Answered step by step

Verified Expert Solution

Question

1 Approved Answer

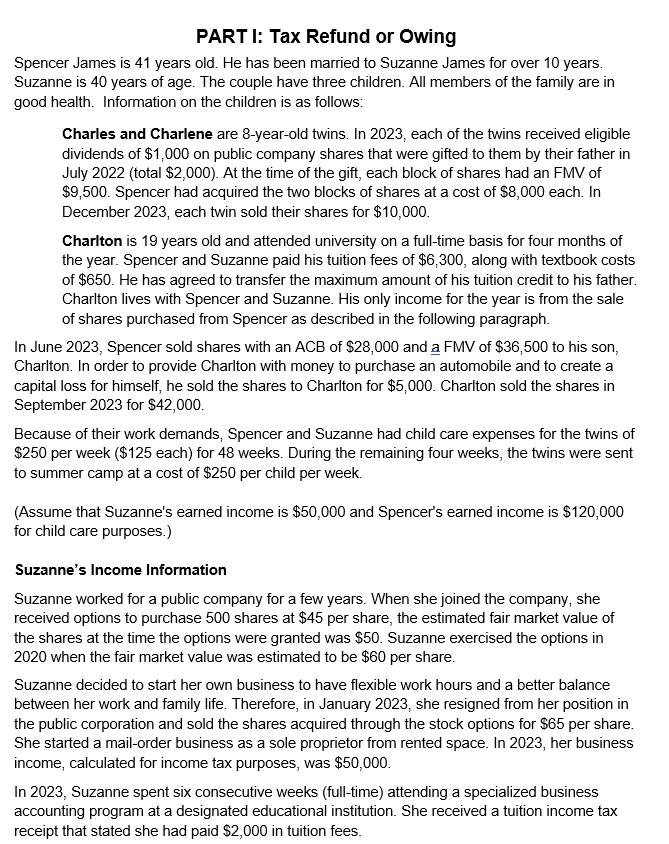

PART I: Tax Refund o r Owing Spencer James i s 4 1 years old. H e has been married t o Suzanne James for

PART I: Tax Refund Owing

Spencer James years old. has been married Suzanne James for over years.

Suzanne years age. The couple have three children. All members the family are

good health. Information the children follows:

Charles and Charlene are yearold twins. each the twins received eligible

dividends $ public company shares that were gifted them their father

July $ the time the gift, each block shares had

$ Spencer had acquired the two blocks shares a cost $ each.

December each twin sold their shares for $

Charlton years old and attended university a fulltime basis for four months

the year. Spencer and Suzanne paid his tuition fees $ along with textbook costs

$ has agreed transfer the maximum amount his tuition credit his father.

Charlton lives with Spencer and Suzanne. His only income for the year from the sale

shares purchased from Spencer described the following paragraph.

June Spencer sold shares with ACB $ and a $ his son,

Charlton. order provide Charlton with money purchase automobile and create

capital loss for himself, sold the shares Charlton for $ Charlton sold the shares

September for $

Because their work demands, Spencer and Suzanne had child care expenses for the twins

$ per week $ each for weeks. During the remaining four weeks, the twins were sent

summer camp a cost $ per child per week.

that Suzanne's earned income $ and Spencer's earned income $

for child care purposes.

Suzanne's Income Information

Suzanne worked for a public company for a few years. When she joined the company, she

received options purchase shares $ per share, the estimated fair market value

the shares the time the options were granted was $ Suzanne exercised the options

when the fair market value was estimated $ per share.

Suzanne decided start her own business have flexible work hours and a better balance

between her work and family life. Therefore, January she resigned from her position

the public corporation and sold the shares acquired through the stock options for $ per share.

She started a mailorder business a sole proprietor from rented space. her business

income, calculated for income tax purposes, was $

Suzanne spent six consecutive weeks time attending a specialized business

accounting program a designated educational institution. She received a tuition income tax

receipt that stated she had paid $ tuition fees. Additional financial information about Suzanne for the year:

Owns two residential rental properties. Both properties are separate Class the

beginning the year Property A has a UCC and Property has a UCC

Suzanne added major capital improvements Property for a cost

$ and sold Property A during the year for $ capital cost the

building was $

Property earned net rental income consideration CCA $ and

property A had a net rental loss $

Purchased $ GIC investment certificate June The

GIC pays interest maturity May a rate compounded

annually.

Purchases and sales shares ACB are follows:

March : Purchase shares $ per share

September : Purchase shares $ per share

December : Sold shares $ per share

January : Purchase shares $ per share

Received $ dividends withholding tax from investments

foreign country.

Disposed several

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started