Answered step by step

Verified Expert Solution

Question

1 Approved Answer

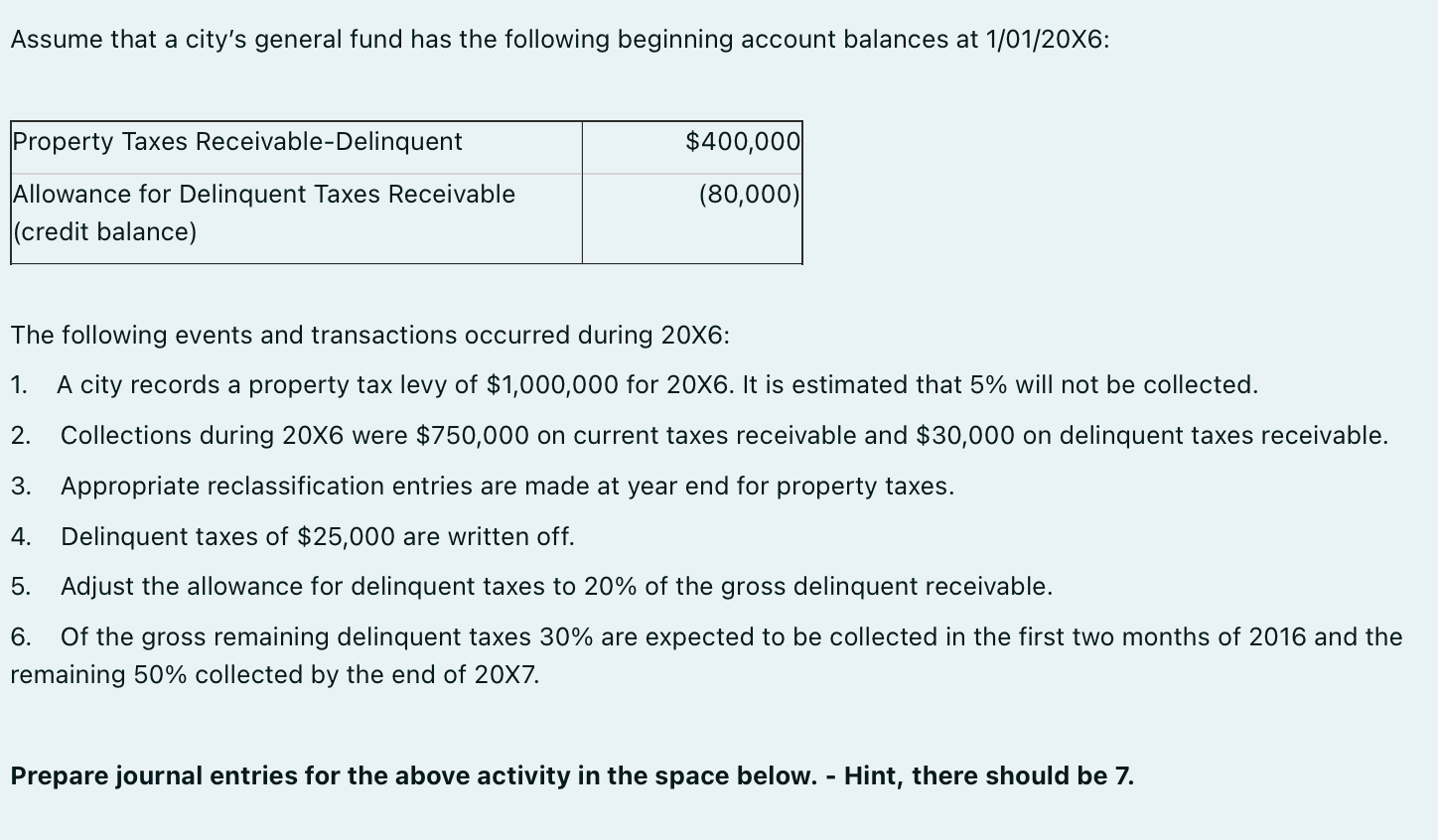

Assume that a city's general fund has the following beginning account balances at 1 / 0 1 / 2 0 X 6 : The following

Assume that a city's general fund has the following beginning account balances at X:

The following events and transactions occurred during X:

A city records a property tax levy of $ for It is estimated that will not be collected.

Collections during were $ on current taxes receivable and $ on delinquent taxes receivable.

Appropriate reclassification entries are made at year end for property taxes.

Delinquent taxes of $ are written off.

Adjust the allowance for delinquent taxes to of the gross delinquent receivable.

Of the gross remaining delinquent taxes are expected to be collected in the first two months of and the

remaining collected by the end of

Prepare journal entries for the above activity in the space below. Hint, there should be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started