Question

Assume that all of you recently graduated and just landed a job as financial planners with Palm Clinic. Because the funds are to be invested

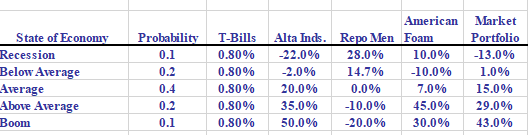

Assume that all of you recently graduated and just landed a job as financial planners with Palm Clinic. Because the funds are to be invested at the end of one year, you have been instructed to plan for a one-year holding period. Further, your boss has restricted you to the following investment alternatives, shown with their probabilities and associated outcomes.

Suppose you create a two-stock portfolio by investing $50,000 in Alta Industries and $50,000 in RepoMen. Calculate the expected return, standard deviation, coefficient of variation, and beta for this portfolio. How does the risk of this two-stock portfolio compare with the risk of the individual stocks if they were held in isolation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started