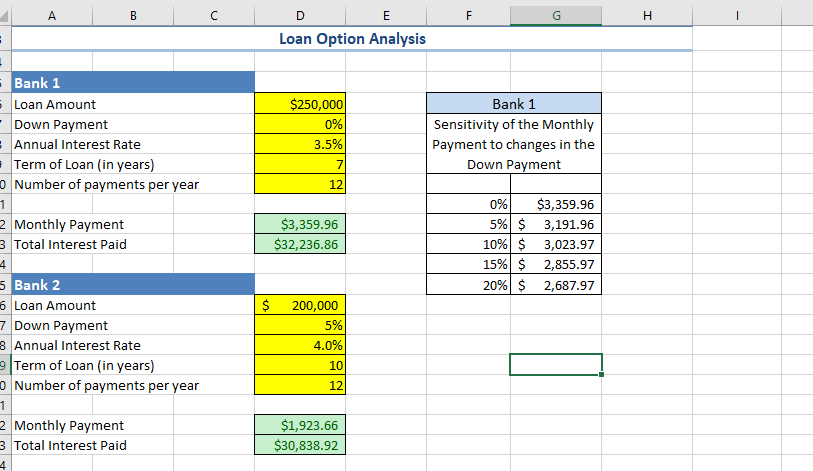

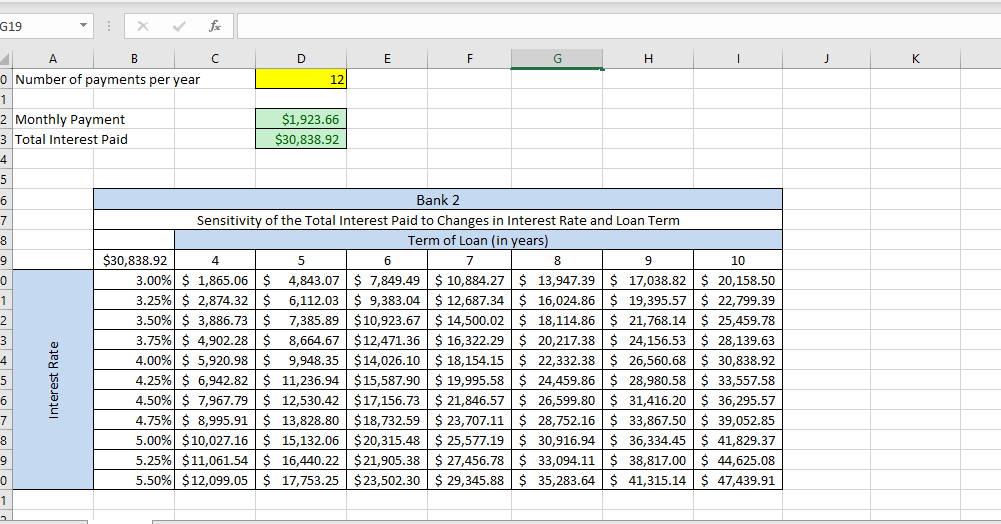

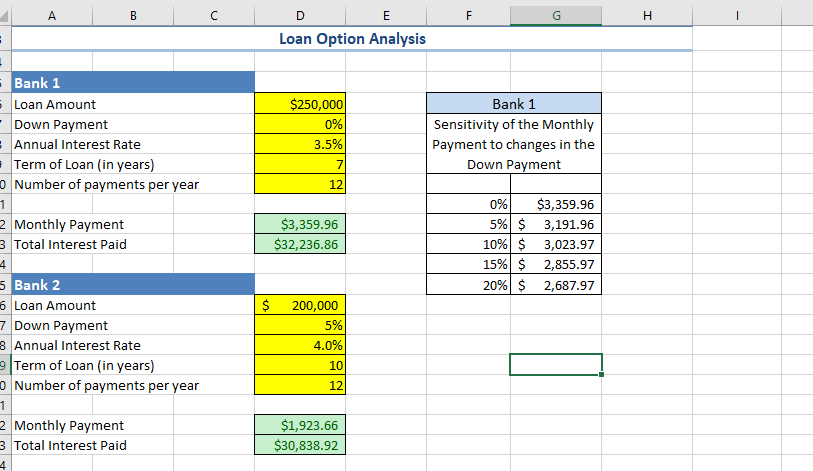

Assume Sports Plus can negotiate the interest rate from Bank 2. What interest rate should they request to make the total interest paid in the loan from Bank 2 equal to the total interest paid in the loan from Bank 1? Use Goal Seek.

Assume Sports Plus can negotiate the interest rate from Bank 2. What interest rate should they request to make the total interest paid in the loan from Bank 2 equal to the total interest paid in the loan from Bank 1? Use Goal Seek.

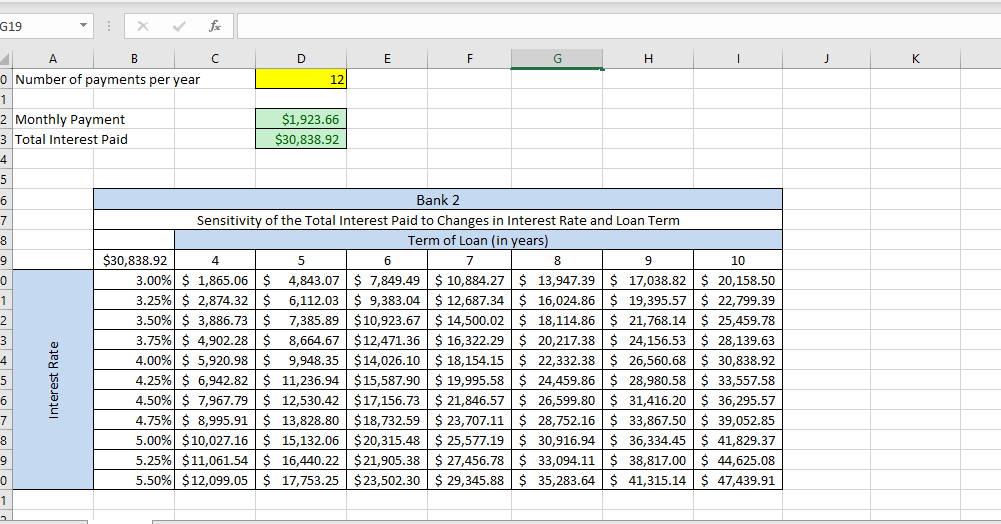

, A B D E F G H E Loan Option Analysis $250,000 0% 3.5% 7 12 Bank 1 Sensitivity of the Monthly Payment to changes in the Down Payment $3,359.96 $32,236.86 Bank 1 Loan Amount - Down Payment Annual Interest Rate Term of Loan (in years) Number of payments per year 1 2 Monthly Payment 3 Total Interest Paid 4 5 Bank 2 6 Loan Amount 7 Down Payment 8 Annual Interest Rate 9 Term of Loan (in years) Number of payments per year 1 2 Monthly Payment 3 Total Interest Paid 0% $3,359.96 5% $ 3,191.96 10% $ 3,023.97 15% $ 2,855.97 20% $ 2,687.97 $ 200,000 5% 4.0% 10 12 $1,923.66 $30,838.92 4 G19 fac D E H 1 J K 8 9 A B C F G o Number of payments per year 12 1 2 Monthly Payment $1,923.66 3 Total Interest Paid $30,838.92 4 5 6 Bank 2 7 Sensitivity of the Total Interest Paid to Changes in Interest Rate and Loan Term Term of Loan (in years) 9 $30,838.92 4 5 6 7 8 10 0 3.00% $ 1,865.06 $ 4,843.07 $ 7,849.49 $ 10,884.27 $ 13,947.39 $ 17,038.82 $ 20,158.50 1 1 3.25% $ 2,874.32 $ 6,112.03 $ 9,383.04 $ 12,687.34 $ 16,024.86 $ 19,395.57 $ 22,799.39 2 3.50% $ 3,886.73 $ 7,385.89 $ 10,923.67 $ 14,500.02 $ 18,114.86$ 21,768.14 $ 25,459.78 3.75% $ 4,902.28 $ 8,664.67 $12,471.36 $ 16,322.29 $ 20,217.38 $ 24,156.53 $ 28,139.63 4 4.00% $ 5,920.98 $ 9,948.35 $ 14,026.10 $ 18,154.15$ 22,332.38 $ 26,560.68 $ 30,838.92 5 4.25% $ 6,942.82 $ 11,236.94 $ 15,587.90 $ 19,995.58 $ 24,459.86 $ 28,980.58 $ 33,557.58 6 4.50% $ 7,967.79 $ 12,530.42 $17,156.73 $ 21,846.57 $ 26,599.80 $ 31,416.20 $ 36,295.57 7 4.75% $ 8,995.91 $ 13,828.80 $ 18,732.59 $ 23,707.11 $ 28,752.16 $ 33,867.50 $ 39,052.85 8 5.00% $ 10,027.16 $ 15,132.06 $20,315.48 $ 25,577.19 $ 30,916.94 $ 36,334.45 $ 41,829.37 9 5.25% $11,061.54 $ 16,440.22 $ 21,905.38 $ 27,456.78 $ 33,094.11 $ 38,817.00 $ 44,625.08 0 5.50% $12,099.05 $ 17,753.25 $ 23,502.30 $ 29,345.88 $ 35,283.64 $ 41,315.14 $ 47,439.91 1 3 Interest Rate , A B D E F G H E Loan Option Analysis $250,000 0% 3.5% 7 12 Bank 1 Sensitivity of the Monthly Payment to changes in the Down Payment $3,359.96 $32,236.86 Bank 1 Loan Amount - Down Payment Annual Interest Rate Term of Loan (in years) Number of payments per year 1 2 Monthly Payment 3 Total Interest Paid 4 5 Bank 2 6 Loan Amount 7 Down Payment 8 Annual Interest Rate 9 Term of Loan (in years) Number of payments per year 1 2 Monthly Payment 3 Total Interest Paid 0% $3,359.96 5% $ 3,191.96 10% $ 3,023.97 15% $ 2,855.97 20% $ 2,687.97 $ 200,000 5% 4.0% 10 12 $1,923.66 $30,838.92 4 G19 fac D E H 1 J K 8 9 A B C F G o Number of payments per year 12 1 2 Monthly Payment $1,923.66 3 Total Interest Paid $30,838.92 4 5 6 Bank 2 7 Sensitivity of the Total Interest Paid to Changes in Interest Rate and Loan Term Term of Loan (in years) 9 $30,838.92 4 5 6 7 8 10 0 3.00% $ 1,865.06 $ 4,843.07 $ 7,849.49 $ 10,884.27 $ 13,947.39 $ 17,038.82 $ 20,158.50 1 1 3.25% $ 2,874.32 $ 6,112.03 $ 9,383.04 $ 12,687.34 $ 16,024.86 $ 19,395.57 $ 22,799.39 2 3.50% $ 3,886.73 $ 7,385.89 $ 10,923.67 $ 14,500.02 $ 18,114.86$ 21,768.14 $ 25,459.78 3.75% $ 4,902.28 $ 8,664.67 $12,471.36 $ 16,322.29 $ 20,217.38 $ 24,156.53 $ 28,139.63 4 4.00% $ 5,920.98 $ 9,948.35 $ 14,026.10 $ 18,154.15$ 22,332.38 $ 26,560.68 $ 30,838.92 5 4.25% $ 6,942.82 $ 11,236.94 $ 15,587.90 $ 19,995.58 $ 24,459.86 $ 28,980.58 $ 33,557.58 6 4.50% $ 7,967.79 $ 12,530.42 $17,156.73 $ 21,846.57 $ 26,599.80 $ 31,416.20 $ 36,295.57 7 4.75% $ 8,995.91 $ 13,828.80 $ 18,732.59 $ 23,707.11 $ 28,752.16 $ 33,867.50 $ 39,052.85 8 5.00% $ 10,027.16 $ 15,132.06 $20,315.48 $ 25,577.19 $ 30,916.94 $ 36,334.45 $ 41,829.37 9 5.25% $11,061.54 $ 16,440.22 $ 21,905.38 $ 27,456.78 $ 33,094.11 $ 38,817.00 $ 44,625.08 0 5.50% $12,099.05 $ 17,753.25 $ 23,502.30 $ 29,345.88 $ 35,283.64 $ 41,315.14 $ 47,439.91 1 3 Interest Rate

Assume Sports Plus can negotiate the interest rate from Bank 2. What interest rate should they request to make the total interest paid in the loan from Bank 2 equal to the total interest paid in the loan from Bank 1? Use Goal Seek.

Assume Sports Plus can negotiate the interest rate from Bank 2. What interest rate should they request to make the total interest paid in the loan from Bank 2 equal to the total interest paid in the loan from Bank 1? Use Goal Seek.