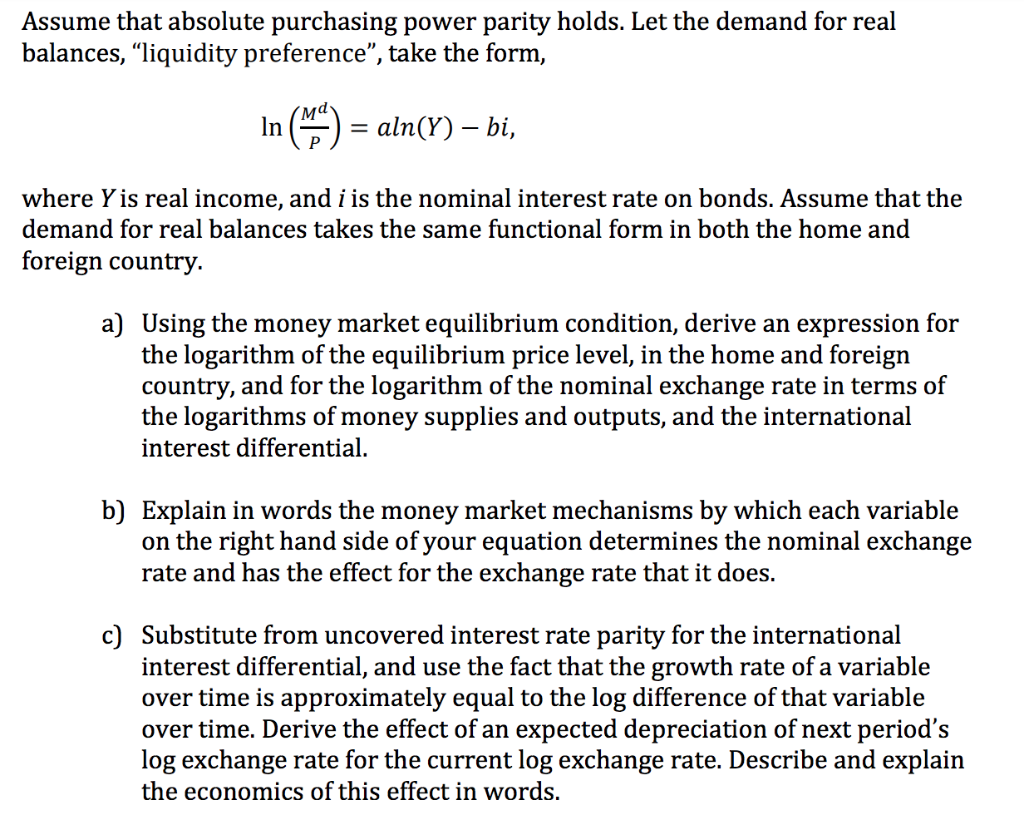

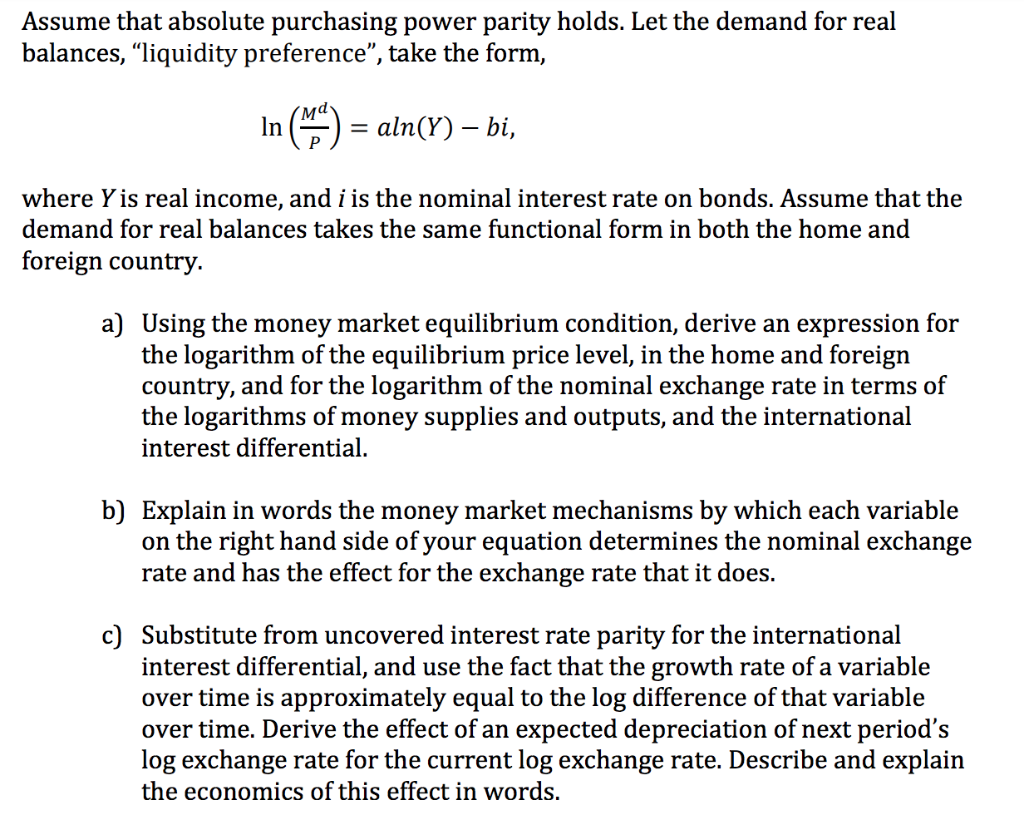

Assume that absolute purchasing power parity holds. Let the demand for real balances, "liquidity preference", take the form In( a-bi, where Yis real income, and i is the nominal interest rate on bonds. Assume that the demand for real balances takes the same functional form in both the home and foreign country a) Using the money market equilibrium condition, derive an expression for the logarithm of the equilibrium price level, in the home and foreign country, and for the logarithm of the nominal exchange rate in terms of the logarithms of money supplies and outputs, and the international interest differential b) Explain in words the money market mechanisms by which each variable on the right hand side of your equation determines the nominal exchange rate and has the effect for the exchange rate that it does. c) Substitute from uncovered interest rate parity for the international interest differential, and use the fact that the growth rate of a variable over time is approximately equal to the log difference of that variable over time. Derive the effect of an expected depreciation of next period's log exchange rate for the current log exchange rate. Describe and explain the economics of this effect in words, Assume that absolute purchasing power parity holds. Let the demand for real balances, "liquidity preference", take the form In( a-bi, where Yis real income, and i is the nominal interest rate on bonds. Assume that the demand for real balances takes the same functional form in both the home and foreign country a) Using the money market equilibrium condition, derive an expression for the logarithm of the equilibrium price level, in the home and foreign country, and for the logarithm of the nominal exchange rate in terms of the logarithms of money supplies and outputs, and the international interest differential b) Explain in words the money market mechanisms by which each variable on the right hand side of your equation determines the nominal exchange rate and has the effect for the exchange rate that it does. c) Substitute from uncovered interest rate parity for the international interest differential, and use the fact that the growth rate of a variable over time is approximately equal to the log difference of that variable over time. Derive the effect of an expected depreciation of next period's log exchange rate for the current log exchange rate. Describe and explain the economics of this effect in words