Question

Assume that a firm in China has an A/R of $10 million due in September 2020 at the same time when the SEP 2020 contract

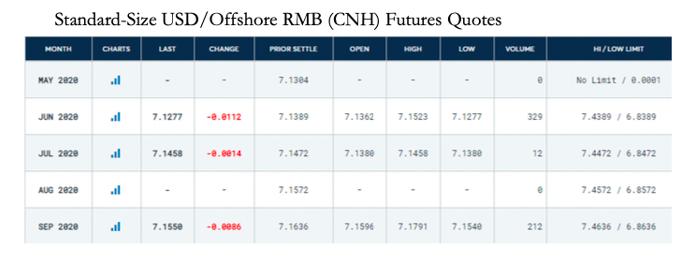

Assume that a firm in China has an A/R of $10 million due in September 2020 at the same time when the SEP 2020 contract matures. Referring to the quotes for the Chinese yuan futures contract on May 18, 2020 (Source: CME).

If the firm wants to hedge its A/R with this USD/Offshore RMB (CHN) futures contracts, should the firm buy or sell such contracts? How many contract should the firm buy or sell? (Visit CME web site for relevant information)

2.Suppose on the last trading of July 2020, the futures price changes to 7.2035. Does the firm's futures position make or lose money? How much?

3.When the firm's A/R is due, the futures price is 7.1005. What is the firm's total revenue in RMB, including proceeds of its A/R and futures contract settlement?

4.When the firm's A/R is due, the futures price is 7.3005. What is the firm's total revenue in RMB, including proceeds of its A/R and futures contract settlement?

Standard-Size USD/Offshore RMB (CNH) Futures Quotes MONTH MAY 2828 JUN 2828 JUL 2020 AUG 2020 SEP 2020 CHARTS al = LAST 7.1277 -0.0112 7.1458 CHANGE 7.1550 -0.0014 -0.0086 PRIOR SETTLE 7.1384 7.1389 7.1472 7.1572 7.1636 OPEN 7.1380 HIGH 7.1362 7.1523 7.1277 7.1596 LOW 7.1458 7.1380 7.1791 7.1540 VOLUME 0 329 12 e 212 HI/LOW LIMIT No Limit / 0.0001 7.4389 / 6.8389 7.4472 / 6.8472 7.4572 / 6.8572 7.4636 / 6.8636

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 To hedge its AR the firm should sell USDOffshore RMB CHN futures contracts Each contract represent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started