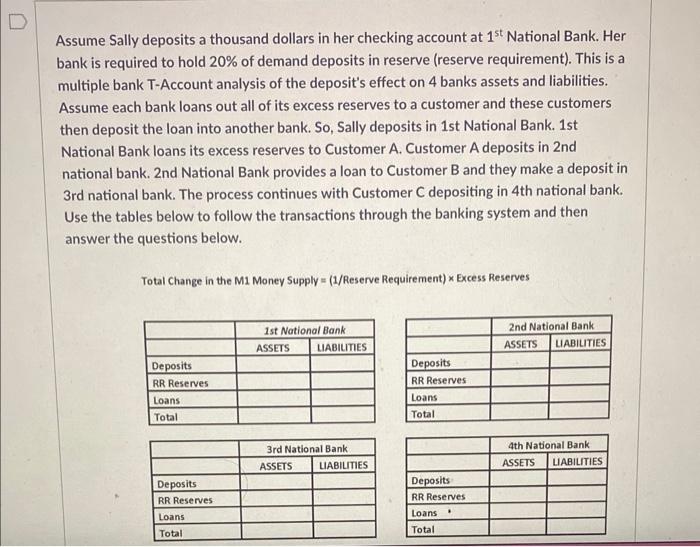

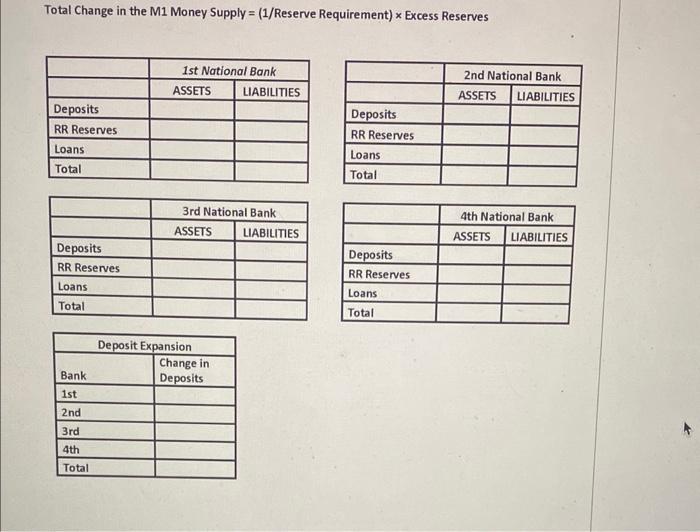

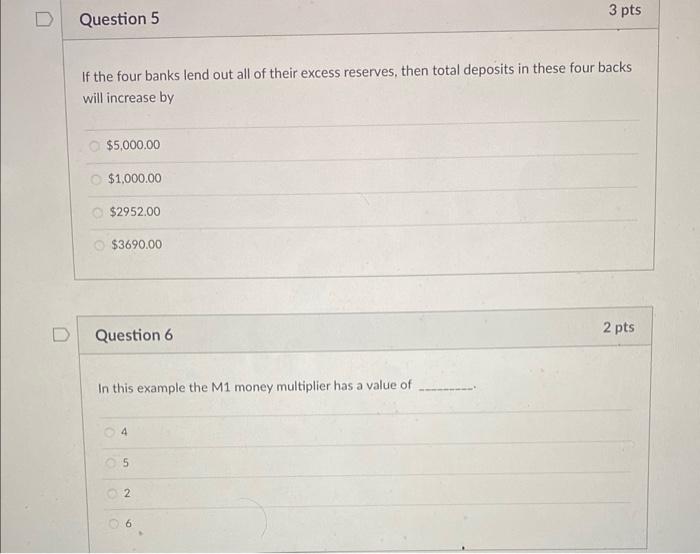

Assume Sally deposits a thousand dollars in her checking account at 1st National Bank. Her bank is required to hold 20% of demand deposits in reserve (reserve requirement). This is a multiple bank T-Account analysis of the deposit's effect on 4 banks assets and liabilities. Assume each bank loans out all of its excess reserves to a customer and these customers then deposit the loan into another bank. So, Sally deposits in 1st National Bank. 1st National Bank loans its excess reserves to Customer A. Customer A deposits in 2nd national bank. 2nd National Bank provides a loan to Customer B and they make a deposit in 3rd national bank. The process continues with Customer C depositing in 4 th national bank. Use the tables below to follow the transactions through the banking system and then answer the questions below. Total Change in the M1 Money Supply =(1/ Reserve Requirement ) Excess Reserves \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c|}{ 1st National Bank } \\ \hline & ASSETS & LIABILITTES \\ \hline Deposits & & \\ \hline RR Reserves & & \\ \hline Loans & & \\ \hline Total & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c|}{ 2nd National Bank } \\ \hline & ASSEIS & LIABILITIES \\ \hline Deposits & & \\ \hline RR Reserves & & \\ \hline Loans & & \\ \hline Total & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c|}{ 3rd National Bank } \\ \hline & ASSETS & LIABILITIES \\ \hline Deposits & & \\ \hline RR Reserves & & \\ \hline Loans & & \\ \hline Total & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c|}{ 4th National Bank } \\ \hline & ASSETS & LIABILITIES \\ \hline Deposits & & \\ \hline RR Reserves & & \\ \hline Loans & & \\ \hline Total & & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Deposit Expansion } \\ \hline Bank & Change in Deposits \\ \hline 1st & \\ \hline 2nd & \\ \hline 3rd & \\ \hline 4th & \\ \hline Total & \\ \hline \end{tabular} If the four banks lend out all of their excess reserves, then total deposits in these four backs will increase by $5,000.00$1,000.00$2952.00$3690.00 Question 6 2 pts In this example the M1 money multiplier has a value of