-free rate is r=0%, the volatility is =40% and the time-to-maturity T is 2 months. Using the approximations above what position should the trader take in the stock for delta neutrality? [6] Assume options are priced according to the Black-Scholes model. However, to save time in the following calculations you can assume that the normal cumulative distribution function N(x) can be approximated as: N(x)21+52x for small x which leads to the following approximation for the price of nearthe-money call options on a stock price S with a strike price K : C21(SB)+52d2(SB)+52ST,whereB=erTK (a) A trader has just sold a call option on 1,00o shares of a stock. The strike price is K=100, the stock price is S=100, the risk-free rate is r=0%, the volatility is =40% and the time-to-maturity T is 2 months. Using the approximations above what position should the trader take in the stock for delta neutrality? [6]

Assume options are priced according to the Black-Scholes model. However, to save time in the following calculations you can assume that the normal cumulative distribution function N(x) can be approximated as: N(x)21+52x for small x which leads to the following approximation for the price of nearthe-money call options on a stock price S with a strike price K : C21(SB)+52d2(SB)+52ST,whereB=erTK (a) A trader has just sold a call option on 1,00o shares of a stock. The strike price is K=100, the stock price is S=100, the risk-free rate is r=0%, the volatility is =40% and the time-to-maturity T is 2 months. Using the approximations above what position should the trader take in the stock for delta neutrality? [6] Assume options are priced according to the Black-Scholes model. However, to save time in the following calculations you can assume that the normal cumulative distribution function N(x) can be approximated as: N(x)21+52x for small x which leads to the following approximation for the price of nearthe-money call options on a stock price S with a strike price K : C21(SB)+52d2(SB)+52ST,whereB=erTK (a) A trader has just sold a call option on 1,00o shares of a stock. The strike price is K=100, the stock price is S=100, the risk-free rate is r=0%, the volatility is =40% and the time-to-maturity T is 2 months. Using the approximations above what position should the trader take in the stock for delta neutrality? [6] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started