Question

Assume that Aardvark and Zebra compete in the same four-digit SIC code industry and offer comparable products and services. The following table contains their reported

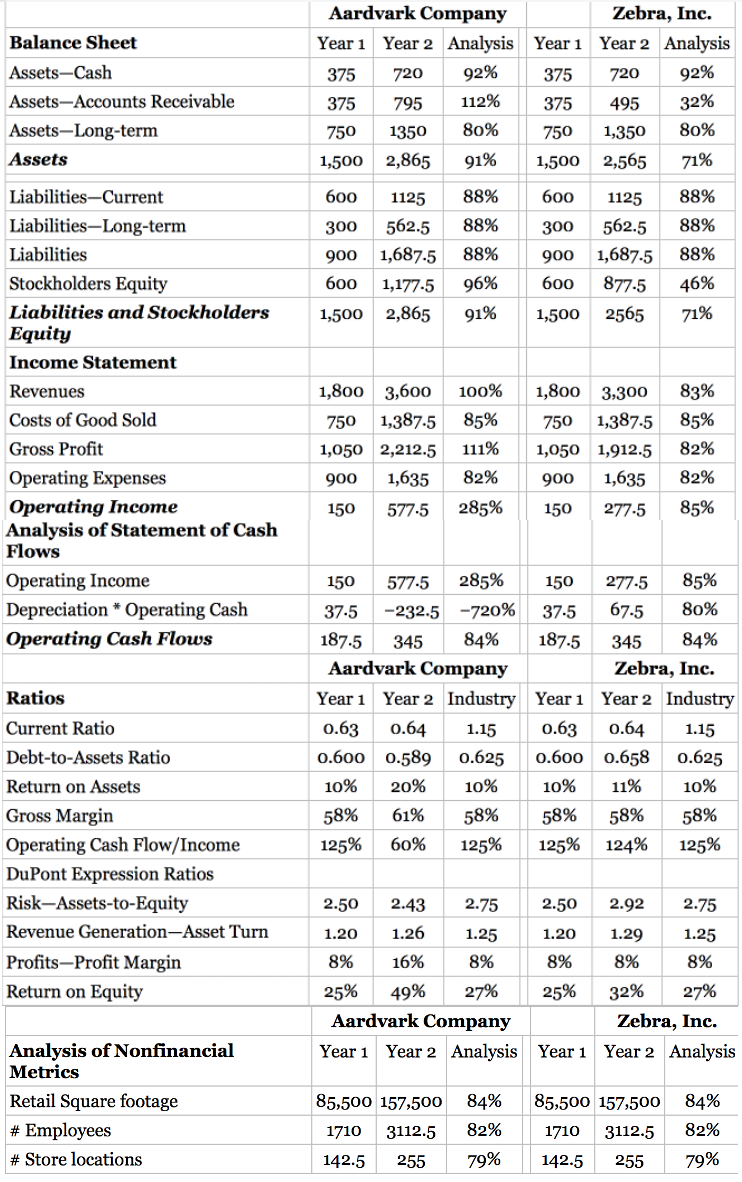

Assume that Aardvark and Zebra compete in the same four-digit SIC code industry and offer comparable products and services. The following table contains their reported financial performance and condition for the last two years, calculated ratios and key nonfinancial metrics. Assume that industry ratios were derived from a reputable source. Further, assume that nonfinancial metrics were derived from reliable public and internal sources. Identification of Red Flags

1) Describe any symptoms of fraud

2) Draw a conclusion about fraud predication and recommend next steps.

Balance Sheet Assets-Cash Assets-Accounts Receivable Assets-Long-term Assets Aardvark Company Zebra, Inc. Year 1 Year 2 Analysis Year 1 Year 2 Analysis 375 720 92% 375 720 92% 375 795 112% 375 495 32% 750 1350 80% 750 1,350 80% 1,500 2,865 91% 1,500 2,565 71% 600 1125 88% 600 1125 300 562.5 900 1,687-5 600 1,177-5 1,500 2,865 88% 88% 88% 88% 88% 300 562.5 900 1,687-5 600 877-5 1,500 2565 46% 96% 91% 71% Liabilities-Current Liabilities-Long-term Liabilities Stockholders Equity Liabilities and Stockholders Equity Income Statement Revenues Costs of Good Sold Gross Profit Operating Expenses Operating Income Analysis of Statement of Cash Flows Operating Income Depreciation * Operating Cash Operating Cash Flows 1,800 3,300 750 1,387-5 1,800 3,600 750 1,387-5 1,050 2,212.5 900 1,635 100% 85% 111% 82% 285% 1,050 1,912.5 900 1,635 83% 85% 82% 82% 85% 150 577.5 150 277-5 Ratios 150 577-5 285% 150 277.5 85% 37-5 -232.5 -720% 37.5 67-5 80% 187-5 345 84% 187.5 345 84% Aardvark Company Zebra, Inc. Year 1 Year 2 Industry Year 1 Year 2 Industry 0.63 0.64 1.15 0.63 0.64 1.15 0.600 0.589 0.625 0.600 0.658 0.625 10% 20% 10% 10% 11% 10% 58% 61% 58% 58% 58% 58% 125% 60% 125% 125% 124% 125% Current Ratio Debt-to-Assets Ratio Return on Assets Gross Margin Operating Cash Flow/Income DuPont Expression Ratios Risk-Assets-to-Equity Revenue Generation-Asset Turn Profits-Profit Margin Return on Equity 8% 8% 2.50 2.43 2.75 2.50 2.92 2.75 1.20 1.26 1.25 1.20 1.29 1.25 16% 8% 8% 8% 25% 49% 27% 25% 32% Aardvark Company Zebra, Inc. Year 1 Year 2 Analysis Year 1 Year 2 Analysis 27% Analysis of Nonfinancial Metrics Retail Square footage # Employees # Store locations 85,500 157,500 84% 1710 3112.5 84% 82% 79% 85,500 157,500 1710 3112.5 142.5 255 82% 142.5 255 79%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started